3M (MMM ) is a world-class, S&P 100 blue chip company that employs close to 90,000 people and sells 60,000 products in nearly 200 countries.

Those are enormous numbers and no company in the world is quite like 3M. Minnesota Mining and Manufacturing Co. began its operations more than a century ago. Today it caters to many sectors, occupying shelves in homes, industries, schools, hospitals and more.

The Topline Problem

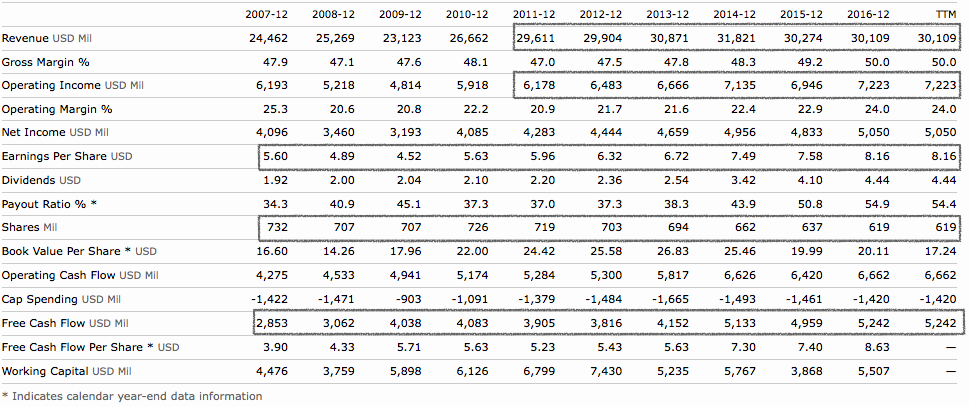

3M has not been able to grow its revenues for four years in a row from 2013 to 2016. To counter that, the company has successfully cut operating expenses, which has led to a steady growth in operating income in the same period. Given the size of the product portfolio and the many industries it competes in, the company has struggled to grow its topline in a meaningful way. 3M must also get credit for managing its outstanding shares by buying back and issuing shares in an efficient manner. The company has been able to consistently reduce the number from 729 million in 2011 to 619 million in 2016. As a result, EPS has gone up from $5.96 to $8.16 during the same period. The company returned a total of $6.4 billion to shareholders in 2016 through dividends and gross share repurchases.

A lot of the savings in operating expenses have come from a series of strategic consolation and efficient financial management. The company has now moved from 40 businesses to 24. It has managed to balance its debt obligations and reduce its effective tax rate from 29.1% in 2015 to 28.3% 2016. By 2020, the company expects $500–$700 million in annual operational savings and $500 million in reductions in working capital.

While financial maneuvering and cost management are effective ways to keep meeting targets in the short run, they can’t continue forever. There is hardly any difference in the topline figures of 2011 and 2016. That is far too long without substantial growth, which should be a cause of concern for any long-term investors looking at a 10-15 year time horizon.

On the bright side, the company recently increased its 2017 earnings forecast, and as a sweetener for investors, it also expects an organic sales growth in the range of 2-5%. Moreover, the company spent $1.7 billion (around 6% of 2016 revenue) in research and development and another $1.4 billion in capex, showing positive intent toward preparing for the future.

3M is a member of the Dow Jones Industrial Average. Click here for a complete list of the Dow 30 dividend stocks. Find out more about the dividend increase and $10 billion share buyback of 3M here.

The Power of Diversification

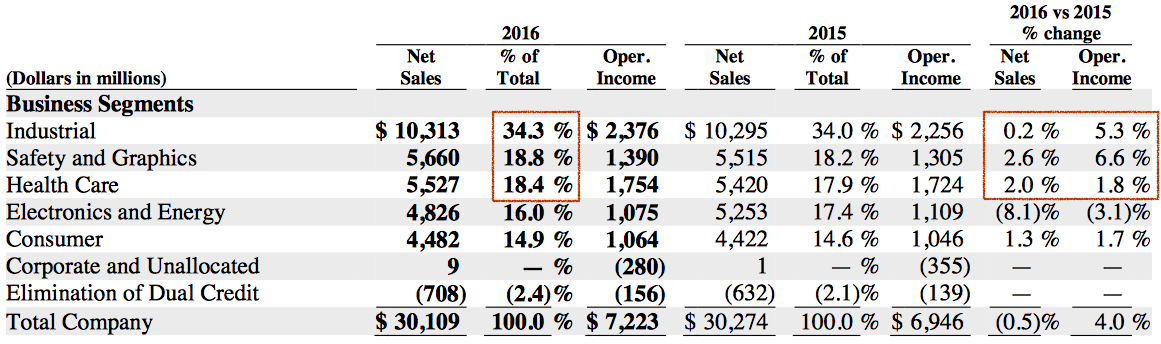

While it is unimaginably complex to manage a portfolio of tens of thousands of products, they end up catering to diversified sectors. As a result, there is always the potential of a shortfall in one segment being covered by others (yes, correlation matters, but it is diversification nevertheless).

To put things in perspective, the company has had a decline in revenues in only one segment: electronics & energy. The top industrials segment has stayed flat, but 3M managed to grow in its other three segments that contribute more than 50% to revenues. If the company can stabilize the losses in the electronics & energy segment (16% of overall sales), the overall topline will start to grow again.

3M is diversified in terms of geographies too. It is a global company with more than 60% of its revenues coming from outside of the U.S. While its Asia Pacific sales declined by 2.8%, it was able to increase its sales in Latin America and Canada by 3.7%. Sales in the United States, Europe, the Middle East and Africa have marginally increased in 2016.

3M as an Investment

The stock has gone through ups and downs in the last one year, but like the broad market, it has performed well since November election, returning nearly 20%. The company has increased dividends for 58 years, and when combined with attractive market returns (e.g. 120% in the last five years compared to 70% for S&P 500), it should find a place in most portfolio management approaches. Click here to research the dividend history of 3M.

3M currently maintains a dividend yield of 2.4%, with an annualized growth of 15% in the last five years. Free cash flows dipped temporarily in 2015, but the company came back strongly in 2016. With the dividend payout ratio holding at 53%, investors can feel confident about future dividend prospects.

3M tested the $168 level a couple of times in 2015, but failed to cross it until early 2016. Since then, it has bounced off that level a couple of occasions and seems to have gone handsomely past that in the first 100 days of the new U.S. presidency. If the price breaks the $168 support level, $138 is a significant resistance for investors to note.

Investors can use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. They can even screen stocks with DARS ratings above a certain threshold. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

The Bottom Line

As the title of this article goes, buying 3M is like buying an index. While it provides good diversification in terms of geographies and sectors, too much of that can result in diluent growth areas. It’s a blue chip stock that deserves a place in portfolios that aim for stable, long-term growth. Since the stock is currently trading at an all-time high with a positive forecast for 2017, it makes sense to build a position in the trenches for better price-averaging possibilities.

Stay up to date with next week’s major corporate changes regarding dividends in our News section on Dividend.com. Start your free trial to Dividend.com Premium account here.