The consumer staples sector is simply on fire. Over the past year, investors have flocked to consumer staples stocks like Kellogg Company (K ), because companies like Kellogg are highly reliable. The economics of this industry are extremely sound. Kellogg is a major food and beverage company and, after all, everyone needs to eat. This gives investors the ability to analyse Kellogg, and forecast its future earnings and dividends with a great deal of predictability. Kellogg is not a volatile company or stock, which allows its investors to sleep well at night and collect its dividends.

Many of the stocks with the longest histories of paying and raising their dividends over many years come from the consumer staples sector, including Kellogg. The company has a large portfolio of industry-leading brands including Kellogg’s popular cereal products, Corn Flakes and Rice Krispies, as well as Keebler, Pringles, Pop-Tarts, Kashi and Eggo.

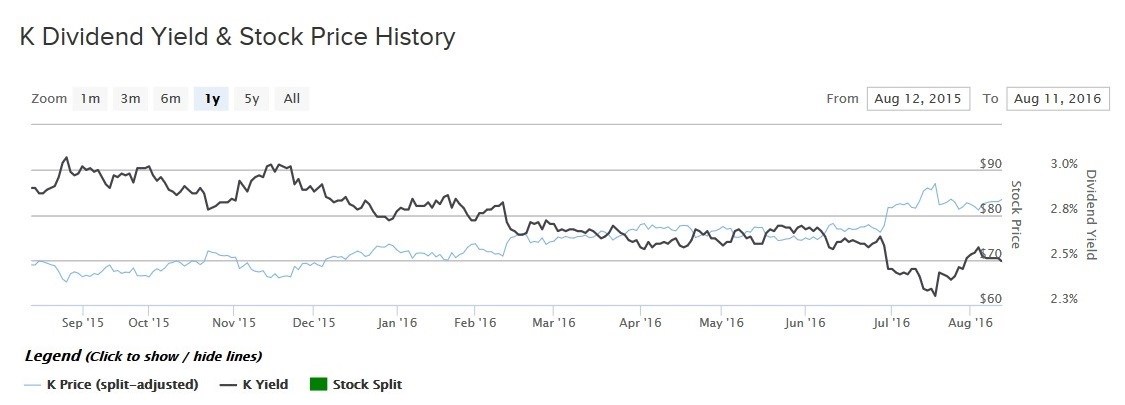

Because of its stable earnings and dividend growth, investors have bid up the valuation of Kellogg and other consumer staples stocks. Kellogg shares have performed extremely well over the past year and have beaten the S&P 500 in that time. This may lead some to feel that Kellogg is overvalued, but high-quality blue chip stocks like Kellogg command premium valuation.

Kellogg: Ideal Stock for Risk-Averse Investors

Kellogg has a reputation for stable profits and dividends with modest growth each year, and it has earned this reputation. Last year, the company generated $13.5 billion of sales and $1 billion of operating profit. Operating profit rose 7% for the year. Revenue fell 7%, but this decline was due mostly to currency fluctuations. As a major multi-national company, Kellogg is vulnerable to swings in foreign currencies. The U.S. dollar has strengthened significantly against other global currencies over the past year, which has actually hurt U.S. companies that have large international operations. That is because a stronger U.S. dollar relative to foreign currencies reduces the competitiveness of U.S. exports, and makes revenue generated overseas worth less when converted back into U.S. dollars.

For example, Kellogg sells its products in more than 180 countries around the world. Last year, Kellogg derived 37% of its sales from outside the U.S., which is why total revenue fell 7% in 2015. However, excluding the impact of foreign exchange movements, Kellogg’s organic revenue actually increased 1.2% for the year. This is a good indication that the revenue decline is due to cyclical factors; the underlying business remains healthy and there is strong demand for Kellogg’s products.

