Stability. It’s what dividend investing is all about. And you can’t get any more stable than 557 consecutive monthly dividends. That’s just under 47 years’ worth of constantly handing back cash to investors. And it’s all in a day’s work for Realty Income (O ).

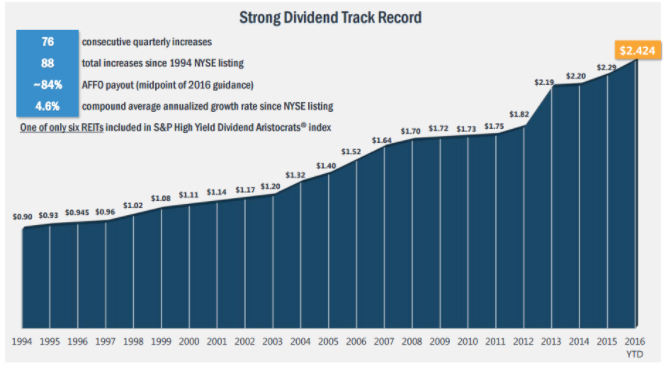

By buying and owning the properties housing your local Taco Bell or Jiffy Lube, Realty Income has managed to build a real estate empire spanning the entire country. That huge portfolio of properties continues to drive rising cash flows and, ultimately, dividends for the firm. With more than 88 increases to its payout, it’s no wonder why the “Monthly Dividend Company” is a popular portfolio addition for retirees.

The real beauty is that Realty Income could just be getting started.

A Wonderful REIT

Every once in awhile, the government gets it right. Back in the 1960s and then in the early 90s, Congress did the right thing. Or I should say, the REIT thing – as in real estate investment trust. REITs were designed as special tax structures for regular retail investors to invest in commercial real estate. In exchange for tax benefits at the corporate level, REITs must kick out the majority of their operating earnings as big dividends back to shareholders. As a result, REITs have been highly sought after investments from those investors in or near retirement. (Find out all about REITs in our Guide to REIT Dividends.)

Realty Income has been especially sought after.

As one of the first firms to adopt the REIT tax structure, O is one of the elder statesmen of the sector. That status as one of the early pioneers has benefited it on several fronts. First is its huge property portfolio.

Realty Income owns more than 4,700 properties throughout 49 states and Puerto Rico. The vast bulk of those are free standing, single tenant and net-leased buildings. It’s your corner Walgreen’s Pharmacy (WBA ), your town’s local McDonald’s (MCD ) and the local convenience store. Its top 20 tenants read like a who’s who of suburbia and feature firms like Dollar Tree (DLTR) , AMC Movie Theaters and LA Fitness. More than 12 different industries are represented by its top tenants alone.

The beauty is that these buildings are often built to suit location. After all, there’s not much you can do to a Taco Bell or movie theater once it’s built. As a result, O’s properties feature long-term leases. Currently, the average lease term for its property is 15 years.

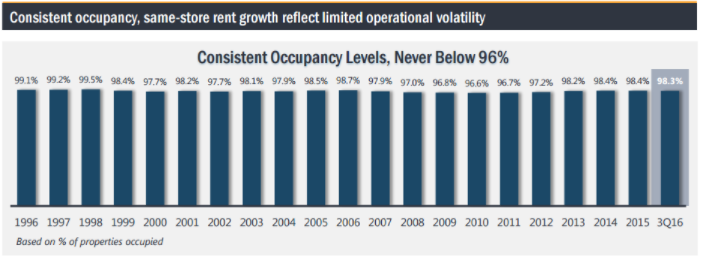

What that really does is boost its occupancy rates to some of the highest in the industry, as illustrated by the chart below. It also provides hefty and steady cash flows that help pad its bottom line.

REITs thrive on a metric called funds from operations (FFO). It’s basically the amount of cash flows that a REIT will have to pay its dividend. If a REIT has FFO numbers that constantly increase over time, the firm will increase its dividend to investors. On this metric, Realty Income scores high again.

Thanks to its strong property portfolio, O has managed to see annual FFO per share growth that has outpaced REIT averages in 14 out the last 15 years. That includes both of the last recessions. The one mishap wasn’t even so much an issue but a case of Realty Income going through some “growing pains.” This year, O expects to grow its FFO per share by 5.5%.

Growth Strategies

However, Realty Income could surprise on that number and actually do better. It’s historically done just that and has realized better-than-expected FFO jumps pretty much yearly. The reason has been management’s smart take on acquisitions. Adding a building here or there, doesn’t necessarily move the needle for a firm as large as O.

But buying other mega-swaths of property does. That was evident by O’s smart purchase of American Realty Capital Trust back in 2012. The $1.9 billion buyout added numerous properties to the mix and instantly added accretive cash flows to its coffers. O was able to boost its dividend by 7.1%, solely because of the deal. Another prime example of smart M&A was its buy of non-traded REIT Inland Diversified, which also instantly boosted cash flows.

In addition to these buyouts, O has started to move beyond just owning net-leased, free-standing real estate. It’s also looking at buying so-called mission critical industrial/office space. These are properties that have been corporate or regional headquarters for sometimes decades. By signing multidecade leases to investment grade tenants, O has been able to continue with its goal of having steady cash flows. (Find out more about another REIT – Digital Realty, and why it’s a high-tech income play.)

What It Really Means Is Bigger Dividends

All of this really comes down to dividends. As a REIT, the onus is on Realty Income to kickback much of its earnings to investors as large payouts. Long leases with steady rent increases written right in already guarantee some bump up in dividend payouts. But when you factor in its accretive acquisitions and additional recycling of capital into newer properties, you get a very strong FFO/dividend picture from O.

That picture has been painted throughout its history. As we said in the article’s opening, O has managed to increase its monthly dividend 88 times and has paid a total of 557 consecutive dividends. Even during the last recession when the average REIT cut their payout 25%, O held steady and actually increased it.

Dividend.com has a dedicated page only for REITs. Here you can sort all the REITs that pay dividends by dividend yield, latest ex-dividend date and the latest pay date. You can also get access to the complete list of REIT ETFs here.

A Great REIT to Own

In the end, Realty Income has proven itself to be one of the best REITs any investor, retiree or otherwise, should own. Its long stretches of dividends secured by its huge property portfolio and growth initiatives are the benchmark to beat of the sector. Risks such as rising interest rates have only provided an attractive entry point for those long-term investors.

In the end, when it comes to REITs, you could do far worse than adding O stock to your portfolio.

Two of the Best Dividend Stocks currently are REITs. Find out the highest rated stocks according to our proprietary DARS rating system by going premium.