After several weeks of speculation, the rumored deal between Verizon Communications (VZ ) and Yahoo! Inc. (YHOO) has finally taken place. On July 25, prior to the market open, the two companies announced a formal merger agreement. The deal finally concludes a long-running saga for Yahoo.

Yahoo has suffered a prolonged decline in its core businesses that has caused the stock to underperform in the broader indices for an extended period. The stock is essentially flat over the past one-year and two-year periods — a worse performance than the S&P 500 in that time. Yahoo has been a highly frustrating stock for investors to own because the company does have strong assets, including its Yahoo! Finance and Yahoo! Sports properties, patent portfolio, and a large business in Japan. In addition, Yahoo’s real gem is its ownership stake in Chinese e-commerce giant Alibaba (BABA ).

However, despite these assets, investors have not been rewarded because of the continued deterioration in Yahoo’s core search business. Yahoo has ceded significant market share in both search and mail to Alphabet (GOOG), which now dominates the landscape.

Deal Structure

The deal is structured as follows: Verizon will acquire Yahoo’s operating businesses for $4.83 billion in cash. Verizon chose to pay cash instead of stock, which makes financial sense. With interest rates still near historic lows, corporate cash balances are earning very little in interest. At the end of last quarter, Verizon held $5.8 billion in cash on its balance sheet. This money was creating no value for shareholders and was more than enough to cover the acquisition.

Verizon will receive Yahoo’s search, email, and messenger assets, along with Yahoo’s advertising technology. After the deal closes, Yahoo will become a holding company. The acquisition does not include the investments in Alibaba and Yahoo Japan. Yahoo will continue to hold the 15% stake in Alibaba and the 35% stake in Yahoo Japan. According to Yahoo management, the company intends to hold onto these investments for an indefinite period. The acquisition also does not include Yahoo’s cash on hand, which totals $7.7 billion.

These investments have been critical to Yahoo’s survival in recent years. The stakes in Alibaba and Yahoo Japan are worth approximately $40 billion based on current market capitalizations of these companies, while Yahoo’s market capitalization currently stands at $37 billion. What this means is that Yahoo’s core business is essentially valued for a negative net worth to the company. This is because the core assets are in significant decline. For example, last quarter Yahoo reported a $440 million net loss, due to an impairment for its Tumblr property, which it acquired three years ago for $1.1 billion.

Outlook for Verizon

The deal carries great potential for Verizon, not because of Yahoo’s core Internet properties, but rather because of its users and advertising technologies. Despite its declining search and email platforms, Yahoo still has more than 1 billion monthly active users, as well as 600 million monthly active mobile users. In addition, Yahoo has a leading advertising technology stack that leverages its data, content, and technology. The real value for Verizon is in using Yahoo’s existing technology to enhance its media and advertising businesses. This was the reason Verizon bought AOL last year for $4.4 billion.

Verizon is making a big push into media and advertising, particularly in mobile video. These areas are still growing, much faster than Verizon’s core cable and wireless businesses, which have become saturated in the U.S. By acquiring Yahoo, Verizon instantly ramps up its user numbers. Scale is the key strategy employed here.

Still, Verizon has a long way to go in order to catch up with the companies at the top of the mobile advertising space, including Google and Facebook (FB ). According to technology research firm eMarketer, Yahoo is expected to generate $2.32 billion in net U.S. digital ad sales this year. At the same time, AOL is expected to generate $1.3 billion in digital ad sales in 2016. These numbers pale in comparison to Facebook and Google, which are expected to produce $10.3 billion and $24.63 billion in revenue from digital ads this year, respectively.

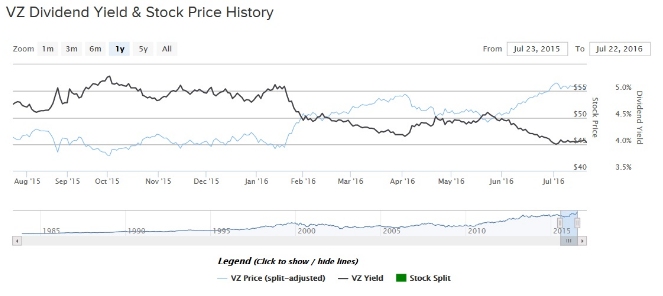

Yahoo stock fell nearly 3% after the deal was announced, which indicates shareholders do not feel the company got a high enough price. By contrast, it would then imply that Verizon got a good deal. For Verizon shareholders, the key question is whether the deal impacts the company’s ability to pay its dividend. After all, Verizon is one of the highest-yielding stocks in the Dow Jones Industrial Average, and it has increased its dividend for nine years in a row. The good news is that Verizon should have no trouble maintaining its dividend growth.

Verizon is a cash cow. The company generated $21.1 billion in free cash flow last year and paid $8.5 billion in dividends. Its dividend payout ratio last year was just 40% of its annual free cash flow. The acquisition of Yahoo is a fairly small deal for Verizon; it is entirely covered by cash on hand, not to mention the prodigious cash flow generation of the underlying business. Verizon typically raises its dividend by 2%-3% per year — a modest pace of dividend growth that it should easily continue going forward.

The Bottom Line

Verizon’s takeover of Yahoo represents a major step forward in its ambitions to become a digital and mobile advertising powerhouse among the likes of Facebook and Google. It appears Verizon is taking a risk by buying a money-losing company, but it’s really after the scale and user numbers of Yahoo’s Internet properties. Plus, considering Verizon has plenty of cash on hand and billions of free cash flow generated each year, it is actually not a risky play for Verizon, given the potential growth benefits.