“Trust is like the air we breathe – when it is present, no one really notices it. When it’s absent, everyone notices.” The irony is that Warren Buffett probably never thought he’d be attributing that statement to one of his largest investments. But that’s exactly what happened to mega-bank Wells Fargo (WFC ).

Since its scandal broke, WFC has been one of the worst-performing bank stocks out there and has trailed its peers by a wide margin. The scandal had wide-reaching implications and significantly impacted the bank’s image and even its earnings. Let’s just say, the Oracle of Omaha was not pleased.

But Buffett is still standing by Wells Fargo. But should you follow suit? Is WFC a bad bank or just a bank that made a bad decision? Digging deeper into its core should help generate an answer.

Check out the dividend scandal that rocked Wells Fargo recently.

A Measly 4% Last Year

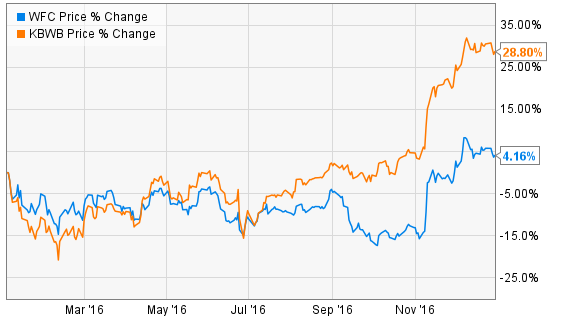

To say that Wells Fargo had a bad year would be an understatement. WFC stock managed to return only about 4% over the course of 2016. That’s a pretty significant underperformance when looking at its big bank peer group of Bank of America (BAC ), Citigroup (C ) and JPMorgan (JPM ). Each of those managed to return in double digits. BAC alone posted gains of more than 36%.

In fact, WFC managed to underperform the entire large-cap banking sector in the U.S. Just take a look at the below chart comparing WFC with the broader KBW Bank Index.

The reason for the sour returns is well known. Through a whistleblower, regulators discovered that Wells Fargo’s unrealistic sales goals had pushed employees to open fraudulent credit card and checking accounts to meet the high quotas. That resulted in the resignation of its long-time CEO, a $185 million penalty and massive damage to its brand image. New account openings dropped by 40% year over year because of the scandal. So much for being the most conservatively run bank in America, huh?

Wells Fargo is part of the financial sector. You can screen similar stocks that make up the financial sector in our Dividend Stock Screener tool. You can apply more than 15 parameters as you make your investment decisions.

Too Harsh Of A Drop?

Perhaps the most telling thing in all of this is that Buffett hasn’t sold a single share of WFC stock. And there has to be some method to his madness. Perhaps, it’s simply because the drop was too far, too fast.

During its recent 4th-quarter report, which included the scandal fallout, WFC still managed to see rising loan and deposit growth. So it has less new accounts, but those who stayed with the bank are depositing and borrowing more from it.

Total average loans for the quarter showed a 6% increase, while total deposits at the bank came in at a whopping $1.3 trillion. That’s a lot of coins to lend out and potentially benefit from higher net interest margins as rates rise. Even better is that WFC’s standing among institutional and commercial clients didn’t even budge. Those sorts of loans are even more profitable than standard loans made to retail customers.

And even with the problems resulting from the “dumb incentive system” as Buffett called it, Wells is still a pretty well-run bank. Proprietary trading, which dominates the bottom lines of BAC, JPM and Goldman Sachs (GS ) just isn’t there at WFC. Neither are some of the reckless energy loans. With Wells, you really are getting an old-fashioned savings & loan-style bank. Just hopped up on steroids thanks to WFC’s size. And that is a pretty good place to be.

Let’s Not Forget the Dividend

Wells Fargo’s continued focus on conservatism has benefited shareholders on the income front as well. Yes, WFC cut its dividend during the financial crisis. However, unlike many other banks, this was more so because of regulatory pressures from its on-the-cheap buyout of Wachovia. Since that time, Well’s brand of banking has paid off in spades as cash flows and profits have allowed it to resume its dividend trajectory once again.

Get Wells Fargo’s complete dividend history here.

Of the biggest banks, it has managed to get that dividend back to pre-crisis levels the fastest. In a little less than five years, WFC is paying what it was before the recession. By comparison, Citigroup and Bank of America have only recently upped their dividends from the token penny that both paid after the crisis. Meanwhile, JPM hasn’t had the same kind of returns to its payouts. It still yields less than previously.

Meanwhile, the problems at Wells Fargo have made it quite a cheap option for investors. WFC can be had for a P/E of just 14. That’s less than the overall market and the previously mentioned KBW Banking Index. Moreover, WFC’s price-to-sales and price-to-book ratios are below the industry average. It seems that the scandal did take Wells down perhaps too far; especially when you consider just how well it is run and the kind of loan/de[soit progress it is still making in spite of the scandal.

Wells Fargo increased its dividend in early 2016. Get our complete analysis regarding the same here.

The Bottom Line

The scandal at Wells Fargo did hurt. But perhaps it’s only a flesh wound. With WFC, you’re getting a top-notch bank that has just hit a speedbump. Investors should take advantage of that and buy the bank as an income play.

Dividend.com has more than 100,000 subscribers to its premium newsletter. Get the latest dividend specific news delivered straight to your inbox every day by going premium for free.