[Updated June 23, 2017]

While most companies pay dividends on a quarterly basis, monthly dividend stocks make their dividend payouts each month. Some investors find a monthly payout schedule more appealing, as it makes it easier to derive regular income from dividends. One can also combine quarterly dividend-payout stocks that pay dividends in different months and ensure that every month there is a payout with our Monthly Income Generator tool.

Below, we’ve selected five monthly dividend-paying stocks that are currently yielding more than 3.5% – some are even yielding higher than 5%.

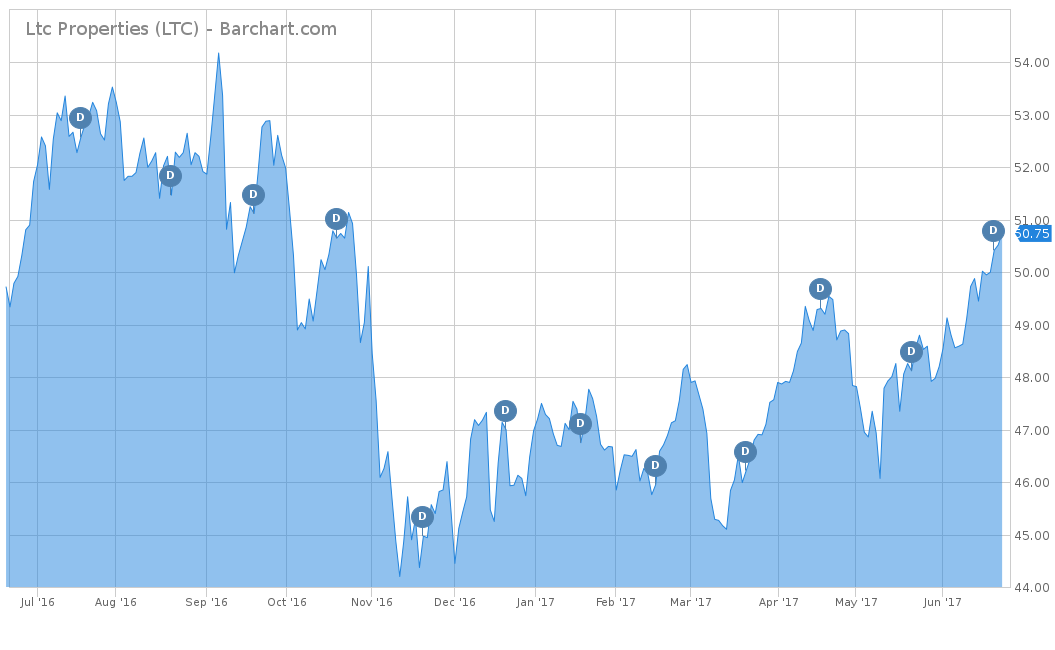

LTC Properties {% dividend LTC %} - 4.49%

LTC Properties is a healthcare real estate investment trust (REIT) that invests mostly in long-term care and healthcare-related properties. The company looks to see future potential from two memory-care facilities and one skilled nursing facility, which are expected to be completed by the end of 2018.

The company currently yields 4.49% and has a payout ratio of 72.4% based on 2017 earnings estimates of $3.15. 2018 earnings estimates are $3.23, which leads to a growth estimate of 2.54%. The stock is up over 8% on a year-to-date basis, but still off 6.37% of its 52-week high. LTC has a monthly payout of $0.19, which leads to an annual payout of $2.28.

Check out what investors are currently most interested in by visiting our Most Watched Stocks Page.

