Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Canada’s banks have succeeded at turning around their fortunes in a harsh environment, as other peers have struggled to satisfy investors. The latest earnings reports from Royal Bank of Canada and Bank of Montreal stand to confirm that. The two banks are present on our list, along with telecom company CenturyLink and McDonald’s.

Bank of Montreal {% dividend BMO %}

Bank of Montreal has seen its traffic rise as much as 83% in the past week, as the firm reported brisk financial results for the second quarter, sending the stock rising. Shares in Canada’s fourth largest lender have jumped more than 2% over the past five days, with the bulk of the gains taking place immediately after the company issued its results on Tuesday. Year-to-date, the stock has soared more than 18%.

Bank of Montreal has benefited from low delinquency rates on its consumer credit loans, lower costs and increased activity at its investment banking division in the last quarter. As a result, net income edged up about 5% compared to the same period a year ago, despite higher loss provisions for the oil sector. Soured energy loans were much lower than many analysts had expected, suggesting the firm weathered a potential storm. Executives, apparently, are not yet confident the worst is over, fretting about second-round effects, such as unemployment and lower overall demand in Canada.

However, the company increased its quarterly dividend from C$0.84 to C$0.86, as part of its policy to return about half of its profits to shareholders. In the same period last year, it had paid C$0.82.

With an annual dividend yield of more than 4%, the company tops the financial average of 3.52%.

Royal Bank of Canada {% dividend RY %}

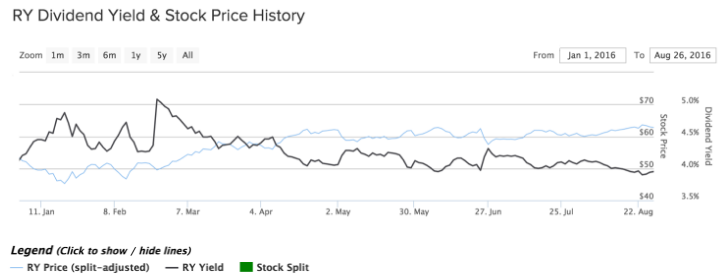

Royal Bank of Canada viewership has jumped 69% this past week, comfortably taking first spot on our list. Similar to Bank of Montreal, RBC posted stunning results for the latest quarter, but the stock has failed to react. Shares in Royal Bank of Canada have risen about 1% over the past five days, and are up more than 10% since the beginning of the year.

The firm surprised investors when it said that profit grew 17% in the third quarter, compared to the same period a year ago, and 13% from the last one. And the good news for investors did not end here. The largest Canadian lender increased its quarterly dividend from $0.81 to $0.83 per share, representing an annual payout of well over 4%. The company’s impressive results, however, stem from a sale of an insurance business for $235 million.

RBC is facing the same challenges as the entire banking sector in Canada: a slump in energy prices leading to higher loan delinquency and default rates. So far, RBC has navigated the headwinds – thanks, in no small part, to its conservative lending practices. It said it had decreased its provisions for credit losses related to the oil and gas sector by 31% compared to the same period a year ago, but warned that the industry was not yet completely out of the woods. The bank thinks if the price of oil goes above $60 per barrel, the environment will become even more favorable for the oil companies, making their loans more sustainable.

But the risk could now come from a different part of the economy – the housing sector, which is overheating. If home prices go down, delinquencies will inevitably rise. RBC, for its part, says it is well prepared and watching the developments closely.

CenturyLink {% dividend CTL %}

Telecommunication services company CenturyLink taken the third spot on our weekly list, with a 43% increase in viewership. The U.S. company, which has been overshadowed by its much larger peers AT&T (T ) and Verizon (VZ ), has jumped more than 14% since the beginning of the year, and has fallen slightly in the past five days.

Over longer periods, the telecom firm has struggled to create shareholder value, underperforming both Verizon and AT&T over the past five years. Its dividend, however, remains high and has been stable over the past three years. In 2013, the firm was forced to trim its dividend by about 20%. Since that cut, CenturyLink has paid a quarterly dividend of $0.54, and confirmed it on August 23. Shareholders are expected to receive the payout on September 16. CenturyLink’s dividend yield is over 7%, significantly above the technology average of just below 2%.

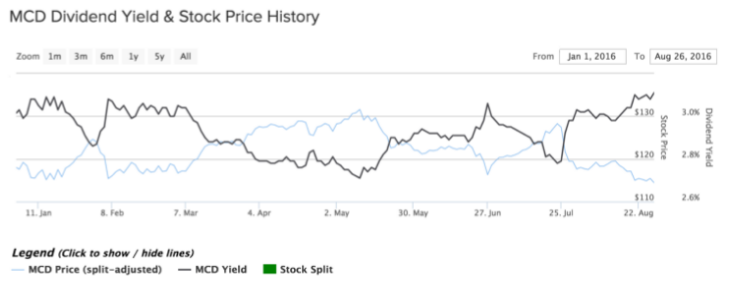

McDonald's {% dividend MCD %}

Iconic fast-food company McDonald’s has seen its traffic rise 34% in the past week. The company’s stock is down more than 3% since the beginning of the year, as its turnaround apparently hit a wall.

Although the company’s all-day breakfast menu proved a hit with consumers – and was mostly responsible for the successful execution of a turnaround, recent developments have got investors worried about its future. The burger chain now faces rising labor costs as a result of wage hikes implemented following severe criticism across the board for the way it treated employees, and the company has experienced some negative publicity lately related to its products. Just recently, McDonald’s was forced to recall 29 million fitness bands meant for children that were part of its Happy Meal menu after a string of skin irritation reports. This negative hype will hurt its brand, and also increase costs.

The Bottom Line

Canadian banks have generated the most traffic this week for their impressive financial results, despite a tough environment in the oil and gas sector, and headwinds from the housing industry. Other Canadian financial institutions are expected to report their earnings soon. CenturyLink has taken the third spot on our list for its hefty dividend, while McDonald’s has been in the spotlight for its flailing turnaround.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.