New Menu Items Boost McDonald’s Sales

McDonald’s Corporation (MCD ) has a long operating history and a proven track record of returning cash to shareholders. These returns come from its highly profitable business model and massive economies of scale; it generates high profit margins thanks to a lean cost structure and effective utilization of the franchise model. By aggressively franchising its restaurants instead of owning them, McDonald’s generates a steadier stream of royalty payments while the franchisee is responsible for most maintenance expenses.

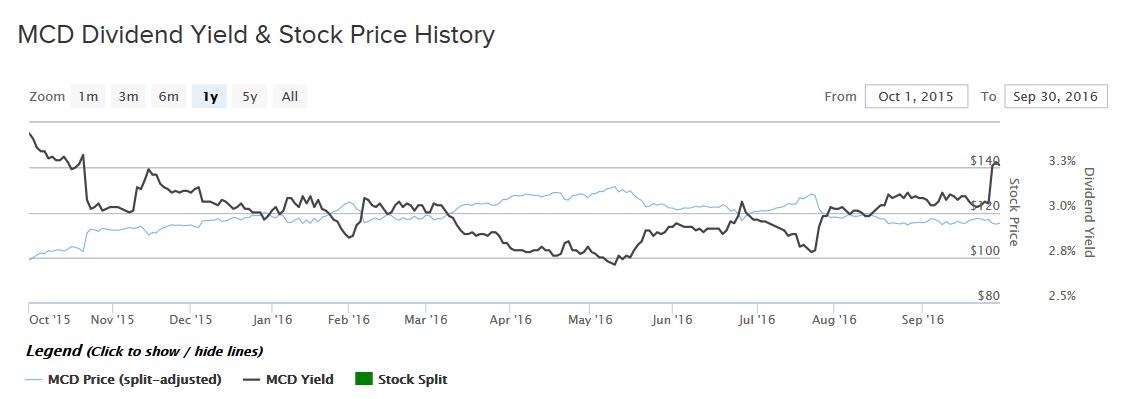

On Sep. 28, McDonald’s declared a quarterly dividend of $0.94 per share. This is a 5.6% increase from the company’s previous quarterly dividend rate. The raise represents the 40th consecutive year in which McDonald’s has increased its dividend as the company has raised its dividend each year since its first dividend in 1976—McDonald’s is a Dividend Aristocrat. The new quarterly dividend will be payable Dec. 15 to shareholders of record on Dec. 1. Based on McDonald’s recent closing price, the forward dividend yield rises to 3.3% annualized.

McDonald’s stock has performed well over the past year. It has delivered a double-digit return in the past 12 months, not including dividends, and the stock has outperformed the S&P in that period.

Turnaround Showing Positive Results

McDonald’s is a huge company, which allows it to reduce costs when it is necessary to do so; its total costs and expenses fell 6% last year. The company has a great deal of flexibility because of its economies of scale. McDonald’s operated 36,525 restaurants in 119 countries at year-end 2015. It has shown increasing reliance on the international markets for growth:

Sales by Geographic Segment

McDonald’s is one of the most popular dividend stocks in the entire market. With that being said, this is a period of transition for the company as its new CEO has had to steer the company through a difficult turnaround. Growth in the U.S. has slowed as domestic consumers are steadily eating less fast food. As a result, McDonald’s took the unusual step of closing more U.S. stores than it opened last year. McDonald’s poor performance in the U.S. market has weighed on its financial results for several years. For example, since McDonald’s sales peaked in 2013 at $28.1 billion, sales have steadily declined each year since, and fell to $25.4 billion in 2015. Total revenue fell 10% in the past three years.

The good news is that McDonald’s is finally beginning to see its turnaround efforts work out. Earnings per share increased 20% over the first half of 2016. For the most part, McDonald’s new menu items in the U.S. are responsible for its domestic turnaround, while high growth in the emerging markets is boosting the company’s sales overseas.

New Menu Items Fuel Sales Growth

McDonald’s results have improved dramatically in the U.S. this year, driven by its two separate new menu initiatives: all-day breakfast and the McPick 2 promotion. The menu shake-up has been a hit with U.S. consumers. McDonald’s comparable restaurant sales, a crucial financial metric for restaurants that measures sales growth at locations open at least one year, increased 3.1% last quarter, year over year.

The U.S. market has turned from a challenge to a source of strength for the company. Last quarter, U.S. comparable sales and operating profit increased 1.8% and 10%, respectively, thanks to the new menu items. Also, there could be further growth in the U.S. going forward, as the company plans to expand its all-day breakfast offerings this fall by adding more popular breakfast sandwiches, such as biscuits, McMuffins and McGriddles.

In the international markets, McDonald’s growth is fueled by the emerging markets. The company’s High Growth markets segment, which includes China and Russia, grew operating profit by 32% last quarter, excluding the effects of foreign exchange translations.

Cash Returns

McDonald’s is a favorite among income investors because the company has a long track record of returning lots of cash to shareholders. In 2013, the company set a goal of returning $30 billion in cash to investors, approximately $10 billion per year, through dividends and share buybacks. Through August, it had returned $26 billion and is now on track to reach $30 billion by the end of the year. Such a huge amount of dividends and share repurchases demonstrates the profitability of McDonald’s underlying business model and management’s confidence in the future prosperity of the company.

Future dividend growth will be attainable thanks to earnings growth. Because of the growth potential of the emerging markets and new menu offerings in the U.S., analysts on average expect McDonald’s to grow earnings per share by 12% next year. With a forward payout ratio of 61%, McDonald’s should be able to continue increasing its dividend in the mid-single digit percentage range.

The Bottom Line

McDonald’s fundamentals began to stagnate from 2013-2015, as the company found it difficult to grow in an increasingly difficult operating climate. However, it has responded effectively with new menu promotions and continued focus on franchising its international locations. This has allowed the company to return to growth in 2016, with further growth up ahead.