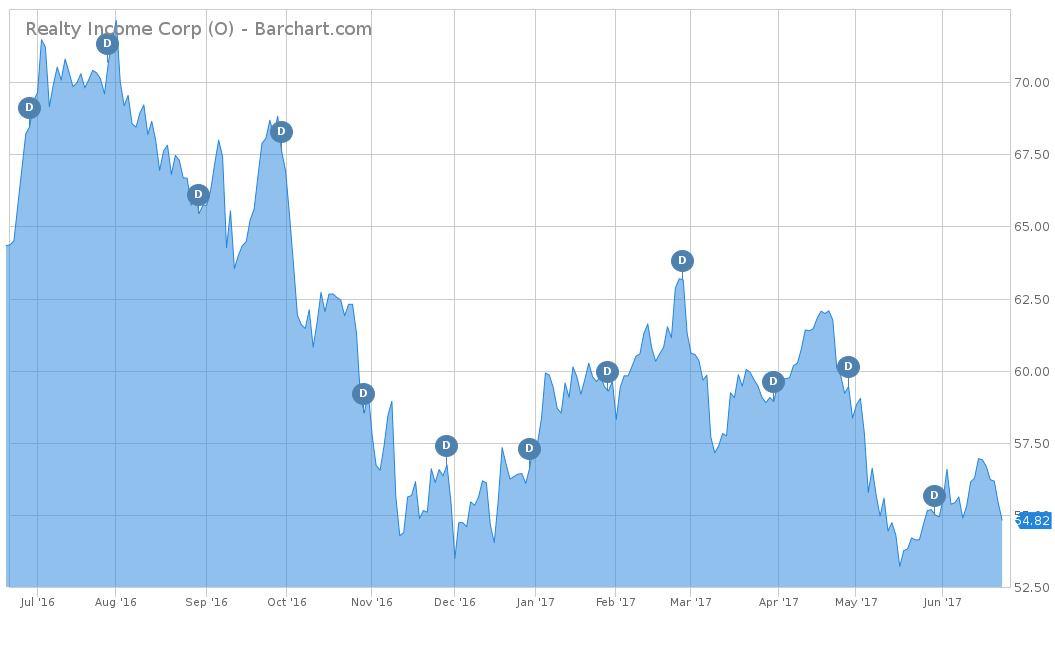

Realty Income Corp {% dividend O %} - 4.63%

Realty Income Corp is another REIT that has been acquiring and managing commercial properties that have been generating rental revenue under long-term, net-lease agreements since 1969.

The company currently yields 4.63% and has a payout ratio of 84.3% based on 2017 earnings estimates of $3.01. The 2018 earnings per share is at $3.17, which lead to a growth estimate of 5.18%. On a year-to date basis, the stock is down just under 1% and is also trading almost 21% below its 52-week high.

However, Realty Income Corp is well-positioned to drive external growth by taking advantage of some acquisition opportunities using its superior cost of capital. Realty Income Corp has coined itself the “monthly income” stock, due to 563 consecutive monthly payouts. Currently, Realty has a monthly payout of $0.19. The company has also historically raised its dividends for 21 consecutive years and has a current annual payout of $2.54.

Check out our dedicated page for monthly dividend-paying stocks here.

