Discount retail giant Target Corporation (TGT ) has taken investors on a turbulent ride over the past three years. In 2013, hackers obtained personal information – including credit card numbers, names, home addresses, phone numbers, and email addresses – on approximately 70 million Target shoppers during the holiday shopping season. The hack turned into a public relations nightmare for Target. It suffered significant damage to its brand image with the public.

Target’s recovery from the hacking scandal was short-lived, as the company soon after went on an ill-advised expansion campaign in Canada. At first, Target Canada made a lot of sense—close rival Wal-Mart Stores (WMT ) has a successful business in Canada, which set a precedent for discount retail there. But Target soon realized it had to offer heavy discounting to maintain traffic. When sales related to new store openings ended, shoppers did not return to stores, and the discounting caused massive losses.

Target Canada lost $2 billion before the company shut it down and closed all 133 stores last year. It was a very expensive experiment for Target that did not work out. But the company eventually recovered, and has found success once again.

Strategic Priorities Hit the Target

Target’s sales and its share price have recovered since the hacking scandal and Target Canada closure, because the company placed renewed focused on its key strategic priorities. The company kept a firm lid on costs to boost earnings. In addition, Target invested in its e-commerce business. It has successfully turned itself into an omni-channel retailer, which is critical in this environment. Cash-strapped consumers are still holding back spending in the U.S. and are intent on getting low prices. Aside from this, consumers love the convenience of shopping at home. This is why internet retailer Amazon.com (AMZN) has seen so much success over the past year.

Fortunately, Target has kept pace. Last year, its comparable sales – a crucial metric for retailers that measures sales at stores open at least one year – rose 2%. Its earnings adjusted for non-recurring items increased 11% last year. Target launched a number of successful initiatives last year designed to reignite growth, including an online promotion, in which it gave shoppers 15% off everything on its website. This resulted in 34% growth in e-commerce sales in the fourth quarter.

Target’s success has continued into 2016. Comparable sales increased 1.2% in the first quarter, driven by increases in both traffic and average basket size. Adjusted earnings per share increased 16.5% year-over-year. Once again, online sales led the way. E-commerce revenue increased 23% from the same period last year. Last quarter was the sixth in a row of traffic growth, due to growth in both in-store visits and online activity.

Target has enjoyed a steady recovery in earnings and maintains a balanced business across product categories.

Analysts see the positive momentum continuing. Target is expected to earn $5 per share this year and $5.77 per share in 2017 earnings. That would represent 15% growth next year. Target continues to generate a high amount of cash flow, and with its shareholder-friendly management, the company remains committed to returning cash to investors. As a reflection of this commitment, on June 8, Target raised its dividend by 7.1%. The next quarter dividend will rise to $0.60 per share, from the previous level of $0.56 per share. The dividend is payable Sept. 10 to shareholders as of record on Aug. 17.

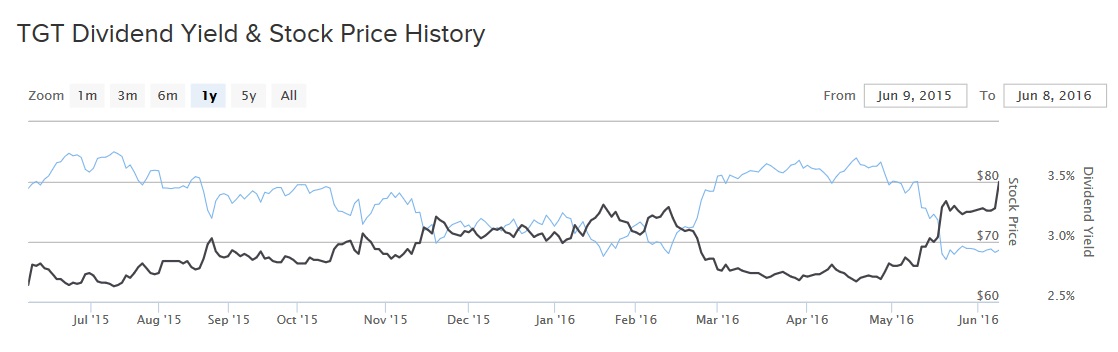

Target has a long track record of returning cash to shareholders. It has paid 196 consecutive, uninterrupted dividends—a streak that goes all the way back to the company’s public offering in Oct. 1967. Moreover, Target has raised its dividend for 45 years in a row. This qualifies it as a Dividend Aristocrat, a select group of S&P 500 firms that have raised shareholder dividends for at least 25 consecutive years. Target’s new annualized dividend of $2.40 per share represents a 3.5% dividend yield based on the stock’s June 8 closing price.

As Target’s future earnings grow, its dividend should continue to grow as well. Even including the recent dividend increase, Target is only going to distribute less than half of its 2016 earnings per share. A payout ratio below 50% gives plenty of room to continue increasing the dividend.

The Bottom Line

Target has had its fair share of challenges over the past few years, but its resilience is a testament to the company’s brand strength and business model. The company offers investors a higher dividend yield and higher dividend growth than close competitor Wal-Mart. Target’s above-average yield, when compared to the S&P 500, makes it a solid dividend stock.