When investors think about the technology sector, they think about growth. After all, innovation and disruption just scream fast-moving start-ups and small firms. But in recent years, tech has also come to mean big dividends and surprisingly high yields. One of the biggest dividend payers has been blue-chip International Business Machines Corp. (IBM ).

Backed by Warren Buffett, old-school IBM has become a favorite stomping ground of income seekers in the technology sector. Driven by its status and prominence, investors place plenty of “stock” in IBM stock.

The problem is, the old-school tech firm is starting to act a little too old-school. Revenues and profits haven’t been up to snuff in many years. IBM continues to have its lunch eaten by rivals across a variety of tech sub-sectors and themes.

The real question now is whether or not dividend investors should move on from IBM and find greener pastures.

Check out Dividend.com’s News section for the latest on dividend investing.

Eighteen Consecutive Quarters

It seems that the tech world may have been leaving IBM behind – or at least that’s what IBM’s continued poor results would have you believe. Big Blue’s last reported quarter was the latest testament to how far it has fallen. When it reported earnings, IBM had the dubious distinction of having eighteen consecutive quarters of declining year-over-year revenues.

In what seems like forever ago, IBM underwent a major transition. It moved away from hardware – by selling its personal computer/device business – and plowed heavily into services. The transition was supposed to update IBM’s stodgy image and help drive future sales. With any transition, turnarounds take plenty of time to complete. Unfortunately, IBM’s turnaround hasn’t come to fruition. The continued sales declines are certainly a troubling sign.

And with continued revenue misses and drops comes share price declines, as well.

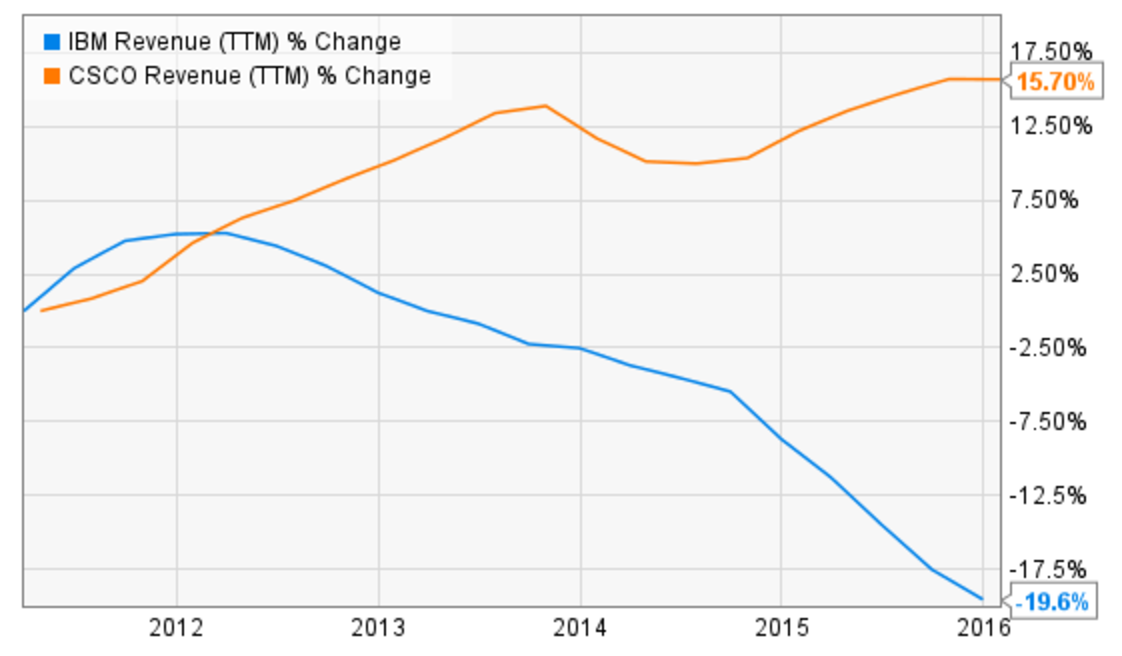

During the first half of 2016, IBM shares hit lows not seen since early 2010 and the depths of the recession. Even accounting for the recent 43% jump – thanks to the Trump Bump – IBM shares are still down a whopping 21% from 2013 peaks. Meanwhile, several main rivals such as Cisco Systems (CSCO ) and Oracle (ORCL ) have gone on their own recent transitions and have executed perfectly. Take a look at the below chart that compares IBM’s revenues to CSCO’s. Not a pretty picture indeed.