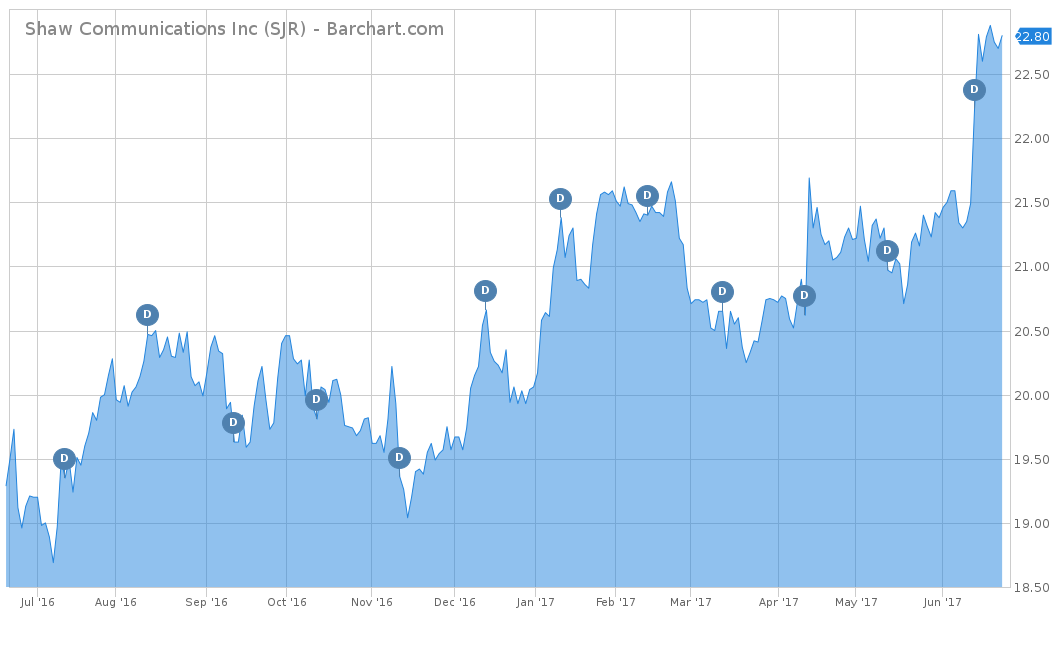

Shaw Communications {% dividend SJR %} - 5.2%

Shaw Communications Inc. is a media and communications company that offers cable television, high-speed internet, home phone, telecommunications and satellite services to customers in Canada and the United States. Shaw looks to compete with phone-rival Telus and its fiber-based network, which offers much higher data speeds.

SJR currently yields 5.2% and has a payout ratio of 118.5% based on 2017 earnings estimates of $1.00. With a payout well over 100%, Shaw may have trouble seeing future dividend growth. In fact, its free cash flow will most likely go toward the recently acquired Wind Mobile (now Freedom Mobile), instead of raising an already high dividend.

The estimated earnings per share for 2018 is $1.04, which leads to a growth rate of 4%. Shaw is up over 13% on a year-to-date basis, but is still off 0.89% from its 52-week high. Shaw Communications has a monthly payout of $0.0988, which leads to an annual payout of $1.19.

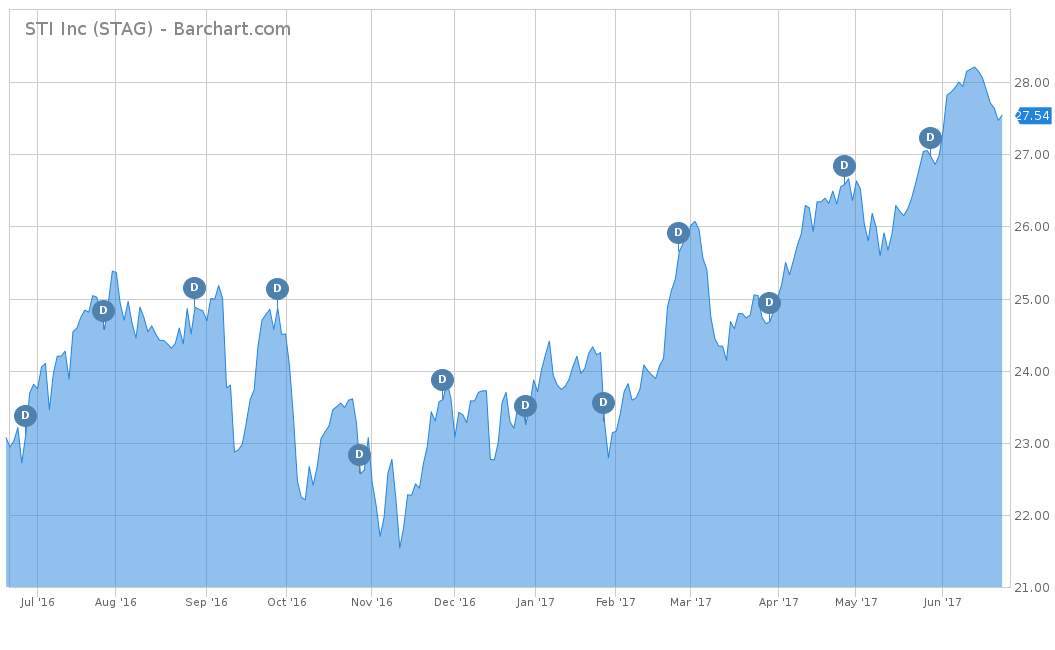

Stag Industrial, Inc. {% dividend STAG %} - 5.08%

STAG Industrial, Inc. is an REIT that is focused on the acquisition, ownership and operation of single-tenant, industrial properties across the United States.

