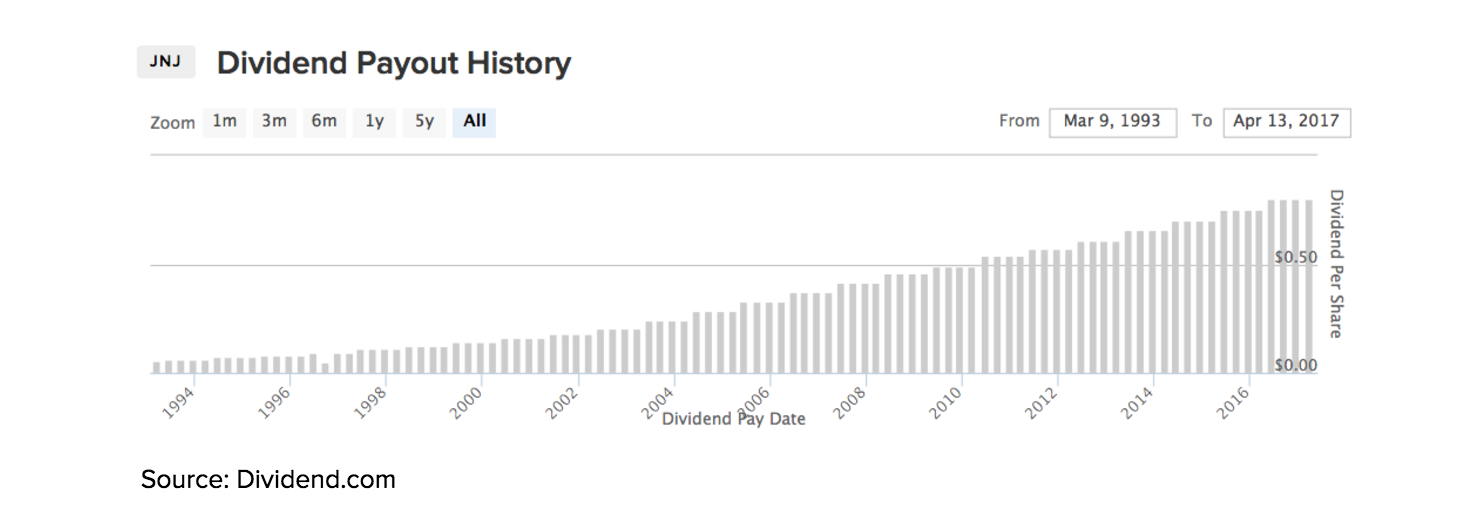

Johnson & Johnson (JNJ ) is a 130-year-old blue-chip company that has raised its dividends for 54 straight years and earnings per share for 32 years straight. It is a classic “slow and steady wins the race” stock, if there ever was one.

With a free cash flow of more than $15 billion in the last two years (2015 and 2016), Johnson & Johnson is a worthy consideration for most long-term portfolios. This article will cover important highlights about the company that you should know before you make your investment decision.

“An Old Horse Knows the Way”

Based out of New Brunswick, NJ, Johnson & Johnson currently clocks in more than $70 billion from its 250 subsidiaries operating in 60 countries and selling in over 175 countries. Chances are you have used one or more of its well-known consumer brands: Band-Aid, Tylenol, Johnson’s baby powder, Neutrogena, Aveeno, Lubriderm, etc.

That is a result of 130 years of innovation, running a profitable business, licensing relevant products and acquiring growth companies. Popular brands like Listerine, Benadryl and Zantac, are examples of the company’s acquisitions. Earlier this year, JNJ announced a whopping $30 billion deal to acquire Swiss drug developer Actelion and recently announced the acquisition of Abbott Medical Optics, a subsidiary of Abbott Laboratories for $4.3 billion. JNJ knows that staying relevant will mean acquiring assets that align well with its vision and parting ways with the ones that can help raise cash (e.g. Cordis and Ortho Clinical Diagnostics). In 2016, JNJ spent a utilized $5 billion for acquisitions and $9.1 billion for internal growth initiatives (including R&D). The company had announced, in 2015, a plan to file new drug applications with the FDA for 10 new drugs potentially capable of at least $1 billion in annual sales by 2019.

With several billion in cash and cash equivalents, the company has the luxury of choice when it comes to circumventing challenges due to dip in innovation or economy. One example of that would be the product defect cases piling up against JNJ. Bloomberg wrote earlier this year about Johnson & Johnson being hit with six of the seven largest verdicts in 2016 and a similar pattern, could continue in 2017. Among them are two hip implant cases in Dallas Federal Court filed for a total of $1.5 billion in damages. With its current levels of cash reserves and annual free cash flow, the company’s future is secure even if all the cases go against JNJ.

Further reading: Stay up to date with JNJ’s latest news: click here.

