Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

The Federal Reserve surprised very few on Wednesday when it voted to raise interest rates for the second time in three months. With the decision already baked into the markets, investors sought to increase their exposure to the full breadth of the U.S. stock market, with an emphasis on high-yielding financials and real estate investment trusts (REITs).

Although markets are bracing both for the best and the worst of a rising interest rate environment, financial blue-chips are poised for solid gains. Expectations of steep tax cuts and looser regulations have also been a boon to the sector, which has emerged as Wall Street’s strongest since the election of Donald Trump in November.

Compare this week’s Trends report with our March 3 edition, which looked at foreign stocks and a popular beverage maker.

Rate Hike Shines Spotlight on Dividend Earners

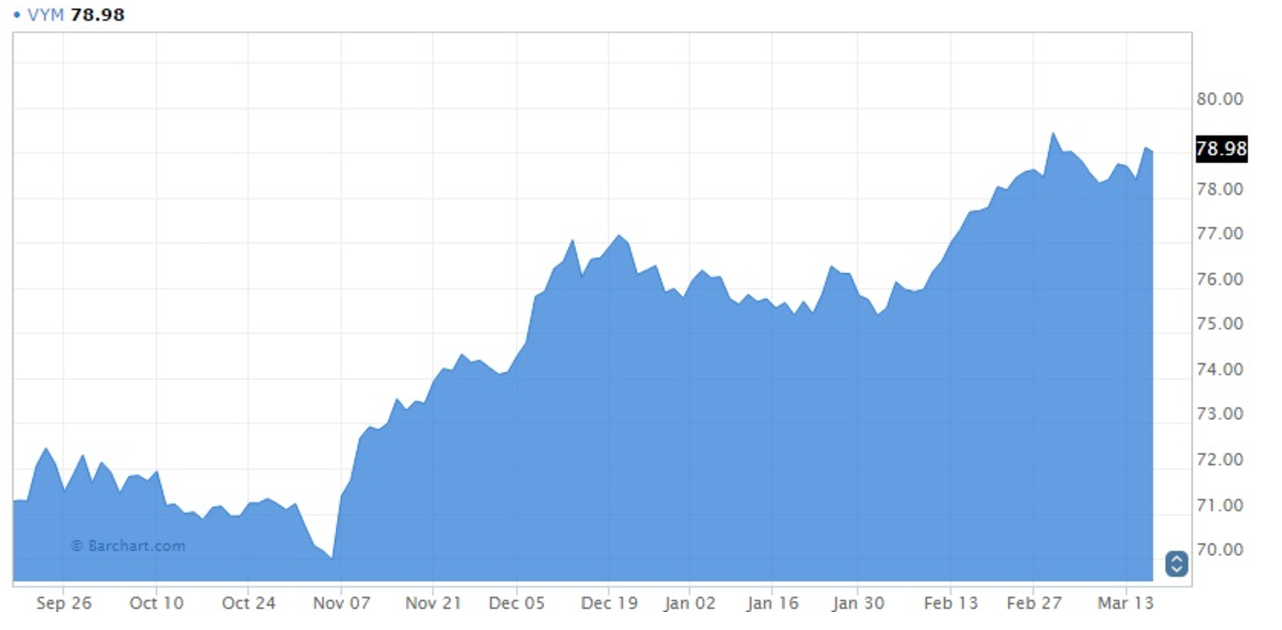

An imminent rise in U.S. interest rates drove investors into the safety of high dividend earners. As a result, the Vanguard High Dividend Yield ETF (VYM ) takes the No. 1 spot on our weekly list with a 49% boost in traffic.

VYM gained steadily this week, but has generally underperformed the market since the November 8 election. With a dividend yield of 3.38% and a heavy weighting in financials, VYM could be a solid play in a rising interest rate environment. It also provides a convenient way for income investors to track stocks that are forecast to have above-average yields. High-dividend plays become more attractive during periods of heightened instability. Although there is plenty of euphoria surrounding the U.S. economic outlook, the Federal Reserve has given a much more somber view.

The quarterly projections that were released alongside the March 15 rate decision showed that policymakers expect growth of 2.1% in each of the next two years. Economic growth is then forecast to slow to 1.9% in 2019. That’s around half of what President Trump pledged both before and after being elected.

Explore high-dividend earners with our list of 25-year dividend increasing stocks.

