Illinois Tool Works has raised its dividend each year for more than 50 consecutive years since 1924.

The industrials sector is composed of companies that are cyclical in nature. Their fortunes are tied to the condition of the global economy. Over the past two years, industrials have had to deal with the rising U.S. dollar — which makes exports less competitive — and the slowdown in economic growth in emerging markets like China. If that were not bad enough, industrials have also struggled with the decline in commodity prices, as the oil and gas industry makes up a significant customer base for industrial firms.

One industrial company that has bucked the trend of broader sector weakness is Illinois Tool Works (ITW ). While many other industrial stocks have fallen significantly over the past year, Illinois Tool Works is thriving, thanks to its highly profitable business model, cost-cutting program, and strong product portfolio. This has kept the company’s sales and profit relatively stable, compared with its industry peers.

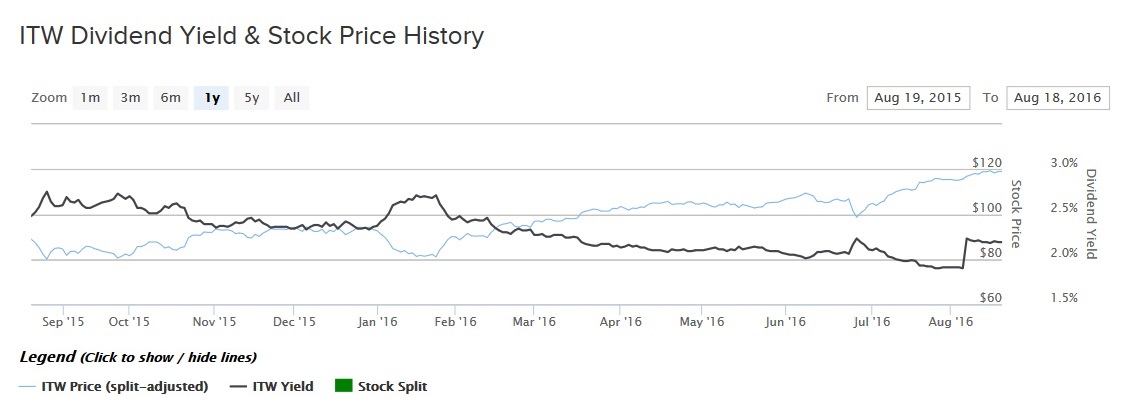

Illinois Tool Works stock has performed very well over the past 12 months. Through its Aug. 18 closing price, the stock is up 32% in the past 12 months, not including dividends. This performance has soundly beaten the S&P 500 Index in the same time. Illinois Tool Works is an attractive stock pick for income investors.

Fundamental & Business Analysis

Even though the industrial sector is struggling broadly, Illinois Tool Works is doing very well. Last year, the company increased earnings per share by 10%, or by 19% excluding the negative impact of the rising U.S. dollar. It accomplished this with a combination of organic revenue growth and cost cuts, which boosted operating profit margin by 150 basis points to 21.4% — a record operating margin for the company. Furthermore, Illinois Tool Works has a strong management team that effectively allocates capital to the best opportunities. This is why it generated a record return of 20.4% on invested capital last year.

The company’s excellent financial performance is due to its proprietary business practices and capabilities, which are called the ITW Business Model. This provides the company with a distinct competitive advantage and allows it to serve its customers in the most profitable way possible. This initiative has given Illinois Tool Works solid growth with best-in-class margins and returns on capital.

A key component of this strategy was to divest low-growth commoditized businesses in favor of higher-margin, higher-growth opportunities. For example, Illinois Tool Works has made more than 30 divestitures in recent years and, as a result, now has a concentrated focus on seven core segments that the company believes have the best long-term growth fundamentals. At the same time, Illinois Tool Works is still diversified across both end-user and geographic markets.

The automotive business manufactures plastic and metal components and fasteners. The food equipment segment provides commercial food preparation equipment, including ovens, ranges, boilers, and refrigerators. Test and measurement, as well as electronics, manufactures solutions that help repair and support proper functioning of electronic components. The welding division produces arc welding equipment in fabrication, ship building, and other industrial uses. The polymers business produces adhesives, sealants, lubrication, and cutting fluids. The construction products provide engineered fastening systems and solutions to the construction industry. And lastly, the specialty products unit provides packaging, coding, and marking equipment to the consumer durables industry.

The combination of operating multiple, highly profitable businesses with excellent returns on capital provides the company with significant free cash flow generation each year. And Illinois Tool Works uses a large amount of this free cash flow to reward shareholders with dividends and share buybacks.

2015 ITW Revenue Breakdown

Dividend Analysis

Illinois Tool Works has a very long and impressive history of paying a dividend to shareholders and raising the dividend each year. On Aug. 5, 2015, the company’s Board of Directors declared a quarterly dividend of $0.65 per share. This represents an 18% increase from the previous dividend rate. On an annualized basis, Illinois Tool Works’ dividend rate goes to $2.60 per share, which is a 2.2% dividend yield. This compares favorably with the S&P 500 Index, which provides a dividend yield of roughly 2%. Illinois Tool Works has raised its dividend each year for more than 50 consecutive years since 1924.

Going forward, investors should expect the company to continue delivering dividend increases in the double-digit range on a percentage basis. It has achieved this growth rate in recent years despite a difficult economic backdrop. As a result, it stands to reason that the company should be able to maintain this growth once economic conditions improve. Analysts expect Illinois Tool Works to earn $5.52 per share in 2016 and $6.05 per share next year, for an expected earnings growth rate of 10%.

This would be more than enough growth to justify strong dividend growth going forward, as the company maintains a modest payout ratio. Illinois Tool Works’ new annualized dividend rate of $2.60 per share represents 47% of 2016 forecast earnings and 43% of next year’s projected earnings per share. A payout ratio of less than half of annual earnings per share provides more than enough flexibility to continue increasing dividends at a high rate moving forward.

The Bottom Line

Illinois Tool Works is highly profitable, pays a compelling dividend, and has a stock that is attractively valued on a valuation basis. The stock trades for 18 times earnings and has demonstrated good relative strength, as it is just 5% off of its 52-week high.

Illinois Tool Works has a strong management team and a demonstrated track record of successfully navigating the ups and downs of its cyclical industry, making it an attractive stock pick for income investors.