Updated on June 22, 2017

The tussle between legislators, administrators and public and private organizations on both ends of the political spectrum fighting over the most significant U.S. healthcare legislation in 60 years might finally come to fruition.

As the new White House takes shape, the air is thick with anticipation of what seems inevitable – the repeal of Obamacare. This article will focus on what investors can do to prepare their portfolios for the winds of change.

Can Obamacare Be Repealed?

Much of the mainstream media conversation has focused on the procedural challenges of Obamacare repeal – party unity, members of Congress, senators, committees, bill repeal, filibuster etc.). In this case, the media fascination is justified. Even Trump would agree with the media for a change! It is not easy to repeal a law that occupies more than 10,000 pages and more than 11 million words. Anyone who thought it could be an overnight process was clearly high on the new political direction. While the repeal is possible, it will probably look more like a gradually uncomfortable series of events than a “Netflix-binge” weekend.

And then comes the replacing part. The infographic below attempts to stitch together the complex web of organizations involved. On one hand, it is hard to miss Rep. Kevin Brady’s emphasis on the role of government in the U.S. healthcare system, but it also points to the complications a repeal (and replace) strategy might have to overcome.

Given that there are only a handful of ideas on what it can be replaced with, it is not surprising to see some GOP members in Congress are now starting to call the exercise a “repair” instead of a repeal. Back to the original question – can Obamacare be repealed? Answer – sure, but it will take time. You can expect limbs to be pulled apart in the coming months but the guts will take a while to reach.

Further reading: How Will Healthcare Stocks Be Affected by Donald Trump’s Win?

Should Investors Care?

Short answer – yes.

Long answer – as usual, it depends.

One of the more obvious first steps is to see if your portfolio has strong exposure to companies in the business of running hospitals. It may not be a bad idea to rebalance away from them for a while to keep the uncertainty at bay. The Affordable Care Act (or ACA or Obamacare) not only subsidized coverage for individuals but also extended Medicaid benefits for patients who previously couldn’t afford to pay for it. One of its programs enables buying prescription drugs at a discount. This has resulted in increased revenue for rural hospitals that typically serve a relatively poorer and sicker patient demographic. As planning around repeal becomes more formal, these hospital stocks are likely to take a beating. Their already strained margins will be under further pressure because of the looming loss in patients.

A lot of these hospitals will have no choice but to reduce their labor headcount to cover the loss in revenue. According to a recent study by the Milken Institute of Public Health at George Washington University, more than 2.5 million jobs could be lost nationwide by 2019 and rising to 3 million by 2021. The states with the highest projected job losses are California, Florida, Texas and Pennsylvania. Ironically, three of the four states were won by Donald Trump, who has vowed to repeal the ACA. Even more ironic is the fact that a lot of the poor who were the beneficiaries of the increased coverage of the ACA voted to get it repealed by voting for a Republican government.