Financials Set to Take Off

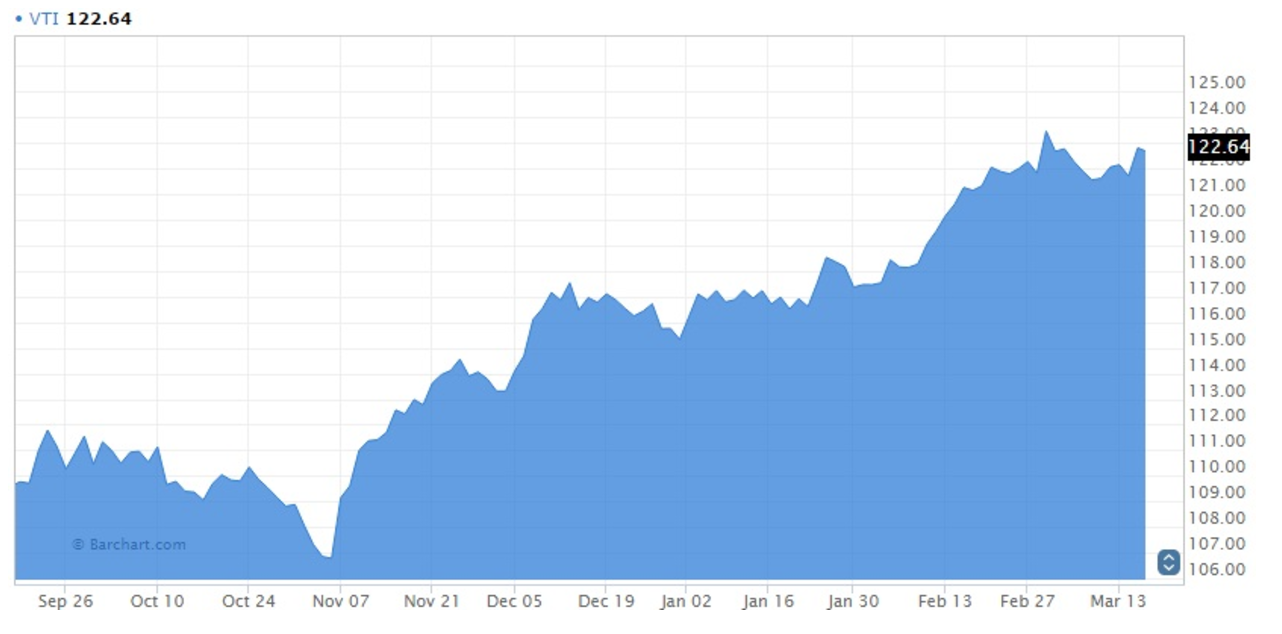

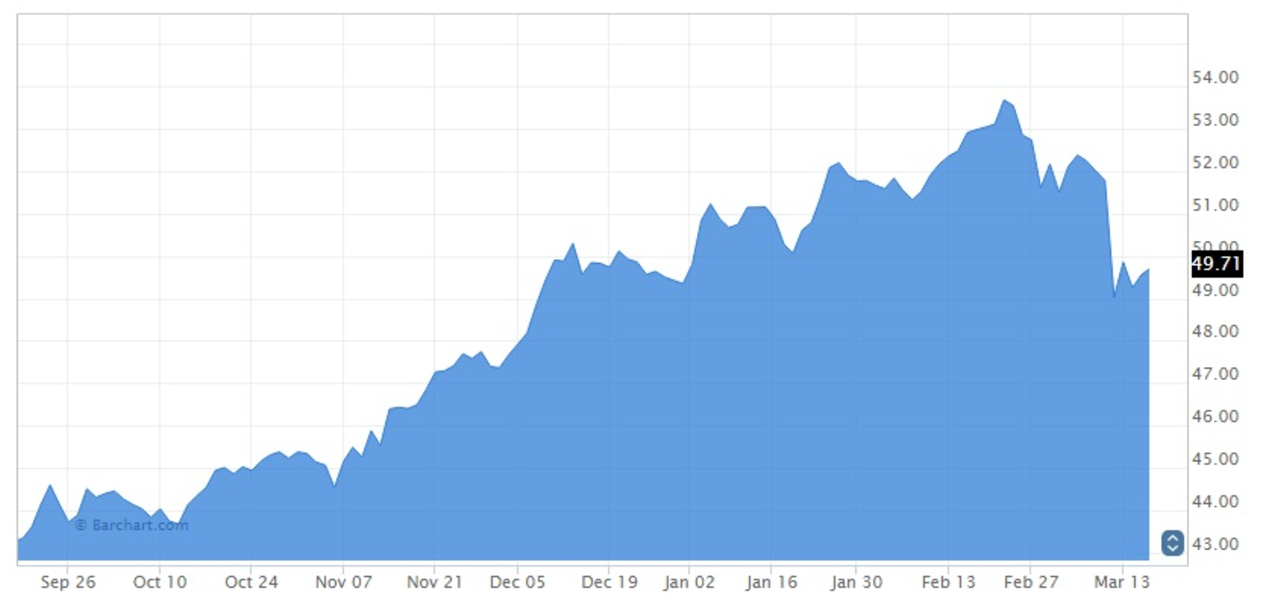

The financial sector potentially has the most to gain as U.S. monetary policy returns to normal. Funds with high exposure to financials, such as the Vanguard Total Stock Market ETF (VTI ), are therefore in higher demand. VTI took second place on our weekly list with 37% growth.

In general, investors want to be exposed to financial stocks as interest rates rise. VTI has a 20.7% weighting in financials as of February 28, 2017, according to the fund’s prospectus. That’s more than any other sector. The S&P 500’s financial index has gained 36.6% over the past 12 months, more than double the rate of the large-cap index itself.

