Billions of free cash flow allows for dividend growth.

The tobacco industry has been a bountiful source of dividend stocks for several decades. Typically, tobacco stocks sport dividend yields of 4%, or even higher in some cases. The reason tobacco stocks are such excellent sources of dividends is because tobacco companies benefit from a highly profitable business model. Production and distribution costs are low for the major industry players, the result of significant economies of scale. In addition, tobacco companies sell an addictive product – cigarettes – which leads to inelastic demand and pricing power.

As a result, tobacco stocks have the ability to lavish shareholders with hefty dividends and regular dividend increases. The latest example comes from Philip Morris International (PM ), which operates the Marlboro brand in international markets. Philip Morris International was spun off U.S. tobacco giant Altria Group (MO ) in 2008. Altria wanted it to operate as an independent company and be free from the harsh regulatory climate in the U.S.

Altria increased its own dividend on Aug. 25, which we discussed in an earlier article.

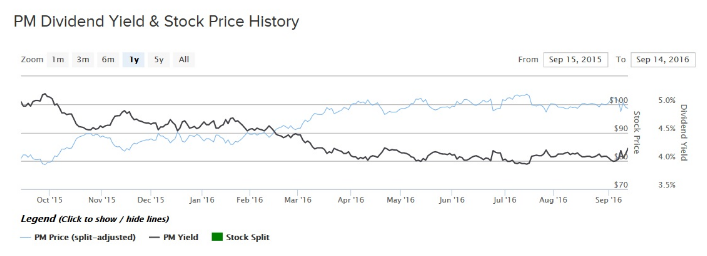

Philip Morris International soon followed suit with its own dividend raise, on Sep. 14. With a 4.2% forward annualized dividend yield, which is double the average dividend yield in the S&P 500, Philip Morris is an attractive dividend stock.

Foreign Exchange Weighs on Growth

Philip Morris International is highly profitable, but its revenue and earnings are in decline because of the strong U.S. dollar. As a 100% international company, it is highly exposed to fluctuations between the U.S. dollar and a basket of foreign currencies of the countries in which it operates. Over the past year, the U.S. dollar has rallied considerably against other currencies amid a heightened level of geopolitical risk and uncertainty. This is a tailwind for international companies that conduct business in the U.S., but the opposite is also true.

Philip Morris International’s revenue was reduced by $4.7 billion last year alone, all because of unfavorable currency movements. The company’s earnings per share fell $1.20 in 2015, as a result. On a year-over-year basis, Philip Morris International’s revenue and earnings per share declined 10% and 12% from 2014. It is only doing slightly better to start 2016: Revenue and earnings per share declined 6% and 10% in the first half of the year.

The foreign exchange issue is exacerbated by declining smoking rates across the world. Philip Morris International’s cigarette shipments fell 3% in the first six months of 2016 compared with the same period last year, an indication that demand for cigarettes is declining.

The good news for shareholders is that the company is responding to these challenges by cutting costs to keep margins high, and it generates more than enough cash flow to continue increasing dividends.

Free Cash Flow Strength

By far, the best aspect of the tobacco business is the very high level of free cash flow generation. For example, last year Philip Morris International generated $6.9 billion of free cash flow, a 5% increase from 2014. Going back further, Philip Morris has created significant value for its shareholders since its initial public offering. Philip Morris has grown its EPS and dividend by 69% and 122% respectively between 2008 and 2015.

Earnings Per Share & Dividend Growth Since IPO

The tough currency environment is making it difficult to grow revenue, but Philip Morris International generated nearly $350 million last quarter from price increases. Cigarettes are an inelastic product, meaning consumers are willing to pay higher prices for the product.

Plus, it is useful to remember that foreign exchange is a cyclical issue and may reverse going forward. In the meantime, the company is utilizing price hikes and expense reductions to boost profitability. For that reason, Philip Morris International expects earnings per share, adjusted for currency, to increase by 10% this year on a percentage basis. Earnings per share are expected to increase 11.6% in 2017.

With double-digit earnings growth expected both this year and next year, Philip Morris International has the financial flexibility to increase its dividend. On Sep. 14, the company declared a quarterly dividend of $1.04 per share, payable Oct. 13 to shareholders of record on Sep. 28. The new quarterly payout represents a 2% increase, and the forward annualized dividend rises to $4.16 per share.

The Bottom Line

Philip Morris International has had a difficult year, but the U.S. dollar may come back down to more normal levels going forward. This would provide a tailwind for the company and its earnings per share. Until then, it enjoys an industry-leading market share in its core markets, and a highly profitable business model. With a 4.2% forward dividend yield, Philip Morris is an attractive dividend stock pick for income.