Industrial giant Stanley Black & Decker (SWK ) is a company that could fly under the radar of many income investors. The stock does not get much coverage in the financial media. But that is in no way a reflection of the business. Quite the contrary: Stanley Black & Decker has a long history of delivering strong returns to shareholders. Based on its July 22 closing price of $120.49 per share, the stock has returned 7% per year over the past 20 years.

A significant portion of its total returns over the past two decades is its dividend. Stanley Black & Decker has a shareholder-friendly management team that is committed to providing shareholders with rising dividends each year. The company recently raised its quarterly dividend by $0.03 per share, from $0.55 per share to $0.58 per share. This is a 5.5% increase and it represents the 49th year in a row of higher dividends for the company. Stanley Black & Decker is a Dividend Aristocrat: one of a list of companies that have raised their dividends for at least 25 years in a row.

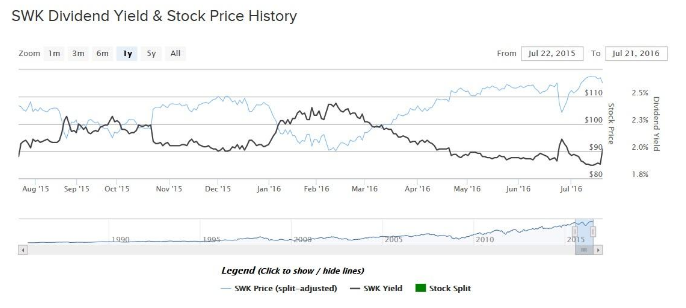

Stanley Black & Decker stock is up 13% in the past one year, not including dividends, and has solidly outperformed the S&P 500 in that time.

Diversified Business Model

Stanley Black & Decker produces hand tools, power tools, and related equipment, as well as solutions for the health care and electronic security industries. The company operates around the world, with an almost even split between domestic and international annual revenue. It is a diversified business in terms of both product focus and geography. It has three business segments — Tools & Storage, Security, and Industrial — each contributing meaningfully to earnings.

Stanley Black & Decker’s balanced business model has produced growth for the company, alongside its strategy of aggressive acquisitions, which has driven additional growth. Between 2000 and 2015, the company grew revenue from $2 billion to $11 billion and delivered a shareholder return of more than 400%. Last year, Stanley Black & Decker achieved 6% organic revenue growth, which strips out the effects of foreign exchange fluctuations. It also achieved significant cost cuts that resulted in record operating profit margin in the Tools & Storage segment. Overall, the company increased earnings per share by 5% last year to a record $5.92 per share.

And the company is off to a solid start in 2016. Even with significant currency headwinds, a consequence of the strong U.S. dollar and the fact that the company generates 47% of its sales from outside the U.S., Stanley Black & Decker grew total revenue by 2% last quarter. It expanded its operating profit margin by another 140 basis points, which resulted in 19% year-over-year growth in earnings per share. The company also raised its guidance for the full year. In fiscal 2016, Stanley Black & Decker expects to generate earnings of $6.30-$6.50 per share, which would represent 6%-10% growth from the previous year. The upwardly revised guidance is driven by better-than-anticipated cost cut improvements expected over the remainder of the fiscal year.

Long-Term Goals

Stanley Black & Decker management believes its strong brand portfolio, diversified business model, and cost cut initiatives will provide sustained long-term growth for the company. Management has set long-term goals for the company to grow revenue by 10%-12% each year, driven by 4%-6% organic revenue growth. In addition, the company expects to achieve 10%-12% growth in earnings per share each year and to increase its dividend every year.

To help achieve these goals, last year Stanley Black & Decker launched SFS 2.0, the next generation of Stanley Fulfillment Systems — a more powerful operating system that will help enable the company to produce sustainable organic revenue growth, margin expansion, and efficiency of assets over the long term. A key pillar of this strategy is improved asset efficiency, which the new operating system boosts by focusing on streamlining working capital and enhancing free cash flow generation. Another aspect of this strategy is to leverage the company’s digital capabilities, including in big data, mobile, and the Internet of Things.

The Bottom Line

Stanley Black & Decker has doubled its dividend in the past decade. The new annual dividend of $2.32 per share represents a 1.9% current dividend yield. This is slightly below the S&P 500 average dividend yield, but the company makes up for this with higher than average dividend growth.

Stanley Black & Decker is highly profitable and has a 34% dividend payout ratio. As earnings grow each year, the company should be able to increase its dividend each year. The stock has a modest valuation with a 17 P/E ratio and is a strong selection for dividend growth.