There is an old saying, that there are only two certainties in life: death and taxes. The latter, while a sore subject for many taxpayers, is nevertheless big business for tax preparers. H&R Block, Inc. (HRB ) is a professional tax preparation company. It also provides other services including financial planning to corporations and individuals in the United States, Canada, and Australia.

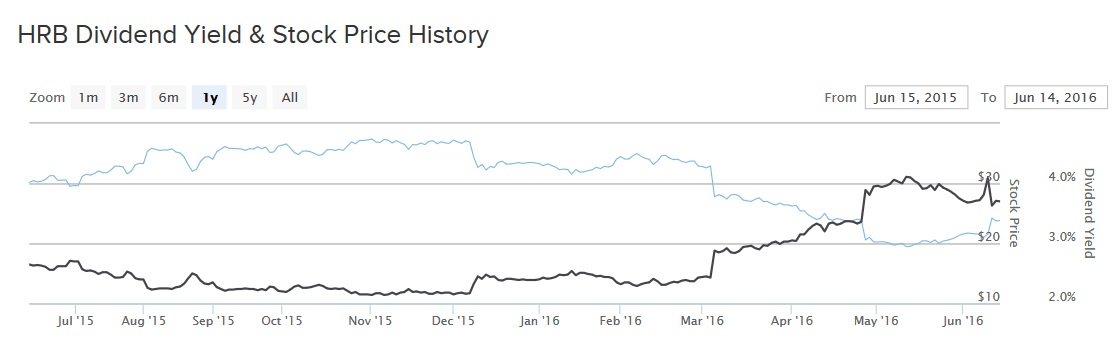

H&R Block has taken investors on a wild ride over the past several years, which is not what one would expect from a fairly sturdy business model. In the past five years, the stock has swung to as low as $13, before rallying above $37 to close out 2015. But in 2016, the stock has taken on another downturn. Shares briefly fell below $20 in June.

The reason why the stock has exhibited such high volatility is because investors are worried about the long-term growth potential of the business model. As tax preparation becomes more of a “do-it-yourself” task, individuals are turning to software that they can use at home to do their own taxes. The company has taken steps to counter this, and its recent dividend increase is a sign of some positive momentum.

H&R Block Must Account for the Shifting Landscape

The tax preparation business is intensely competitive. Not only does H&R Block have to compete with other tax preparation services such as Jackson Hewitt and personal tax preparers, but it now has to compete with software tax preparation products. The biggest danger to H&R Block is Intuit Inc. (INTU ). Intuit offers QuickBooks and Turbo Tax, the tax preparation and financial planning software brands. Intuit has seen excellent growth of its software packages. Last quarter, which included the critical April tax season, Intuit delivered 15% growth in TurboTax Online units.

If consumers widely adopt at-home tax preparation, H&R Block would face a significant headwind. Naturally, as the world’s largest consumer tax preparation provider, this would mean less demand for H&R Block’s services. Indeed, H&R Block has seen revenue stall for a few years in a row. In fiscal year 2014, H&R Block had annual revenues of approximately $3 billion, with 24.2 million tax returns prepared worldwide. Not much changed since—fiscal 2015 revenue was also just over $3 billion. Looking further back, revenue has increased only at about a 1% annual rate since fiscal 2011.

| Year | EPS | Revenue (billion) | Shares Outstanding (5-Year) |

|---|---|---|---|

| 2011 | $1.27 | $2.94 | 305,366 |

| 2012 | $1.16 | $2.89 | 292,119 |

| 2013 | $1.69 | $2.91 | 272,635 |

| 2014 | $1.81 | $3.02 | 274,228 |

| 2015 | $1.75 | $3.08 | 275,275 |

| 2016 | $1.59 | $3.04 | 249,009 |

The good news is that while online services are becoming more popular, H&R Block has not yet seen a significant decline in revenue. The key factor for H&R Block is that it has worked to shift its business focus. Even though paper returns are becoming less common, H&R Block has offset this to some degree, with providing more online returns to its customers. Online returns increased 7.2% since fiscal 2013, while total U.S. tax returns have declined 8.7% in that time. This shift to higher-value products and services has helped to boost margins, as the company has closed physical stores due to less demand for in-person assistance. H&R Block closed 4% of its U.S. stores from fiscal 2014-fiscal 2015.

The other reason why H&R Block has managed to increase earnings at a much faster pace than revenue is because the company buys back a significant amount of stock each year. Despite its lackluster top-line growth, H&R Block still generates a lot of free cash flow. Last year, H&R Block generated $503 million of free cash flow. Since it remains a strong cash flow producer, H&R Block can use this excess cash flow to buy back stock to reduce its share count, which increases earnings. H&R Block spent $2 billion on share buybacks last year alone. Another use of cash is the company’s dividend program.

Attractive Dividend Growth

Another promising aspect of H&R Block’s value proposition to investors is that it pays a compelling dividend. On June 9, along with providing full-year fiscal 2016 results, the company announced a 10% dividend increase. The new quarterly dividend rate will be $0.22 per share, up from $0.20 per share previously, payable July 1 to shareholders of record as of June 20. The next quarterly dividend rate will be the company’s 215th consecutive quarterly dividend since H&R Block went public in 1962.

In addition, the company added a statement to its dividend increase, that it intends to review the dividend policy on an annual basis moving forward. This implies the potential for future dividend increases, presumably as long as the fundamentals do not deteriorate. There is good reason to suspect H&R Block can support future dividend increases. Due to its strategic shift and share buybacks, earnings continue to rise at a modest pace. Next year, analysts expect H&R Block to increase earnings per share by 15%. As a result, the dividend payout ratio is supportive of future dividend growth. To that end, H&R Block distributed slightly less than half of its trailing-12 month EPS.

The Bottom Line

H&R Block is a company in transition. Physical tax returns and tax preparers are seeing less demand, as tax payers increasingly flock to software and at-home tax preparation. But the company is responding to these changes by shifting its model toward new services designed to cater to this demand. H&R Block is not likely to be a growth stock, judging by its difficulties in growing revenue, but the company remains highly profitable and pays an attractive 3.7% dividend yield.