The stock currently yields 5.08% and has a payout ratio of 83.3% based upon 2017 earnings estimates of $1.68. Its 2018 earnings estimates have come in at $1.80, which is a growth rate of 7.14%. Stag is up over 14% on a YTD basis, but is still off 4.21% from its 52-week high.

STAG acquired eleven buildings worth around $100 million in the first quarter of 2017, which will lead to a positive-weighted average-capitalization rate of 8.2%. STAG pays a monthly dividend of $0.1175, which leads to an annual payout of $1.40.

Stay up to date with the highest-yielding stocks and their latest ex-dividend dates on our High Dividend Stocks by Yield page.

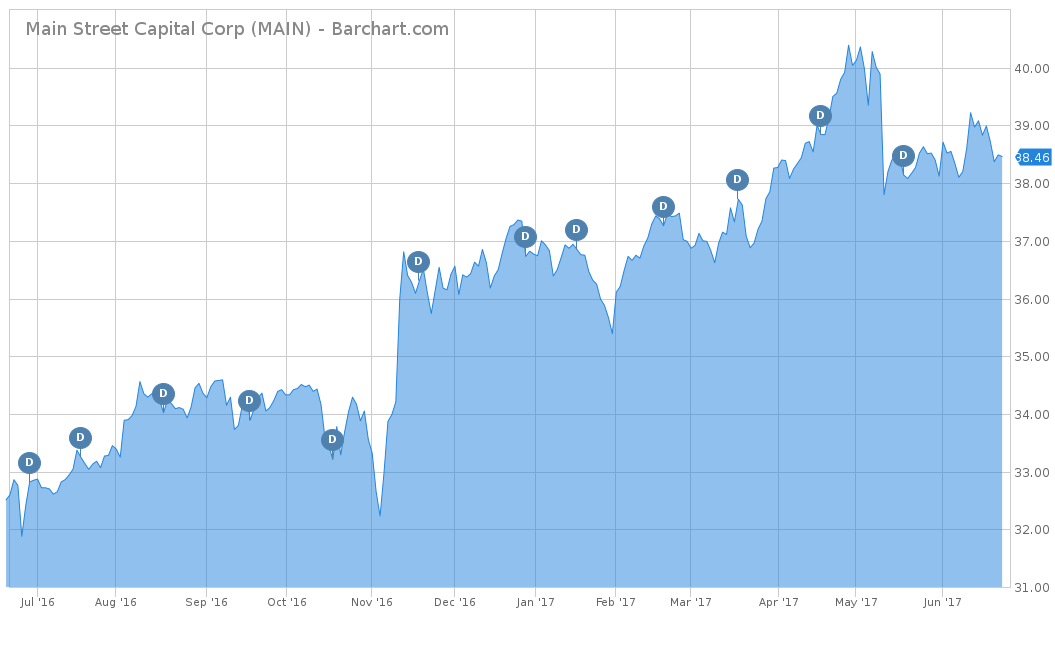

Main Street Capital Corp. {% dividend MAIN %} - 5.77%

Main Street Capital Corporation is an investment firm that engages in providing equity financing and debt capital to lower middle-market companies. Main Street recently announced it is funding $20.0 million in a combination of first-lien, senior-secured term debt and a direct equity investment in Meisler Rental Group that should yield positive results in the near future.

Currently yielding 5.77%, MAIN has a payout ratio of 99.1% based upon 2017 earnings estimates of $2.24. Its 2018 earnings estimates have come in at $2.27, leading to a marginal growth of 1.34%. Main Street is up 4.6% for a year-to-date basis, but is still off 5.87% from its 52-week high. MAIN pays a monthly dividend of $0.185, which leads to an annual payout of $2.22.

The Bottom Line

Three out of the five stocks that made this list are REITs with higher payout ratios than others because, by law, they are required to pay out at least 90% of their earnings as dividends.

Check out our Best Dividend Stocks page by going premium for free.