In all seriousness, when was the last time you logged onto your bank’s/brokerage firm’s website or checked your email? How about use one of your smartphone apps or watch an on-demand movie or television program? Chances are, the answer is most likely today. And that underscores a very important trend – everything seems to be driven by computers and our lives are becoming more and more digital.

We’ve had the “space age.” Today, we’re in the “big data age.”

And in that shift to creating, consuming and storing all of this digital information, some firms are ready to cash in on the trend. And Digital Realty (DLR ) could be the biggest long-term winner in the space.

Set up as a real estate investment trust (REIT), DLR owns data centers. A lot of data centers. And given the complexity of setting up one of these spaces and the demand for them, that’s a great place to be. For investors, it’s even a better place given DLR’s long history of rising rents and strong dividend growth. (Could REITs actually benefit from the Brexit? Find out here.)

Rising Data Center Demand

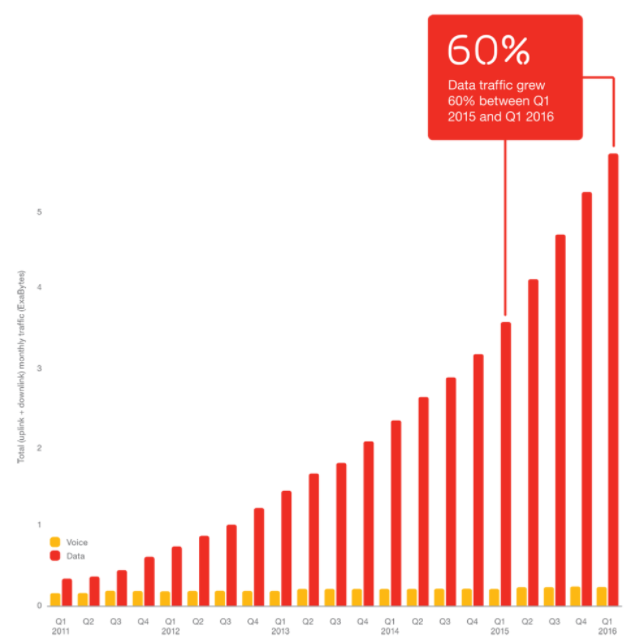

According to commercial real estate brokerage Jones Lang LaSalle, the global multi-tenant data center market is expected to rise by a compound annual growth rate of 12.1% over the next few years. This will effectively double the size of the industry. And there is good reason for that demand. The internet – both mobile and traditional wireline – is controlling our lives.

Retail consumers have quickly taken to smartphones and their apps as a way to access pretty much everything in a big way. In 2015, monthly data per smartphone averaged 1.4 gigabytes per month. That’s roughly a 40% increase over 2014’s numbers. By the time the calendar rolls over to 2020, that number will be closer to 9 GB. At the same time, various enterprises and governments continue to focus on cost controls and efficiency.

All of these factors push toward significant growth in cloud computing and internet usage. And this doesn’t even include the new pushes toward interconnectivity of devices through the Internet of Things (IoT).

For Digital Realty, that spells an opportunity for growth.

How DLR Earns Its Profits

Building/operating a data center is a pretty time-consuming and expensive proposition for the average Joe. Heck, it’s even a pain for some larger tech companies. But not for specialists like DLR. Developing sites in a modular way allows for massive scale and great efficiencies.

Luckily, for DLR, the firm owns 155 different data centers. Space in those centers is rented to such firms as IBM (IBM ), AT&T (T ), J.P. Morgan (JPM ) and Facebook (FB). Around 51% of its total portfolio is rented to those firms in its SMACC group (Social, Mobile, Analytics, Cloud & Content). That’s basically all the things that are being driven by rising smartphone adoption and internet demand.

The beauty is that DLR just manages the buildings. AT&T, Facebook or whoever is still responsible for managing their own software and physical hardware needs. DLR just sits back and collects a rent check.

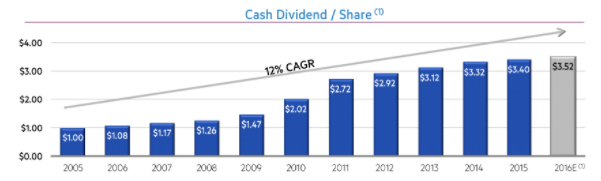

And those rent checks continue to come in at a fevered pace. DLR has continued to have occupancy rates north of 90% over the last six years, while earnings have grown 14% compounded annually since 2005. For income seekers, that’s resulted in rising cash flows and big dividends.

As a REIT, DLR kicks out much of its cash flows back to investors as dividends. Rising rents and demand directly translate into rising payouts. Digital Realty started out paying just $1 per share in dividends. Today that number is $3.52. This is a 12% annual compound growth rate in terms of dividend growth.

(DLR recently went ex-dividend on 2016-09-13. In our ex-dividend calendar, you can find a complete list of stocks going ex-dividend. Want to know when your favorite stocks will be paying you their cold hard cash? Try the tool today.)

In order to continue that torrid rate of dividend growth, DLR has a few tricks up its sleeve.

For starters, its size and scope make it a prime buyer of smaller rivals. Buying these assets, tucking them inside its umbrella and wringing out all efficiencies instantly adds to its cash flows. Secondly, DLR is able to buy into quality – read: high cost – locations with relative ease. Moves like its plan to add a data center high rise in Chicago or its purchase of 126 acres of undeveloped land in Virginia are examples of future planning in high-growth areas. These centers will instantly add to cash flows when rented out.

DLR’s latest plans also include a digital economy of sorts that uses its various partners to link its customers across a wide variety of services. Already, this interconnection business has provided $193 million in new revenues for DLR, and it’s only been operating for a very short amount of time. More importantly, it’s designed to pick up steam as internet/mobile adoption grows. (What about the multi-family homes and apartments? Find out if apartment REITs are overvalued.)

Static at DLR

But, there are some risks with DLR. For one thing, many of its largest clients – such as Facebook – have been building out their massive data center campuses. Several have achieved the scale needed to do so. While that is a threat, the thing to remember is that today’s startup is tomorrow’s tech giant. There’s a content stream of new firms needing data center space. And DLR’s new services and interconnection platform enable a smaller firm to “get out the door running.” That’s a valuable feature for smaller firms.

And while smaller startups such as WeWork may look like threats on the surface, they don’t have scale and size of DLR. In fact, you may actually be plugging into a Digital Realty data center while using a WeWork colocation office.

The Bottom Line

The future looks rosy for DLR. Growing internet, mobile and cloud computing will only continue to strengthen its cash flows and demand for its data centers. That’s bullish for investors. Dividend.com remains bullish on DLR as well. We originally recommended it on April 11, 2014 when it was at $52 and removed it from our Best Dividend Stocks list at $111, for a gain of 113%.

However, since removing it, shares have fallen to about $91. That could make for a perfect entry point for investors, as the fundamentals and its DARS rating is still high.

DLR was part of the Best Dividend Stocks list until recently. Get a complete list of our recommended best dividend stocks by going premium.