Kellogg has a long operating history and, as a result, it is managed for the long term. The company’s management team has set growth targets that are both meaningful and realistic. The long-term objectives are to grow organic revenue by 1-3% annually, along with 7-9% organic earnings growth. Revenue growth will be obtained from entry into new geographic markets, particularly the emerging markets, where populations are high and rising standards of living will result in expanding consumer classes. In addition, Kellogg can generate revenue growth from pricing increases and from new product categories. Last year, the company built a new segment for the Kashi brand, a product aimed at health-conscious consumers. These initiatives will help fuel earnings growth, as will Kellogg’s significant cost-cutting program.

These are already having a positive effect on the business. For example, over the first half of 2016, operating profit is up 12% year-over-year. Continued cost-savings measures are expected to increase operating income by an even higher margin this year. Kellogg recently raised its full-year forecast. It now expects 15-17% growth in operating profit this year, up from the previous forecast of 11-13% growth. Along with this, management also raised the guidance for earnings per share to $4.11-4.18 per share, from previous guidance of $4.00-4.07 per share, excluding currency fluctuations.

Going forward, Kellogg expects to generate even greater cost savings, thanks to the implementation of a zero-based budgeting strategy. This is a managerial tactic, in which corporate leaders create a new budget, each year, as though there wasn’t a budget the previous year. Zero-based budgeting is a popular tool being employed among a number of consumer goods companies, especially those with a global reach, in light of geopolitical uncertainty and slow global economic growth. Kellogg has seen great success with this initiative, and now expects to increase its currency-neutral operating profit margin by approximately 350 basis points this year, compared with 2015 levels, and that margins will continue to increase through 2018, as the company takes its zero-budgeting process to its international operations.

Dividends

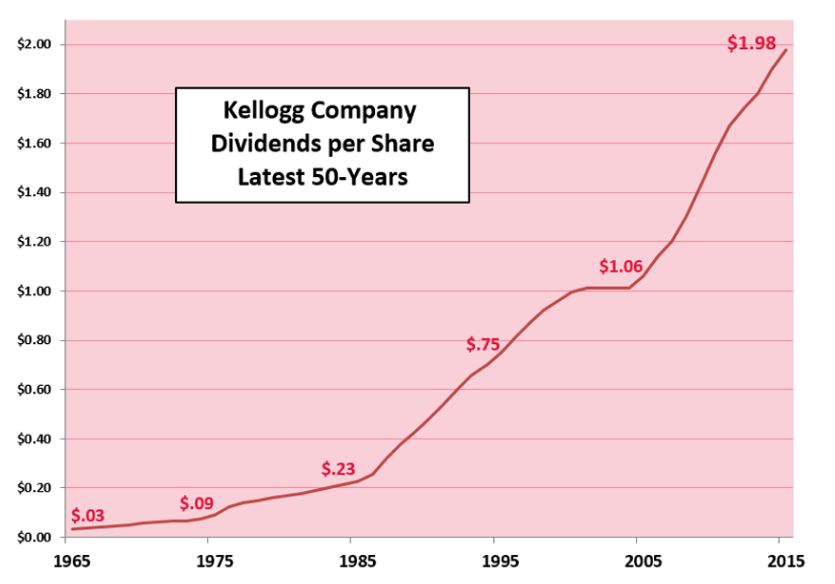

On July 29, Kellogg’s Board of Directors declared a $0.52 per share quarterly dividend, payable on Sep. 15, 2016, to stockholders of record on Sep. 1, 2016. The new dividend rate is a 4% increase from the previous dividend level. On an annualized basis, Kellogg’s dividend rises to $2.08 per share.

Based on Kellogg’s Aug. 11 closing price of $83.46 per share, the new dividend provides a 2.5% yield. This is approximately 50 basis points above the average dividend yield in the S&P 500 Index. The next quarterly dividend represents Kellogg’s 367th payout since 1925.

Indeed, Kellogg has been one of the most impressive dividend stocks over the past five decades.

The Bottom Line

Kellogg has been an extremely rewarding stock for investors over a very long period. Based on its Aug. 11 closing price, the stock has returned 21% over the past year, not including dividends. The stock could perform well into the future, as the company grows revenue organically and achieves significant margin expansion. This will help fuel dividend growth as well.