When it comes to dividend stalwarts with long histories of keeping the cash flowing, Procter & Gamble (PG ) is as good as gold. The consumer products giant has a multitude of brands and with its focus on ‘needs’ over ‘wants,’ PG has continued to generate robust cash flows over the years. The household staples firm has managed to keep paying an increasing dividend for sixty consecutive years.

However, sometimes dividend gold needs a good polishing. Over the last three years, PG’s rate of dividend growth has slowed to a trickle.

With its dividend dominance now on ice, PG has recently undergone a massive transformation to make it better, and ultimately a better dividend payer. The question now is whether PG will deliver.

Some Headwinds at PG

For PG, the last couple of years haven’t exactly been stellar. Despite its huge portfolio of consumer brands being sold in over 180 countries, fewer people are buying its laundry soap, razor blades and other consumer staples. On the top end of the market, PG seemed to miss the boat on the organic and natural product brands to which many wealthier consumers have migrated. On the lower end, rivals such as Church & Dwight (CHD ) have managed to eat PG’s lunch with lower prices and deep discounting.

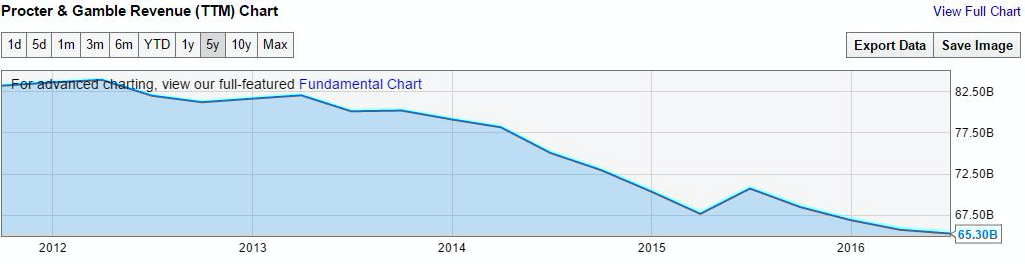

As a result, PG’s sales have fallen. Last year, revenue tanked by more than 15%; but over the last three years, sales have declined by an average of 6.6%. One quarter of lower sales can be considered a fluke or explained away. However, a multi-year decline comes down to the reality that people are simply looking elsewhere for toilet paper and toothpaste.

Other problematic effects – such as currency fluctuations and general global macro problems in emerging markets – have also taken their toll on the consumer products giant. And that toll has ultimately taken its own toll on the dividend as well.

While the firm still generates plenty of cash, it’s using more of that cash to keep its dividend going. PG’s payout ratio is a whopping 69% – that’s pretty high. Meanwhile, the rate of dividend increases has slowed as sales have gone to rivals, which is a problem since investors buy PG for one thing: a juicy dividend.

PG’s Turnaround Plans

Given its declining sales, Procter & Gamble started a massive shift in how it does business.

This includes becoming both smaller and nimbler. PG is now focusing its efforts on the ten categories in which it is leading market positions and most dominant brands. Already the consumer products giant divested more than 60 brands, including its Duracell battery business to a subsidiary of Berkshire Hathaway (BRK-A) (BRK-B). More recently, it completed the sale of 41 different beauty brands to Coty Inc. (COTY) for $12.5 billion. The remaining 65 brands are top product leaders and generate plenty of revenue for PG. (For more on consumer staples, check out: How Will Consumer Stocks Be Affected If Hillary Clinton Wins? )

At the same time, Procter & Gamble has undergone a major cost-cutting program, which included reducing CAPEX spending, closing plants, and rightsizing inventory and personnel. These efforts have resulted in nearly $7.2 billion in cost savings over the past five years.

Is It Working?

PG’s moves are designed to grow revenue, cash flows and profits at PG’s once-mighty rates. In due course, that will trickle down to the dividend and resume its previous rate of growth.

So far, the results have been mixed. PG managed to beat Wall Street’s expectations last quarter and managed to generate free cash flows of $12.1 billion in fiscal 2016. That’s the good news, and it shows the firm is making real progress towards its goals.

However, sales remain a huge issue. For fiscal 2017, Procter & Gamble is expecting flat sales. After adjusting for its recent asset/brand sales, PG estimates that it will only see revenue growth of around 2% – and that’s with currency movements going Procter & Gamble’s way.

Without sales growth, the turnaround story is going to only be about cost cutting, and you can only fire/close/reduce so much before you hit a wall. PG will need to innovate, and boost research spending and advertising to convince consumers to return to its brands. And to make the turnaround worthwhile.

The Bottom Line

Let’s be clear, Procter & Gamble is still a dividend stalwart. It generates plenty of cash flows to cover its dividend and still have some growth left in the tank. This is not a case of a dividend about to go bust or be cut. It’s as solid as they come.

Nonetheless, PG isn’t exactly a screaming dividend-growth story. This is a bond disguised as a stock – and that’s not necessarily a bad thing. But for investors who want more dividend growth (or potential for growth), they may want to look elsewhere. In the end, the turnaround is working – albeit slowly, and with a few hiccups. Sales growth will be the key factor, because without it, Procter & Gamble will be stuck in neutral.