It seems that the current trend in the corporate world of “growth by acquisition” is the new mantra. As the global economy has stalled, many of the largest firms in the world have found buying out rivals is a lot easier than trying to ignite organic growth. There’s certainly nothing exciting about the global chemicals sector. Growth has slowed pretty much across the board in the industry.

And on the surface, the pending merger between giants DuPont (DD ) and Dow Chemical (DOW ) seems to fit that bill – grow to survive.

But digging deeper, investors – especially dividend investors – will be treated to a trio of firms that should be able to provide plenty of growth, cash flows and dividends when all is said and done. If the deal and plans to split go through, dividend investors should take note. This is an opportunity in the making.

Slowing Growth in Chemicals

The simplistic state of the chemicals industry is divided into two parts: low-margin commodity chemicals and faster-moving advanced materials or agriculture products. Agriculture is growing like a weed, so to speak. Growth here remains swift as farmers around the world continue to search for new ways to feed, grow and protect their crops. For chemicals, margins remain fat as the real proprietary formulas provide large moats and big-time margins.

The problem is, the other side of the equation is as slow as a turtle trying to cross a highway. Commodity chemicals – the basic building blocks of everything we use – are just that, commodities. There’s no differentiation when it comes to titanium dioxide or ethylene. It’s pretty much the same around the world. And because of its commodity-like nature, its demand is 100% driven by the state of the global economy and profits are driven by internal cost controls and processes. And this side of the equation – still the main revenue generator for the industry – is slowing big time. (Both DOW and DD were targets of activist investors. Learn the whole story in The Carl Icahn Effect: A Primer on Activist Investing.)

While the global economy has plodded along, we’re still not surging like we did during the go-go days of the mid-2000s. The chart below looks at global GDP data versus the American Chemistry Council’s global chemical Capacity Utilization (CU%). There’s a lot of info on it, but the thing to focus on is the dark red line. After a short, post-crisis pop, chemicals utilization – which is driven by demand – has started to fall over multiple years. In fact, global CU% has sunk every month in 2016 and is now sitting at lows reached during 2009.

A Big Merger

That drop in CU% of commodity chemicals – which is 100% driven by demand – is the reason why DD and DOW have looked to a massive merger to fuel growth. Products like titanium dioxide simply don’t make enough money for the giants. In fact, DD has already spun out its TiO2 operations as Chemours (CC ) about a year ago.

With that in mind, DOW and DD are undertaking a unique merger then separation to drive growth and eliminate many of the problems with commodity chemicals. After combining operations, the pair will turn themselves into three separate companies.

Firstly, there will be an agriculture company that will join together the seeds and crop protection businesses of DuPont and Dow. More importantly, this firm will control about 41% of the global seed market.

Secondly, all the industrial and commodity chemicals stuff would be placed in a second materials sciences company. This is the real meat and potatoes of the two firms and features both the boring stuff as well as advanced plastics and materials operations. Finally, the third firm will focus on specialty products. This includes nutrition, electronic materials and films, safety/protection products and advanced bioscience-derived polymers.

Essentially, investors get one very high-growth firm, one high-growth firm and one slower-moving stock. But what they also get is the potential for cash flows and dividends. (For further information, refer to Dow Chemicals’ dividend history here and DuPont’s dividend history here.)

