Betting on people’s vices has played out big time for Altria (MO ). The producer of cigarettes and other tobacco products has a long history of reaping large cash flows and dividends for its investors. In fact, Altria has managed to increase its dividend 50 times over the last 47 years and MO shares – if you include the performance of its various spin-offs – is the number one performing stock of all time. So there is certainly a lot of pressure on the firm to continue to deliver high results.

This is a problem, considering people just aren’t smoking like they used to.

But a recently completed deal will allow Altria to keep betting on another major consumer vice. One that doesn’t face nearly as much scrutiny or regulation. In the end, Altria continues to prove that there’s a “win in sin.” (For more on that “win in sin”, check out Smokin’ Good Dividends )

A Legacy Holding Pays Off

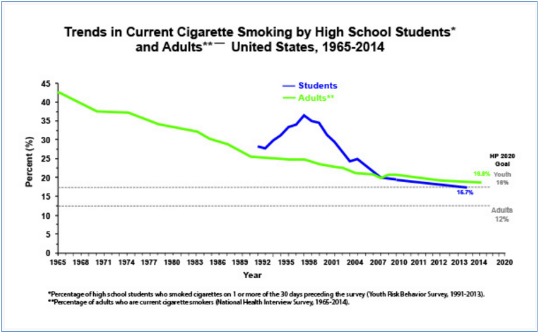

Here in the developed world, we just don’t smoke much anymore. According to the Centers for Disease Control and Prevention (CDC), the U.S. smoking rate dropped from nearly 45% of the population to just 16% over the last 50 years. The relentless regulation and onslaught of anti-smoking campaigns seem to have actually taken their toll on cigarette demand.

That’s a problem if you happen to be one of the world’s largest manufacturers of cigarettes and other tobacco products.

For Altria, it’s meant expanding product and business lines outside of the world of cigarettes to diversify its income and cash flow streams. The firm owned various businesses of Mondelez International (MDLZ ) and Kraft Heinz Company (KHC ), at one time or another. MO also has numerous beer and wine holdings.

It’s these wine and beer holdings that are truly going to pay off for the firm and investors over the long term.

While its packaged food holdings have long been spun-off, Altria has had a soft spot for its stake in mega-brewer SABMiller. Over the years, its stake in the global beverage giant has grown to a whopping 27% of the company. That massive stake already pays big-time benefits for MO. Altria has been able to clip a steady diet of a billion plus dividends from the holding.

And the legacy holding is about to get even better for investors.

A Big-Time Buyout

The key for MO’s future is that SABMiller has been recently purchased by rival mega-brewer Anheuser Busch Inbev SA (BUD ).

For Altria, that’s a huge coup. Because of the age and size of its SABMiller holdings, the tax bite would have been massive had it just taken cash like many of SAB’s other shareholders. Instead, MO decided to take a combination of cash and stock. In the deal’s terms, Altria will get 185.1 million shares of restricted stock and $5.3 billion in cash. This gives Altria a 9.6% stake in the newly larger BUD.

In addition, Altria will also help run Anheuser-Busch, since it will get two board seats. Aside from steering the beverage giant, MO is also able to use certain accounting practices that will allow it to include a portion of BUD’s profits on Altria’s financial statements. Thanks to a lag in reporting times, MO will suddenly get a monster boost in earnings when it kicks in.

The Good News for Dividend Investors

The really good news about the SABMiller buyout is what it means for Altria’s future profits and, ultimately, its dividend growth.

To start with, the $5.3 billion in pre-tax cash MO received from the deal is going directly into buybacks and share repurchases. Altria announced that it will buy back $3 billion worth of its own shares. While share buybacks aren’t as lucrative as most investors think, this might actually be great news. In the end, it’ll reduce the amount of total dividends that Altria needs to pay out each quarter. Since it has to spread dividend-related cash over fewer shares, it should be able to raise its dividend even further. (Want to know how dividends and buybacks can work together? A Look at Shareholder Yield has the answers)

And it did just that ahead of the deal. MO managed to raise its payout by 8% last month.

Future gains will come from its new stake in BUD. With the addition of Miller, the moat at Anheuser-Busch is beyond huge. Dubbed the “mega-brew,” the year-long buyout process united the world’s two largest brewers of beer and created a company that literally sells one out of every three beers consumed in the world. Think about that. One in three beers. And Altria now owns 10% of it.

In the end, the dividends it receives from its new stake in the world’s largest brewer should eclipse its revenues from its previous Miller holdings by a wide margin, and go a long way in reducing its dependency on cigarettes and tobacco. And it’ll also go a long way in helping to boost its dividend over the long term. Something Altria has no problem doing as it is.

The Bottom Line

Altria is already a dividend machine with a long history of rising payouts. But the recent deal with BUD purchasing SABMiller could be a major game changer for the firm. Owning a commanding stake in one of the world’s largest brewers will only help move the firm away from controversial cigarettes and onto a different vice. And that move should continue to pay rising benefits over the years. Ultimately, MO still has plenty of avenues to grow and its shares remain a huge buy for long-term investors.