Something amazing happened on Feb 5, 2017. It was the night of one of the biggest sporting events in the world – the Super Bowl. It didn’t break viewership records, but it deserved to. Before this game, no team had come back from being down by more than 10 points to win a Super Bowl.

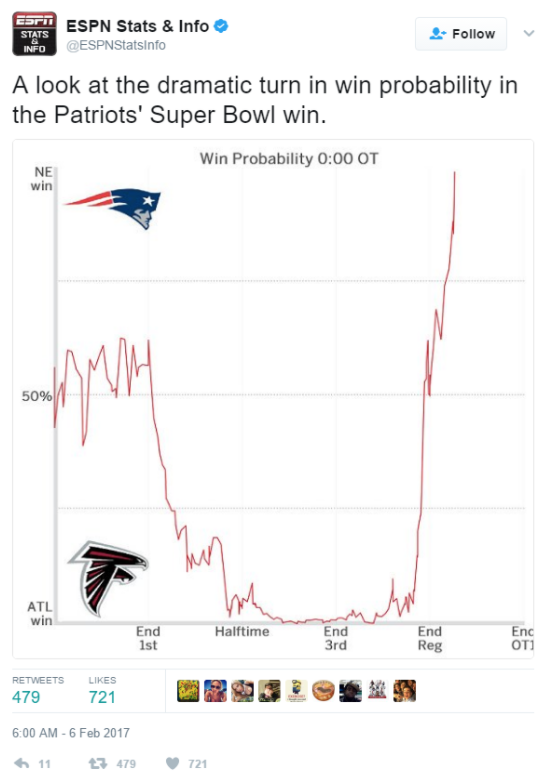

On this historic day, the Patriots came back from a 25-point deficit to win the most unlikely high-stakes game ever. ESPN tweeted a probability graph of the game. There was a 0.2% probability of the Patriots winning with 21 minutes left to go. In simple terms: it wasn’t supposed to happen. And, yet, it did! Not to mention in overtime. And that had never happened either. As investors, we need to pay attention to these lessons and learn from them.

Don’t Wait. Build a Solid Process.

Bill Belichick and his very experienced coaching staff have a solid process and they prepare well for these situations. It’s not by chance that they’ve won two of the last three Super Bowls. If you go back in time to when Belichick took over as head coach, you’ll find that his team featured in the championship game seven times in the last 17 years, winning five of them. In percentage terms, it would equate to being in one of the most popular “finals” 40% of the time. That can’t be attributed to individual brilliance, but instead a successful methodology. It’s not hard to see why Tom Brady has outshone everyone else and why he deserves every bit of it. It is, however, disappointing not to see an equal amount of coverage of the process of winning. Consistent performance is almost always about process.

Now, that’s not how it works with most individual investors. They often end up waiting for the right time or a moment of inspiration instead of designing a process of investing that suits their needs. There is too much focus on short-term goals and very little objective planning. Defining a process is even more important for dividend investors as they are looking for a locked-in income from their portfolio. Dividends can’t be left to chance. They need to be captured using an effective strategy. To research stocks based on ex-dividend dates: click here.

Further reading: Dividend Capture Strategy: The Best Guide on the Web.

Focus on Underlying Fundamentals in Times of Crisis

It has been a distracting and challenging year for Tom Brady and team because of deflategate and all the surrounding media hoopla. After losing multiple appeals, he decided to accept the suspension instead of dragging the whole team through the ordeal of a Supreme Court challenge. Similarly, when the Patriots were down and almost out, they dug deep and stuck to their fundamentals: an airtight passing game. Even when time was against them, they patiently worked with machine-like precision instead of trying to execute some wild strategy their team wasn’t designed for. It must have been a tough decision to execute a slower pace for assured progress when there was a mountain of deficit to climb.

Individual investors, on the other hand, too often give in to the distractions of tweets and trends. Let’s face it: Human beings are designed to pay attention to their surroundings and be social. It’s hard not to get swayed by the unabating political conversations on the way to work and the constant news notifications on our phones. It takes great resolve and deep-rooted fundamentals to ignore the Brexits of the world and refocus on the underlying assumptions driving the valuation cycle.

Further reading: Click here to visit Dividend Investing Ideas center to build knowledge on topics ranging from terrorism to dividend ETFs, plus strategies used by investors like Warren Buffet and Kevin O’Leary.

Practice Your Exit Game

If you held on to the “Patriots stock” when it smashed into the ground and sat there hoping for a comeback that the game had never seen in its 50-year Super Bowl history, it would’ve been a poor decision. The arguments above were not intended to make you believe in contrarian investment strategies.

Let’s return to the ESPN probability graph.

It’s hard to make the case for a “hold” decision when the probability of success hits close to zero. In fact, only speculators are left in the game at that stage. There is indeed a promising exit lesson to be learned here. Like professional sports, investors have to face ugly losses. They may stem from poor strategy or imperfect research or just bad luck. It takes practice and a lot of self-awareness to build an exit strategy that helps you in these situations.

There’s a simple way to test how good your exit strategy is: If you feel a sense of strong disappointment after exiting a position, either because you feel you could have cut your losses sooner or clocked in more profits, then you need to refine your strategy. It’s not just about building emotional awareness, but also about defining a set of metrics that work for you. Those metrics could be related to business cycles or ratios like P/E or technicals like RSI. The idea is to clearly define what success or failure means for you instead of leaving it open-ended. An exit situation can come unannounced on a Tuesday afternoon when you are out for your free Starbucks refill. While a tall pike coffee might help, even better would be to re-assess those metrics.

Watch: How Investors Can Conquer Their Fears When the Market Gets Rocky.

The Bottom Line

Crisis happens. Luck runs out. We make poor decisions. None of that is unavoidable. No investor is isolated from uncomfortable situations. Building the right hedges in your portfolio is important, but it’s equally important to design a process that can help you deal with a storm.

For more Dividend.com news and analysis, subscribe to our free newsletter.