Three Firms, Three Dividend Opportunities

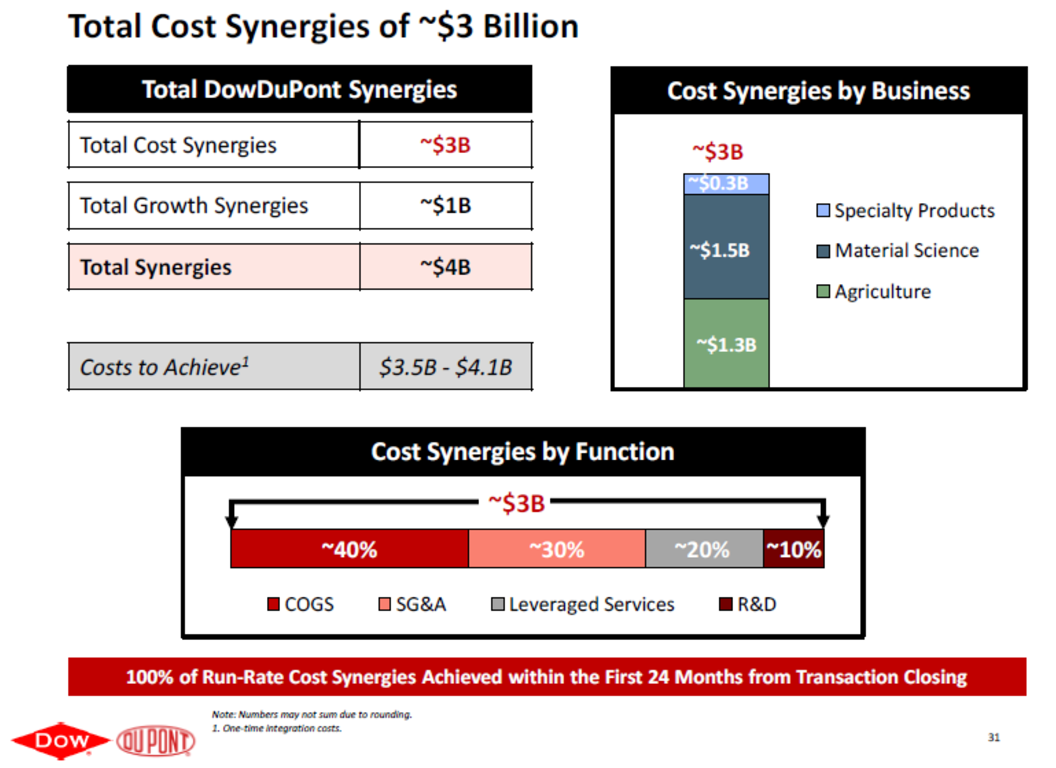

Aside from the focus on growth, the real reason any two firms join forces comes down to synergies and cost savings. And the projections for the DD-DOW merger are massive. In terms of costs alone, the combo will save the firms about $3 billion a year as they combine operations, lay off workers and remove red tape/overhead. Growth synergies are projected to be over $1 billion as they combine. That’s a lot of cost savings for investors. The real benefit is that many of these cost savings come at the “boring” commodity chemicals businesses. As we stated above, the profit driver here comes down to cost controls, rather than to products. The projected $1.5 billion in savings will directly translate into higher profits at this new division, with all things being equal.

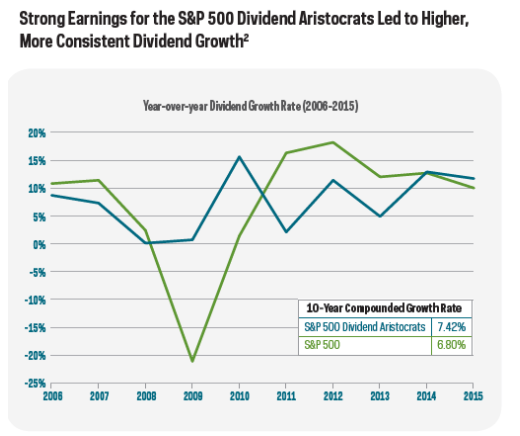

Given that DOW and DD have two of the longest streaks of dividend-paying ability out there – nearly 100 years – it stands to reason that investors will see much of that cash as dividends and share buybacks after the merger closes. While actual yield info and payout potential are almost impossible to predict at this point, what we can say is that investors will have three opportunities to play.

(Screen more high-quality dividend stocks like Dow and DuPont in our Dividend Screener. You can select multiple parameters like minimum and maximum dividend yields, the market cap range that you want and 15 other parameters that can help you in your investment decision making.)

After the split, investors will get shares in all three as it’s a tax-free spinoff. The specialty products firm will be more focused on growth, with dividends being an afterthought. The agriculture firm should be somewhere in the middle and could be thought of as a dividend growth play. Rising revenues should translate into rising payouts down the line. Finally, the basic materials firm – with all the boring stuff – should be the current high yielder. That will be especially true as the cost savings take hold. Investors should put a premium on the other two higher-growth firms in the DD/DOW hook up.

In the end, the merger will allow investors to pick their dividend futures by aligning their needs and interest with all or a few of the new chemicals firms.

The Bottom Line

With the deal set to clear any antitrust concerns during the first chunk of 2017, investors are being given a unique opportunity with the merger. Here, they’ll be able to bet on growth, growth with dividends and straight up yield at the same time. If and when the deal closes and the spinoff is complete, DD/DOW could be a huge win for dividend investors over the long term.