For the largest exploration and production firms, the oil rout has been pretty hard hitting. Just like many of their smaller rivals, the largest oil stocks have had to deal with dwindling cash flows, stagnating profits and even massive debt issues. One of the hardest hit was former integrated superstar ConocoPhillips (COP ).

After spinning-off its refining operations, COP spent much of the last few years struggling under the weight of lower oil prices. That struggle eventually culminated in the independent energy producer cutting its once-mighty dividend.

But income seekers and Conoco may have the last laugh.

The moves it made before the crash, as well as several made during it, could help it to regain its former dividend mojo and become a dividend stalwart once again. For investors, COP could be a big-time buy, based on its potential for rising payouts.

Refining a Mistake?

Hop into the DeLorean and set the year to 2011 or 2012. High oil prices were a killer for COP’s bottom line. That’s because its refining operations were struggling under the weight of those prices. In order to free itself from that yoke and focus 100% on opportunities in shale, Conoco spun-off its refining and downstream arm as Phillips 66 (PSX ).

At first, that seemed like a wonderful idea. The relatively higher price for crude helped pad COP’s coffers. However, as the clock rolled-over to 2014 and the price of oil began to drop – by a lot – COP began to seriously suffer.

There was no downstream sector to feast on the lower crude oil prices that help to reduce upstream losses, as was the case with integrated rivals like Exxon Mobil (XOM ) and Chevron (CVX ). And when your profits are 100% derived from the underlying cost of crude oil and natural gas, every dip hurts your bottom line.

And in the case of Conoco, the dips were really low. When oil bottomed out around $30 per barrel, COP simply couldn’t keep the cash flowing, so it did the unthinkable: it cut its dividend at the start of the year. Conoco had previously paid a steadily rising dividend since 1995.

Getting “Lean & Mean”

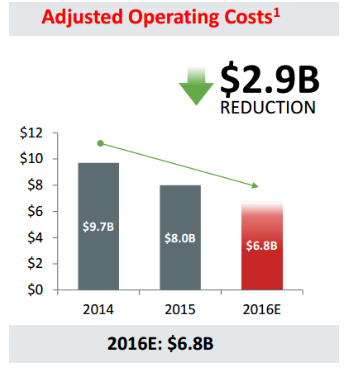

For a major dividend stock like COP, cutting its payout was a hard, but necessary step. By not sending that cash out the door – an estimated $4.4 billion worth of potential cash flow improvements – Conoco has been able to reduce its debt expenses, fund CAPEX programs and plow money into the biggest producing regions under its umbrella. Asset sales and labor reductions also helped “right-size” the organization. Overall, operating costs have been reduced from about $9.7 billion in 2014 before the oil rout down to just $7 billion this year. (Did you know that Verizon is also going through a rebirth? Check out Is Verizon’s New Business Model in Jeopardy?)

In the end, those cuts and moves have helped bring down COP’s inflection point – or the price per barrel needed to be profitable – to just $46.

COP’s Moves May Finally Pay Off

The key for COP is that oil has finally started to rise again. West Texas Benchmarked (WTI) crude oil has recently crossed the $50 per barrel mark as stockpiles in the U.S. have dwindled. Meanwhile, OPEC has decided to cut production down to just 32.5 to 33.3 million barrels per day. That potential 750,000 barrel per day drop has reignited oil prices.

This is wonderful news for COP.

With oil hovering above $50 and a break-even point of around $45 to $46, Conoco may finally be making money again. The real beauty could be the continued rise in those prices. While no one is expecting oil to hit $100 anytime soon, estimates of the upper $50s are quite possible for next year. Without the refining operations clogging up the works when oil is high, COP can really feast on those higher prices and its now juicer margins. Perhaps even more so, when you take into consideration that COP gets more than 60% of its revenues from oil over natural gas. (It’s not just Conoco. Learn more with Is It Finally OK to Trust Energy Dividends Again?)

All of this will finally translate into dividend growth, once again. After all, COP is cash flow positive when oil is at $45 per barrel. Anything else is gravy. And there is still wiggle room to raise its payout further. Currently, COP sends about $1.2 billion of annual dividend payments out the door. Boosting the payout by 4 to 5% would only cost around $50 million in total. Even still, that’s a pretty sizable chunk that would only cost peanuts over the long term.

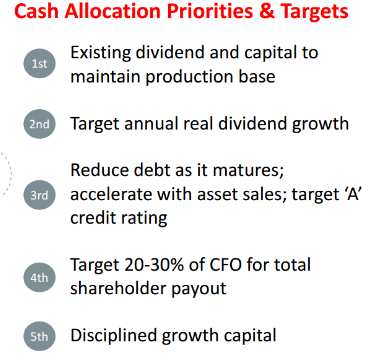

Management seems bent on returning Conoco to its former dividend glory days. Dividends and returning cash to shareholders dominates its cash activities list. And now COP will have more to hand out.

The Bottom Line

Moves made just before the oil price crash will ultimately prove to be great for COP stock and its potential to a pay an increasing dividend. With a now low break-even point and rising oil prices, Conoco is set to enjoy significant free cash generation.