Real estate investment trusts (REITs) have come in favor over the past year. Investors who desire income from their stock investments, such as retirees, have flocked to the REIT asset class in light of the current investing climate. In today’s environment of record-high stock prices and historically low interest rates, income investors are in a very difficult position. Yield is hard to find in the stock market, but REITs continue to be a source of high dividend yields.

Because of such high demand for income producing stocks, REITs have significantly outperformed the broader market for an extended period. General Growth Properties (GGP) is a REIT operating in the mall industry. It owns and manages 120 retail properties across the U.S., with additional renovation projects under construction.

As a reflection of its strong business model, on Aug. 1, 2016, General Growth’s Board of Directors declared a third quarter dividend of $0.20 per share. On an annualized basis, the new dividend rate will be $0.80 per share, representing an 11% increase from the same quarterly dividend paid last year. The updated quarterly dividend will be payable on Oct. 31, 2016, to shareholders of record on Oct. 14.

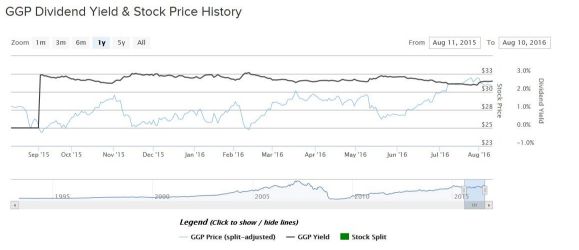

General Growth stock has performed well over the past year, as investors demand the high yields typical in the REIT asset class. The stock sits less than 1% off of its 52-week high.

Fundamental Performance and Risk Factors

General Growth has exhibited the steady growth that investors look for from REITs. For example, last year the company generated growth across a number of important metrics. General Growth grew earnings before interest, taxes, depreciation and amortization (EBITDA) by 5.4% from 2014, to $2.12 billion. Funds from operation (FFO) – a non-GAAP equivalent to traditional earnings per share that is more appropriate for analyzing REITs – rose 8.7%, to $1.44 per share. These strong results have continued into 2016. Company EBITDA rose 6.5% and 13% last quarter and in the first half of the year, respectively.

General Growth also has a strong tenant base. As of last quarter, it held a 96% occupancy rate. Plus, initial rent rates for leases signed in the past year are up 13% when compared to the rental rate for expiring leases. This shows the dual benefits of rising occupancy and rising rental prices, and it shows that General Growth has high-quality, in-demand real estate properties and enjoys pricing power as a result.

Going forward, this steady growth is expected to continue. Analysts currently expect General Growth to earn $1.56 per share this year and $1.63 per share in 2017, which would represent 4.5% annual earnings growth. The analyst forecasts are in-line with management’s guidance. General Growth has guided investors to expect $1.53 in FFO at the midpoint of the 2016 forecast, which would represent 6% growth this year. This growth will be fueled largely by new properties and rent increases. General Growth invested $1.1 billion last quarter in development and redevelopment activities, of which approximately $500 million is under construction and the remaining $600 million is in the future project pipeline.

One risk for investors to keep in mind is the state of malls in the U.S. Due to heightened popularity of online shopping, Internet retail companies like Amazon.com (AMZN) have taken significant market share from brick-and-mortar retailers. This directly affects General Growth, as mall traffic has declined over the past year. Fortunately, General Growth has responded by divesting from poorly performing properties to focus investment on the best opportunities. And, the company still enjoys high occupancy and rent increases, so it is clear that demand for malls is still strong, albeit somewhat weakened.

High-Quality Properties

The take-away from this data is to emphasize General Growth’s strong property portfolio. It owns 100 of the top 500 malls in the U.S. These properties carry satisfactory sales per square foot. This means General Growth will not be as affected by erosion in mall traffic than its competitors, because General Growth has focused on higher-end properties. Low-quality properties will be most affected if malls fall further out of favor.

Another key risk factor that investors need to keep in mind is the direction of interest rates. Last December, the Federal Reserve hiked interest rates for the first time in the past 10 years. Investors should expect higher interest rates because the U.S. economy continues to grow at a steady pace. The Federal Reserve has maintained two critical thresholds for raising interest rates, which are full employment, as measured by a 5% unemployment rate, and 2% inflation. The U.S. economy is close to reaching both targets.

This means that companies sensitive to fluctuations in interest rates, such as REITs, may see business conditions become more difficult. Higher interest rates will raise the cost of capital for companies that rely heavily on debt to finance their assets, such as REITs. If interest rates rise, it will be costlier to take out debt to fund purchases of new properties, which is the biggest growth driver for REITs. As a result, rising interest rates could be a significant headwind for future earnings growth. This is why interest rates are an important risk factor that investors should keep in mind going forward.

The Bottom Line

In this low interest rate environment, investors are starved for yield. Income investors have plowed into traditional high-dividend sectors like utilities, telecoms and REITs, because these companies tend to pay higher dividends than most stocks. General Growth has an attractive 2.7% dividend yield and a path for future growth.