Royal Bank of Canada (RY ) is located in Canada and has its business focus there. It is the largest bank in Canada, by market capitalization. But it is not just confined to Canada; Royal Bank of Canada has a significant international business, operating in 40 countries around the world. This is a positive because it diversifies the business, but it can also be a negative because it exposes the company to geopolitical risk. As the global economy has slowed down this year due to renewed geopolitical concerns such as the Brexit and declining economic growth in the emerging markets, this has impacted Royal Bank of Canada’s fundamental progress.

Still, Royal Bank of Canada is a well-run financial institution. It is highly profitable, even in an uncertain global economy. And this allows the company to consistently return cash to shareholders as a dividend, and management is committed to paying a competitive dividend and raising the payout over time. As a reflection of its strong underlying business fundamentals, Royal Bank of Canada recently announced a 2% dividend increase in Canadian currency. The new quarterly distribution will be paid on Nov. 24, to shareholders of record on Oct. 26.

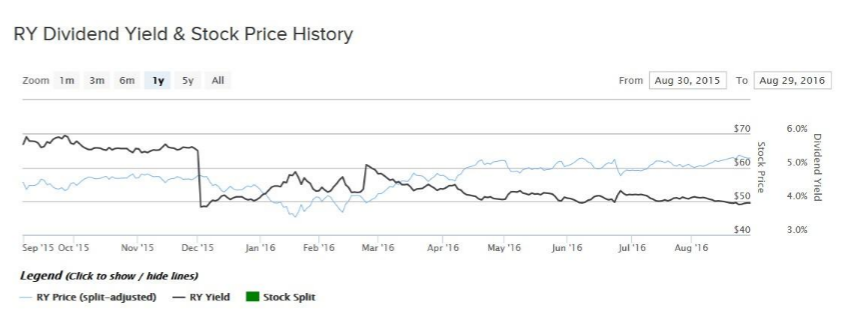

The current dividend yield is now 4.2% in U.S. dollar terms, which is roughly double the dividend yield of the average stock in the S&P 500 Index. This is a very strong dividend yield rate, and the stock has rewarded investors with compelling share price gains as well. Over the past one year, Royal Bank of Canada has returned 13%, not including dividends, and significantly outperformed the S&P 500 Index in that time.

Growth Catalysts

Last year, Royal Bank of Canada achieved 12% growth in earnings per share and 18.6% return on equity. These are very healthy metrics for a financial institution and were above the company’s own internal forecasts. The company had expected 7% earnings growth and an 18% return on equity. In addition, the bank generated a 10.6% Common Equity Tier 1 capital ratio, an increase of 70 basis points from the previous year. Royal Bank of Canada has done a very good job of growing earnings in recent years, which has fueled its strong stock performance.

Net Income & Dividends Per Share (in Canadian dollars)

Since 2005, the company has increased its dividend by 10% annualized, which is a very impressive dividend growth rate over the past decade. The main reason the company has successfully grown earnings and dividends at such healthy rates — despite the persistence of historically low interest rates — is largely due to a balanced, diversified business model across the financial services spectrum. Royal Bank of Canada is not entirely reliant on traditional banking, which depends on higher interest rates. For example, last year the company derived 52% of its earnings from personal and commercial banking, with the remaining 48% from wealth management, insurance, capital markets, and investor and treasury services.

Even though Royal Bank of Canada has performed well in a difficult environment more broadly, investors remain pessimistic on the financial sector. The stock is valued at a price-to-earnings ratio of just 11 on both a trailing and forward-looking basis. This is a very cheap valuation, as the S&P 500 Index has a P/E of approximately 20, which implies that investors do not expect much earnings growth from Royal Bank of Canada going forward. But analysts expect the company to increase earnings per share by 5% next year, and its earnings growth could be even stronger than that if global economic growth improves or interest rates rise. This growth should allow the company to continue increasing its dividend in future years.

To be sure, the recent dividend increase is in Canadian dollars. The U.S. dollar equivalent may not change, due to currency translation. But the rally in the U.S. dollar that has taken place over the past year may be a passing trend as global currencies fluctuate. Significant movements, such as the strengthening U.S. dollar in the past two years, are often cyclical.

Meanwhile, the company has an added catalyst in the form of interest rates. The U.S. Federal Reserve raised interest rates last December, for the first rate hike in nearly a decade. The pace of future interest rate hikes is likely to be gradual, but most economists expect the Federal Reserve to raise rates once more this year. This is expected to happen by December, or as early as September. Rising interest rates are a significant tailwind for banks, because the business model is to accept deposits and use them to issue loans. Banks then earn a spread between the interest paid on deposits and the interest generated from loans. When interest rates rise, it increases the profit margin for financial institutions, since the additional interest received on longer-dated loans grows at a faster rate than the interest paid on shorter-term deposits.

The Bottom Line

Royal Bank of Canada produced double-digit earnings growth last year, even with a meaningful headwind on growth in the form of low interest rates. As a result, the company will likely continue growing profits at a high rate, given interest rates are projected to rise moving forward. This could propel the stock price with a higher valuation multiple. Royal Bank of Canada is an attractive stock for value and income investors.