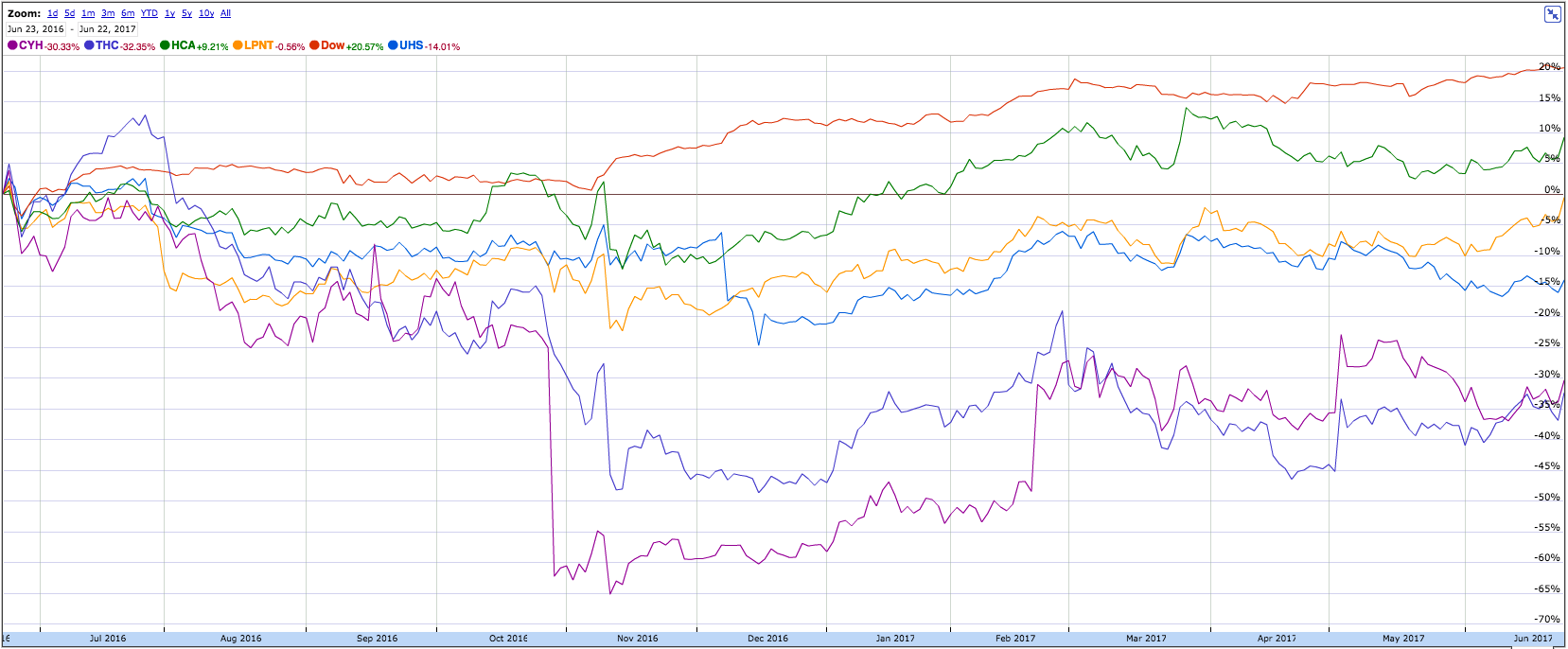

Below is a comparison of some “hospital stocks” and Dow Jones from June 23, 2016 to June 22, 2017. Even with the broad-based stock market uptick since the November 8 election last year, most of the providers have struggled.

If the repeal and replacement are done in an orderly fashion and Republicans deliver on Paul Ryan’s promise that “no one will be left out in the cold,” there is hope for this sector and these stocks might start to benefit. While the effect on hospitals is somewhat obvious, it is not as clear when it comes to healthcare providers like Humana (HUM ), Cigna (CI ), Aetna (AET) and United Health (UNH ). United Health may be better positioned because of its diversification with Optum and because it has already removed itself from healthcare exchanges, reducing its dependency on Obamacare.

It is not clear if millions of people will lose insurance, but if they do, the fewer people buying insurance could gain from the reduced coverage of people who are already sick. Drug companies might see the Trump victory as a moment of relief as the Clinton campaign consistently talked about price caps, which Republicans are expected to stay away from. However, recently the new U.S. president talked about keeping prices down by encouraging competition and better price discovery.

Discover the problems behind social security here.

How to Construct Your Portfolio Changes

Dividend.com has a robust screener specifically built with dividend investors in mind. It is easy to focus on specific factors and zoom into niches that investors want. For example, you could get results for “major drug manufacturers” that pay dividends annually in under a minute.

There are 16 parameters available for investors to filter, such as dividend payouts, stock prices, yield, ex-dividend date ranges and a proprietary DARS Rating which would help investors in their dividend capture strategy. Results can be exported to Excel for further analysis.

Investors can monitor the highest-yielding stocks and their latest ex-dividend dates by accessing this list. Investors can also monitor the highest-yielding stocks and their latest ex-dividend dates by accessing the Dividend Payout Changes Announcement tool.

Watch: “How Repealing Obamacare Will Affect Pharma, Biotech”

The Bottom Line

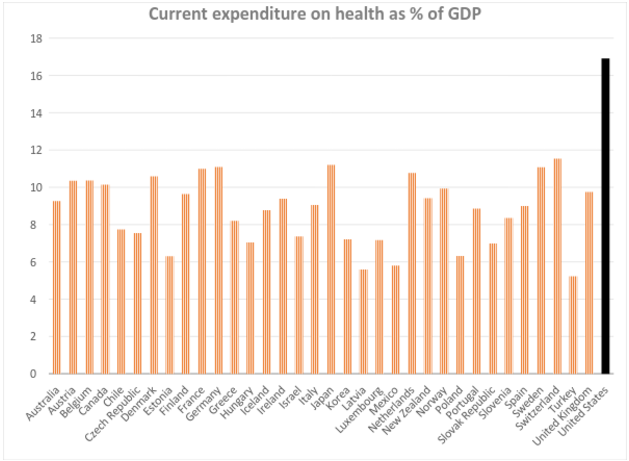

The problem is not just about Obamacare, but also the fact that the U.S. has the highest health expenditure among OECD countries and yet in many ways is one of the least effective healthcare systems. The United Kingdom, on the other hand, spends less than 10% of its GDP and yet has consistently ranked among the best healthcare systems in the world.

Canada is also able to provide hardy universal healthcare by spending about the same percentage of its GDP. To address this, Republican lawmakers can’t consider Obamacare in isolation but must address it as part of a larger problem. A failure to do that will result in a different problem ready to be torn apart by a different campaign rhetoric in the next election cycle.