Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Centrist candidate Emmanuel Macron secured the French presidency in convincing fashion Sunday, an outcome that likely ensures France’s continued membership of both the European Union (EU) and the euro. However, the election result failed to lift Wall Street and European stocks, a sign Macron’s place in the Elysee Palace was already priced into the market in the weeks leading up to the second-round runoff.

Investors were also drawn to individual stocks amid earnings season, with Apple Inc. (AAPL ) dominating the headlines after reporting another dividend increase. S&P 500 companies are on track for their best earnings quarter since 2011, according to financial research firm FactSet. Click here to find out which other companies increased their dividend during the latest round of earnings.

Pipeline companies were also in the spotlight, with investors growing optimistic that an oil-friendly Republican administration will boost development in the sector. Latest rig-count data suggest the U.S. shale industry is booming, placing downward pressure on the global energy market at a time when the Organization of the Petroleum Exporting Countries (OPEC) is trying to rein in supply.

Compare this week’s Trends report with our April 28 edition, which looked at an escalating lumber dispute between Canada and the United States.

Macron Wins in Landslide Election

Market-friendly Macron secured 66.1% of the French electorate on Sunday, compared to 33.9% for nationalist Marine Le Pen. With the Frexit risk reduced, investors turned their attention back to French equities and exchange-traded funds (ETFs). It, therefore, came as no surprise that French ETFs took the No. 1 spot on our weekly list with a 195% spike in traffic.

Macron’s election victory carries the risk of a “buy the rumor, sell the fact” scenario for the world markets. The oft-quoted phrase explains price declines that occur after an anticipated positive event has taken place, likely due to the outcome already being priced into the market.

Despite the market’s tepid response to the election result, French and European equities have scope for further upside as rebounding corporate earnings and a stabilizing regional economy support investor appetite. Bank of America Merrill Lynch (BAC ) reported last month that big brokers are shifting their focus from Wall Street to Europe, with billions of dollars flowing across the Atlantic to seize the new opportunity.

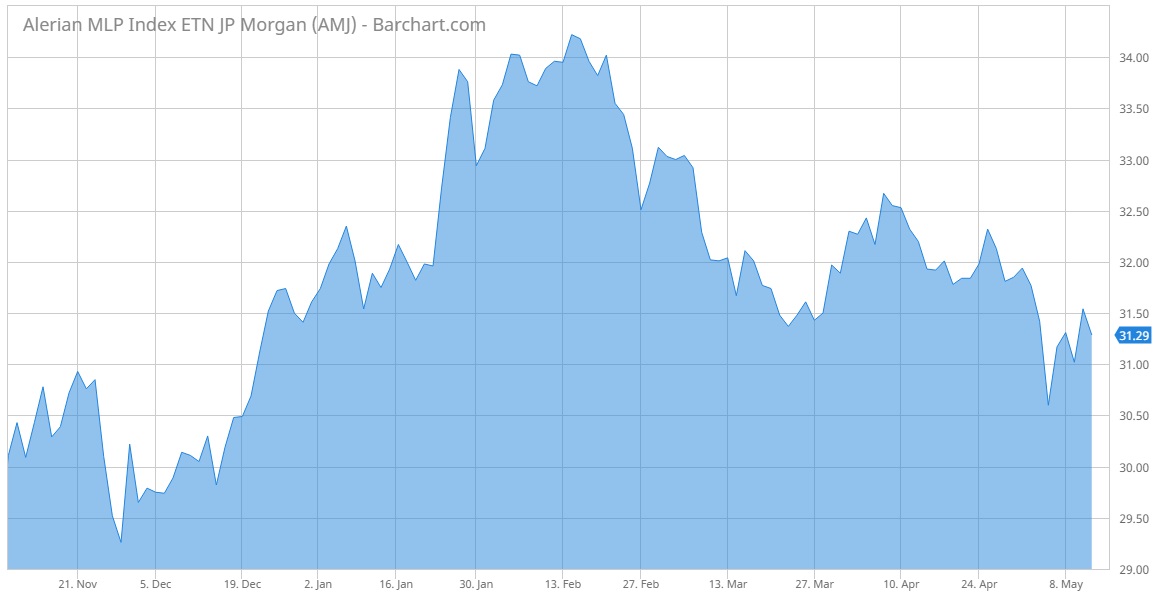

Alerian MLP Sees Huge Spike in Put Options

Alerian MLP ETF (AMLP) experienced an unusual spike in trading activity at the beginning of May. Dividend.com readers took notice and increased their viewership of the asset by 107% over the past five days.

Alerian, a leading index of energy Master Limited Partnerships (MLPs), was purchased 11,690 times as a put option on May 4, which is 1,868% higher than its average daily volume. The sharp uptake in activity came a week after the company announced that Energy Transfer Partners (ETP) will be removed from several Alerian gauges in a special rebalancing.

The uncategorized security last reported a dividend yield of 7.03%, but is not a regular dividend earner.

For a comprehensive list of income earners, refer to the Best Dividend Stocks page, which provides daily recommendations on the best equity plays.

