The global package delivery business is essentially a duopoly, with UPS (UPS ) and FedEx Corporation (FDX ) dominating the industry. This provides both companies with huge economies of scale and competitive advantages. Since barriers to entry are high, UPS and FedEx – for the most part – do not have to worry about competitive threats entering the business and taking market share.

As a result, UPS and FedEx enjoy strong margins and profitability, which they can use to raise shareholder dividends.

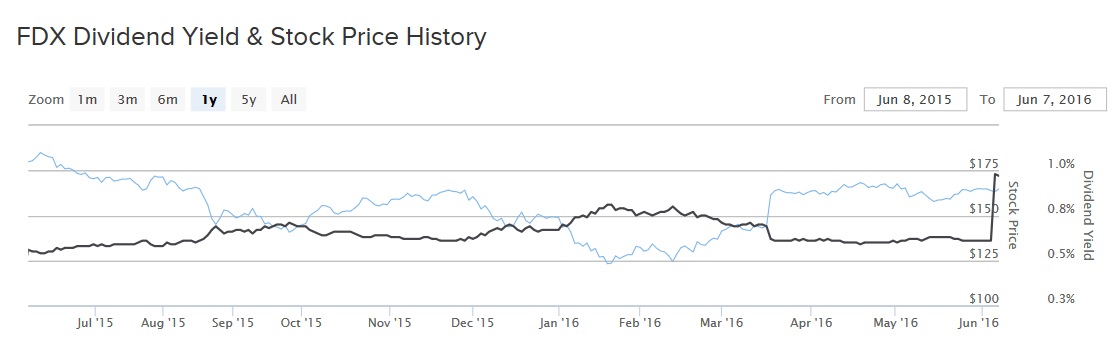

The two industry giants have different capital return programs. On one hand, UPS has a high current dividend yield of 3.0%, meaning it distributes a higher level of its earnings right now. On the other hand, FedEx distributes less of its current earnings—its dividend yield was less than 1% throughout 2016—but it makes up for this with rapid dividend growth each year. On June 6, FedEx raised its quarterly dividend by 60%. The distribution rose to $0.40 paid per quarter, up from the previous level of $0.25 per share. On a percentage basis, FedEx stock now offers a 1% dividend yield. While UPS is the better choice for investors who desire income now, such as retirees, FedEx is likely the better stock choice for growth investors.

FedEx Delivers Long-Term Growth

FedEx is off to a good start in fiscal 2016. Through the first three quarters of the current fiscal year, total revenue rose 6% to $37.38 billion, as compared to the same period in fiscal 2015. However, earnings per share declined 1% in the first nine months of fiscal 2016, year-over-year. The company is enjoying success in its ground segment, where revenue is up 31% through the first three quarters. A major growth driver for shipping is the boom in e-commerce. Online retail is growing at a rapid pace in the U.S., which serves as a strong tailwind for FedEx. Ground volume increased 11% last quarter because of this, and FedEx is enjoying pricing power as well.

Unfortunately, this growth is being offset by unfavorable currency fluctuations and higher costs. The rising U.S. dollar is undercutting growth for FedEx because it has a large international presence. One thing holding FedEx back is the strong U.S. dollar, which affects the express segment, where revenue declined 4% over the first three quarters of the fiscal year. This is a particularly strong drag on the company because the express business is its largest, representing slightly more than half of FedEx’s total revenue. In the freight business, revenue is down 1% through the first three quarters. Operating profit in that segment declined 16% last quarter, due to higher employee salaries, which outpaced volume growth.