The fund’s other major sectors in terms of weighting include technology (16.9%), consumer services (13%) and industrials (12.9%).

VTI has gained a healthy 5.5% since the start of the year and nearly 12% since the election. Recent trend levels show the potential for steady upside in the short run.

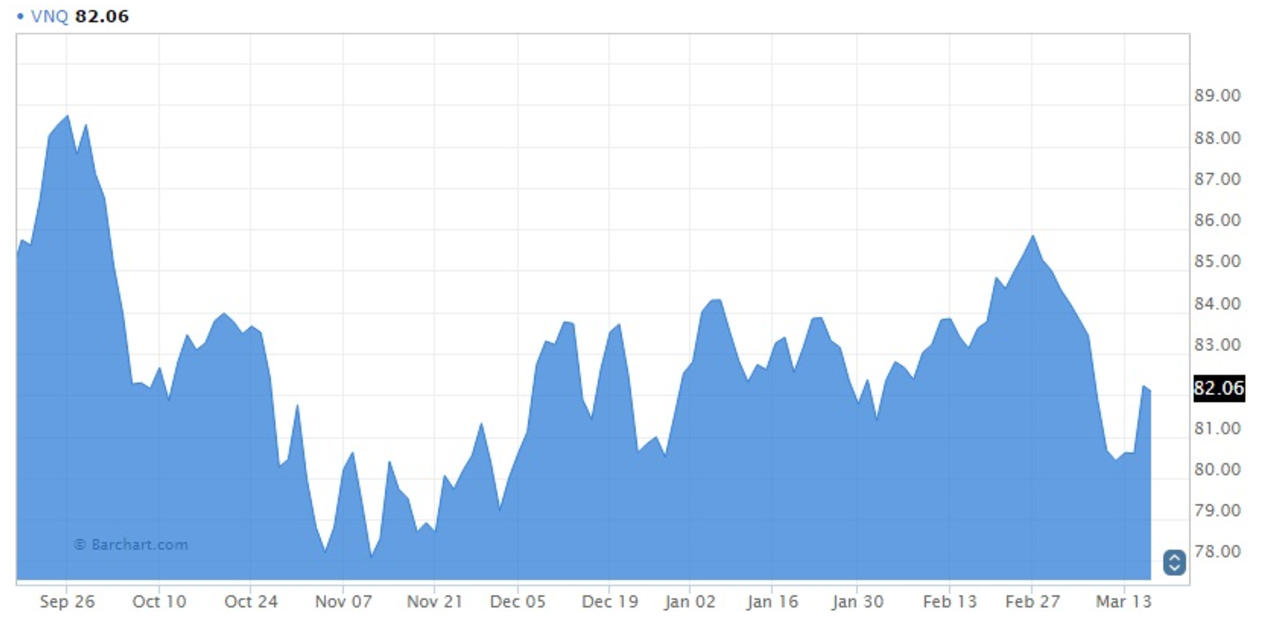

REITs Hold Firm Following FOMC

Real estate investment trusts held firm in the face of the Fed’s recent decision, with the Vanguard REIT ETF (VNQ ) standing out as one of the biggest winners. VNQ rose 2% following the Federal Open Market Committee’s (FOMC) decision and takes the No. 3 spot on our weekly list with a 31% rise in traffic.

REITs are rate-sensitive assets that generate steady income during policy-tightening cycles. They are poised to enjoy strong gains as the Fed signals for two additional rate adjustments this year, followed by another two or three in 2018. The FOMC’s next policy meeting is scheduled for May 2-3.

The rise in the federal funds rate is also coinciding with a firmer housing market. The Commerce Department reported this week that housing starts – a proxy for real estate demand – rose to nearly nine-and-a-half-year highs in February.

Learn more about investing in REITs by comparing the top dividend stocks in the industry. Click here to sort the best REITs by highest dividend yield, latest ex-dividend date or most recent pay date.

TD Bank Reeling From Nasty Headlines

North of the border, Canada’s second-largest bank by market capitalization is reeling after a news story drew concerns from the country’s consumer banking watchdog. Toronto-Dominion Bank (TD ) is the fourth entrant on our list with a 25% rise in weekly traffic.

The bank experienced a tumultuous week after CBC News revealed that TD employees are under “incredible pressure” to meet “unrealistic” sales goals. This includes, among other things, selling customers unnecessary financial products. The Financial Consumer Agency of Canada (FCAC) has since responded, with the group’s commissioner vowing to examine the industry’s business practices during its next formal review scheduled in April.

You can keep track of TD’s next ex-dividend date by using our free Ex-Dividend Date Search function.

If dividend investing excites you, learn how you can gift your loved ones a dividend stock during special occasions.

The Final Word

The Federal Reserve’s path to normalcy continued this week. As rates continue to rise, the winners and losers of tighter monetary policy will become more apparent. To understand how monetary policy impacts dividend stocks, read our dedicated section on Rising Interest Rates.

For the latest dividend news and analysis, subscribe to our free newsletter.