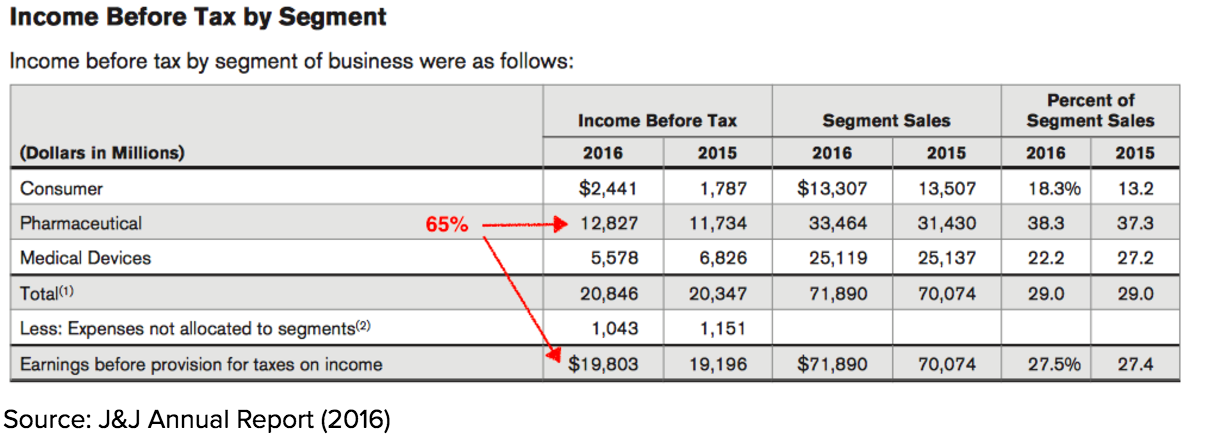

Diversified, but Mostly a Pharma Company

Johnson & Johnson is organized into three broad divisions: consumer health, medical devices and pharmaceutical. Even though the sales are slightly well spread, when it comes to income, the pharma division brings home close to 65% of the total income (based on 47% of the sales). To put things in perspective, the medical devices division contributes 35% of the sales but only spits out 28% of the income.

Both medical devices and consumer segments have been declining sales since 2014. 2015 witnessed a sharp decline in sales of 8.7% and 6.8%, respectively (as compared to 2014), but the company was able to recover in 2016. Its pharma segment, which also had a decline of 2.7% in 2015, recovered by a massive 6.5% to recover the losses from the other two segments, and more. Inside the pharma segment, sales are diversified, but are still heavily dependent on their top four drugs, which contribute more than 40% of sales. Remicade contributes a massive 20% to pharma sales and the three other top drugs (Stelara, Zytiga & Xarelto) contribute another 23% to the sales. While Remicade held onto its sales in the last two years, the Stelara, Zytiga, and Xarelto have quickly risen to fill the void left by drugs that have lost sales (e.g. Olysio and Sovriad) to become top drugs in the JNJ portfolio.

Pharma is a fast-moving segment with risks of biosimilar drugs always looming large and with almost continuous legislative pressure to reduce prices. Despite these unfavorable winds (and none less than the new president promising to “stop price gouging”), JNJ has done well to keep making steady progress. While it is risky to increasingly depend on the pharma segment, it is still better placed than pure pharma companies that don’t have any diversification into other segments.

Further reading: Worried about Obamacare? Find out how you should prepare your portfolio for Obamacare repeal here: click here.

JNJ as an Investment

Johnson & Johnson has an annualized growth of 7% in the last five years, 7.5% for the five years before that (2008-2012) and 13.2% for the five years between 2004-2008. With a payout ratio of less than 50%, the company is in a comfortable position to continue to pay dividends on a consistent basis.

Find out the dividend yield of the healthcare sector here. You can also get company count and dividend yield of the industries within the sector. For JNJ’s dividend history: click here.

Combine that with exceptional capital gains of more than 140% in the same time period. If we combine the two – very rough math, I agree – it gave out an annual return of 12% or more every year in the last 15 years.

JNJ’s current P/E ratio of 21 is lower than Pfizer, Novartis, Merck, Medtronic and even P&G. Some of these companies don’t have a 100% overlap in terms of the business model with JNJ, but they do have related or similar business divisions. It is close to the P/E for the Dow Jones Industrial Average and lower than that of S&P 500. This puts JNJ’s close-to-lifetime high price of $125 in perspective. Also interesting to note is that JNJ has beaten S&P 500 handsomely when you compare the historical chart for last 15 years.

$125 also happens to be a good price level to watch for from a support and resistance point of view. The stock tried to breach that level twice in July 2016, and was finally able to do so in March 2017. Since then, the stock has bounced off that level twice in the last few weeks. The other important levels to watch for are $120 and $111, if investors are looking for signals to enter or exit.

JNJ is a proven dividend aristocrat with decades of consecutive dividend growth. This puts JNJ in the prestigious 50-year dividend club of Procter & Gamble, 3M, Coca-Cola and Colgate-Palmolive.

Find out other companies that are dividend aristocrats on our 25-year dividend increasing stocks page: click here.

The Bottom Line

JNJ is a war horse that always seems to be on the road ahead and whichever way the wind is blowing. Despite ups and downs in its product portfolio, it has delivered a steady capital gain and dividend growth. Even though the current price is close to its all-time high, the stock is not priced at an unreasonable premium. Given that the dividend payout is very manageable, it is well placed to deliver comfortable dividends in the near future.