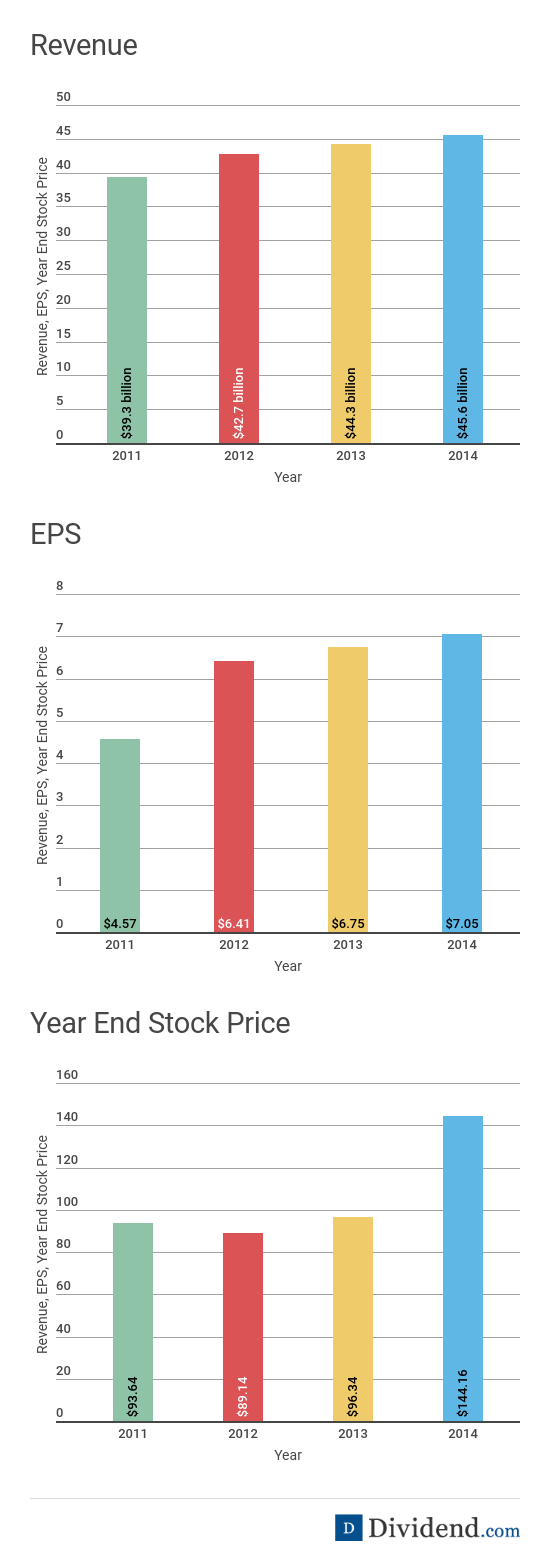

Still, FedEx is a healthy business. It has achieved a proven model of growth over the past several years and the company is solidly profitable. This has resulted in significant wealth creation for shareholders.

This year, the company earned $6.71 in earnings per share through the first three quarters. For the full year, management expects 20-22% growth in adjusted earnings per share. This forecast excludes certain pension accounting adjustments, as well as other one-time costs. Analysts expect continued growth for FedEx into next year. Earnings per share are expected to rise another 12% in fiscal 2017.

Over the long-term, FedEx’s growth will be boosted by its recent acquisition of rival Dutch shipping firm TNT Express. FedEx has acquired TNT for $5 billion. The acquisition gives FedEx access to TNT Express’ strong European road network. It also gives FedEx an advantage in cross-border e-commerce traffic. Global e-commerce is growing at double-digit rates. In addition, it is likely FedEx will be able to generate significant cost synergies from the merger. Since both companies have very similar processes and distribution, there will be many duplicate costs that FedEx will be able to squeeze out. As a result, the merger should be accretive to FedEx’s earnings over the long term.

With the gradual recovery in the global economy and the boom in e-commerce, FedEx has a clear roadmap of growth projected over the next several years. As its earnings grow, the company should have little trouble raising its dividend. In addition, FedEx still has a very low payout ratio. After the recent dividend increase, FedEx’s annualized dividend will grow to $1.60 per share. But this is still a small payout considering the company’s earnings power. FedEx is projected to earn $10.78 per share in fiscal 2016. This represents a tiny payout ratio of just 15%. Therefore, investors should expect rapid dividend growth rates from FedEx moving forward. FedEx could easily continue to increase its dividend by 25% per year over the next five years and still maintain a healthy payout ratio.

The Bottom Line

FedEx has many growth catalysts ahead, both organically and through acquisition. As its revenue and earnings rise, so will its dividend. Investors who prefer high-yield stocks may view UPS as the better choice, but growth investors should see FedEx as the more attractive stock pick given its earnings and dividend growth prospects.