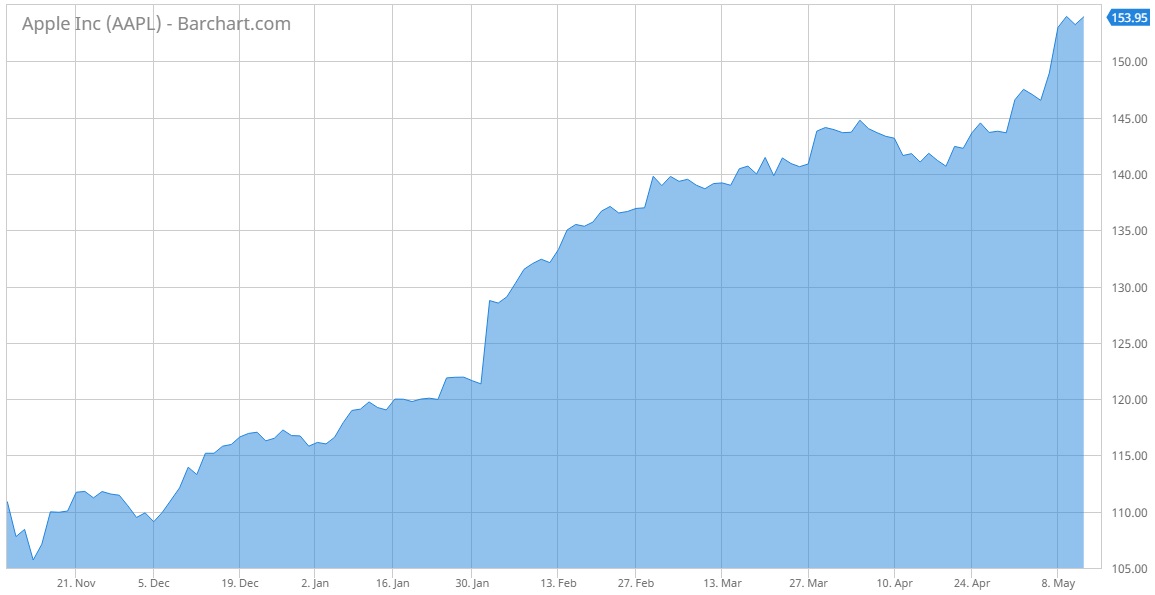

Apple’s Market Cap Tops $800 Billion

Apple’s $800 billion milestone caught investors’ attention this week. The iPhone maker takes the No. 3 spot on our list with a 62% rise in traffic.

The world’s most valuable brand overcame mixed quarterly earnings en route to its highest-ever market valuation. Shares of the Cupertino, California-based company have gained 7% this month and nearly 40% since the presidential election, leaving little doubt that Apple is the undisputed king of consumer electronics.

Apple announced last week it will be increasing its quarterly dividend by six cents to 63 cents a share. That represents a 10.53% increase.

To explore other companies in the technology sector, check out our Dividend Stock Screener, where you can sort companies based on market capitalization and dividend payout frequency.

In case you are wondering about other high-yield dividend stocks, check out our full list here.

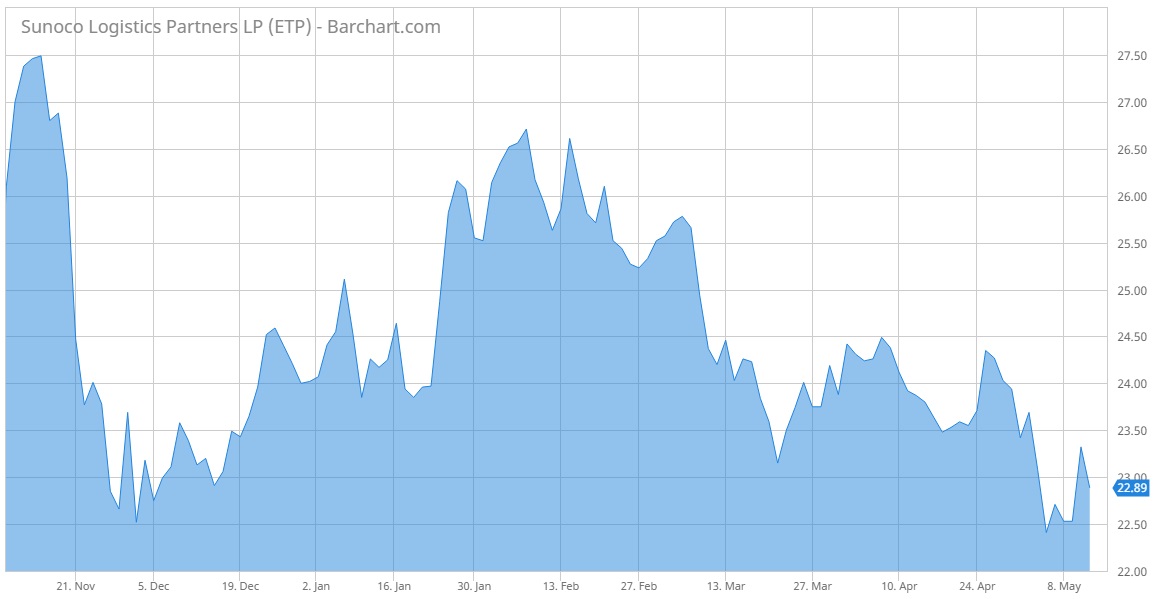

Energy Transfer Partners Begins New Chapter After Merger

Energy Transfer Partners, which was recently acquired by Sunoco Logistics (ETP), is No. 4 on our weekly list with a 45% jump in volume.

Like other midstream master limited partnerships, ETP has struggled to grow volumes and earnings amid the two-plus-year oil rout. However, the company appears to be finally turning things around following upbeat first-quarter results, which resulted in ratings upgrades from the likes of Stifel and Credit Suisse.

With Energy Transfer’s merger with Sunoco now complete, investors can expect to see more exciting pipeline projects in the coming year.

Oil and gas pipelines stocks have an average dividend yield of 5.23%.

Click here to explore other dividend stocks in the industry.

The Bottom Line

While Frexit risks have faded, the United Kingdom’s divorce from the EU is just getting started. Consider reading “It’s Post-Brexit; Now What?” to learn what the next two years will look like for the financial markets. While you’re at it, check out Dividend University to brush up on your investing knowledge.

For more Dividend news and analysis, subscribe to our free newsletter.