Since the end of the financial crisis and Great Recession, the Federal Reserve embarked on a policy of very low interest rates. This was designed to make borrowing cheaper and boost economic activity. The downside of this policy is that it compressed profitability for big banks like JP Morgan Chase (JPM ). Last December, the Federal Reserve finally raised interest rates, for the first time in nine years. Recently, the Fed implied that another rate hike could come as early as June.

If this is true, it would represent a meaningful catalyst for JP Morgan. When interest rates go up, it generally raises a number of other rates, including mortgages, credit cards, and auto loans. As a result, if the Federal Reserve raises rates for a second time, the banking sector should benefit from improved interest margins. JP Morgan will benefit from higher rates because the rates it charges on longer-dated loans such as mortgages and auto loans will increase at a faster pace than the rates it pays on short-term deposits.

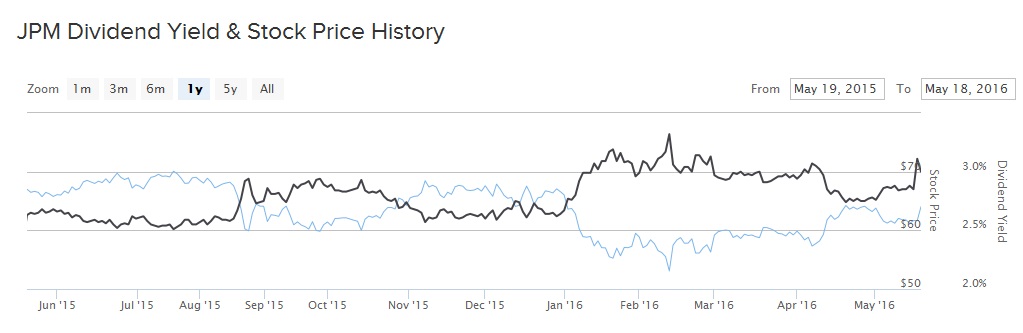

As an indication of management’s confidence in the future of the business, on May 18 JP Morgan raised its dividend by 9%. The stock has not performed well over the past year, although its consistent dividend growth makes it an attractive dividend stock.

Stable Earnings Lead to Dividend Growth

Low rates are hurting JP Morgan, the biggest bank in the U.S. by assets. Last quarter, its total profit fell 6% to $5.52 billion, down from $5.91 billion in the same quarter last year. On a per-share basis, earnings declined 6% as well, to $1.35. Still, its earnings per share figure handily beat analyst expectations, which called for just $1.26 per share in quarterly profit. Total revenue fell 3% year-over-year, to $24.08 billion, but again that was good enough to beat analyst expectations of $23.40 billion.

Not surprisingly, JPMorgan’s weakest-performing segments were its fixed-income trading segment – which is a highly volatile business – as well as investment banking. Revenue from fixed-income trading and investment banking fees declined 13% and 24%, respectively, in the first quarter. Its loan portfolio showed some impact of the steep decline throughout the energy sector as a result of extremely low oil and gas prices. The company set aside $1.8 billion for credit losses last quarter, nearly double the $959 million in the year-ago quarter. This was offset somewhat by higher loan growth overall. Average core loans grew 17%, an indication that as a whole, the U.S. economy continues its modest growth. Earnings were also boosted by cost cuts. The company trimmed non-interest expenses by 7% year-over-year, thanks in large part to lower legal fees.

In response to the weakness spreading throughout its energy loans, investors should expect JP Morgan to trim its allocation to the commodity focused businesses within its loan portfolio. It has already taken a step in this direction. In March, it announced it would end financing of new coal mines, and also will stop financing new coal-fired power plants in high income countries in developed countries. It is reasonable for the company to cut its loans to energy related sectors, in light of its significant exposure.

JP Morgan’s oil and gas loans are a significant weight on the company. As of Dec. 31, 2015, JP Morgan had a $42 billion loan exposure to the oil and gas industry, its seventh biggest out of 19 industry groups. Of that, only $24.3 billion was considered investment grade—meaning 43 percent of the company’s oil and gas loans are rated below-investment grade, or junk. In an environment of $40 oil or below, that is a major concern. Of its non-investment grade loans, the portion allocated to oil and gas has a higher level of what JP Morgan refers to as “criticized non-performing” loans, than any other industry within the company’s wholesale credit portfolio.

Future Dividend Growth Expectations

JP Morgan has done a good job of raising its shareholder dividends since the recession ended. Over the past five years, it has increased its dividend by 92%. Investors should expect future dividend growth to continue. Going forward, JP Morgan should experience accelerating earnings growth as interest rates rise. Earnings are expected to grow 11% next year, to $6.32 per share. Continued dividend growth is likely because JP Morgan has a low payout ratio. Its current annualized dividend represents 30% of its projected 2017 EPS. Moreover, JP Morgan has a major catalyst for future growth in the form of rising interest rates, which should lead to higher earnings and therefore higher dividends going forward.

Assuming normalizing interest rates over the next several years, it is reasonable to project 10% annual dividend growth per year based on its earnings growth estimates.

Under that scenario, JP Morgan’s annual dividend rate would rise to $2.81 per share by 2020.

The Bottom Line

For the time being, JPMorgan is performing admirably in a difficult climate. Earnings are suppressed by low interest rates and the weakness in its energy loan portfolios. But JP Morgan has a strong management team and its fundamental strength remains intact.

Investors are nervous, and that is resulting in a low valuation for the stock. JPMorgan trades for 10x its 2017 earnings estimates, which is a far lower multiple than the S&P 500 index. JP Morgan pays a 3% dividend yield as well, which means it could be an attractive stock for value and dividends.