Needless to say, IBM has been a tough pill to swallow for investors over the last few years.

Could Big Blue Stop Singing the Blues?

But IBM still has its believers. Warren Buffett still owns a huge slice of the tech firm and hasn’t sold any significant number of shares. In fact, it’s his only technology holding. And the Oracle of Omaha may be on the right side of this trade.

IBM has doubled down on its so-called strategic imperatives. These initiatives formed the basis of the entire turnaround and transition at the tech firm. The strategic imperatives include businesses like cloud computing, monetizing its artificial intelligence platform Watson, big-data analytics, cyber security and the overall Internet of Things (IoT) – all the high-tech stuff that IBM’s rivals have been cashing in on.

And IBM CEO Ginni Rometty isn’t taking these action items lightly. She continues to plow some very hefty research and development dollars into these now-core businesses. Additionally, IBM has gone on the hunt for smaller acquisitions that it can use to fuel its Watson and big data analytics business segment. Over the summer, it snagged Promontory Financial Group as a financial add-on for Watson’s brain.

And the results are pretty impressive. The so-called strategic imperatives managed to see their revenues grow by more than 16% during the last reported quarter. This increase follows a 12% jump recorded in the second quarter of the year. All in all, the $8 billion–plus in revenue the new businesses have generated now represents roughly 40% of IBM’s overall sales pie.

This growth for IBM is critical. At the same time its high-tech initiatives were seeing rising sales, its legacy businesses – hardware, software, and services – saw a 21% decline. If it can continue to boost the “good” side faster than the “bad,” IBM may complete its turnaround goals.

So Is Big Blue a Big Buy?

On the one hand, IBM does have some pretty impressive growth behind it. Its Watson business is growing and other avenues, like IoT, are still in their infancy. But the growth has been slow going, thanks to continued declines in software and hardware. For income seekers, this raises an interesting quandary. Is Big Blue still a big buy or not? The answer may not be so simple.

IBM is still a dividend machine. IBM has not missed a single dividend payment since 1916 and has become a dividend growth name in recent years. The last increase for the stock marked the 21st consecutive year that it has increased its quarterly payout. IBM’s payout amount has doubled since 2010, when it underwent its transition. Buybacks have increased under Rometty’s watch as well. (Check out our analysis of IBMs most recent dividend increase here.)

So IBM is clearly returning plenty of its hefty cash flows back to investors. And those cash flows have increased as these strategic imperatives feature fat margins. The problem is the continued return of profits to investors via dividends, and buybacks haven’t overcome the share price drops for the missing revenues. They’ve provided little comfort for longer-term investors, including Buffett.

In the end, IBM is still very much a waiting game. And while investors have waited, rival stocks have seen better share price growth and dividend increases. Investors need to ask themselves just how long they are willing to wait until the new businesses finally overtake the old legacy junk clogging up the works. Unless IBM immediately spins off or sells these assets, the wait could be quite a while. Better prospects are out there.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. You can even screen stocks with DARS ratings above a certain threshold. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

The Bottom Line

IBM isn’t a bad stock, and it does have plenty of growth potential. The problem is that the potential is just that – potential. The gains in new businesses haven’t eclipsed its old one yet. And the continued decline in revenues and its share price have reflected that. For those betting big on Big Blue, patience is the name of the game.

Go Premium for free and get access to our latest Best Dividend Stocks list.