It’s close to two years since Target hit an all-time high. It is now 33% lower despite making several attempts at recovery in 2016 and 2017. The company’s valuation is currently attractive as it’s going through a phase of business transformation.

This article will attempt to shed light on whether the company is primed to make a comeback as a retailer in the future and if it’s a worthy resident of a long-term investment portfolio.

The Sales Target

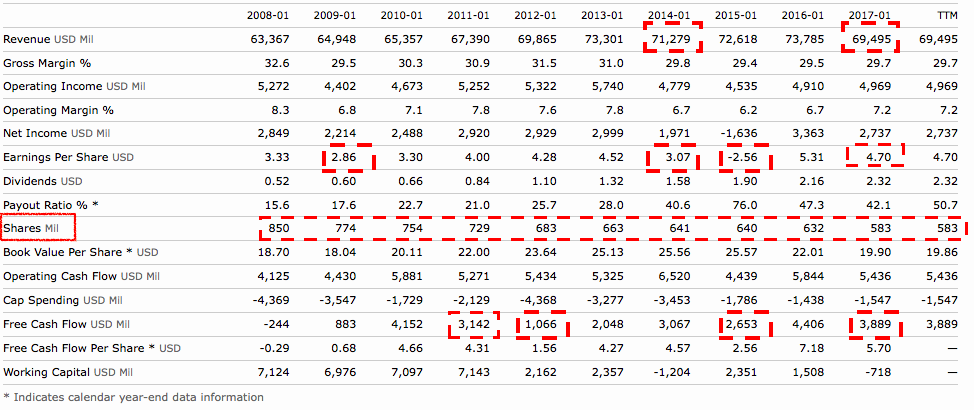

There has been gloom and doom in the stock market for Target (TGT ). It is not farfetched to expect a similar story on the business side. While not the prettiest, Target’s sales haven’t exactly been in freefall either. The company has had just two down years in sales over the last decade. Earnings per share (EPS) and Free Cash Flow (FCF) have had down years four times during the same time scale. It has been effective in reducing the shares outstanding on a consistent basis from 850 million in 2008 to 583 million in 2017. That has helped to improve their ratios (e.g. EPS, ROE) and increase shareholder value. The company has had to raise much-needed cash by selling its pharmacy business to CVS (CVS ) for $1.9 billion in 2015, after its Canadian adventure ended with a $5 billion hole in its pocket. This also gives an opportunity to focus on its online business, which is crucial for its long-term success as discussed below.

Target has been trying to use its grocery (food, beverage and pet supplies) business as a destination for in-store sales and long-term stickiness. Despite executive attention, billions of dollars spent on setting up the business and contributing 22% to its revenue, Target has not succeeded to grow the business at a meaningful rate. Anne Dament, Target’s grocery business chief, left the company just 18 months after taking on the role. A successful grocery business would put Target in direct competition with Walmart (although different customer demographics) but analyst consensus seems to be building against that possibility.

Target has been slow in addressing the threat from web and mobile commerce. Meanwhile, Amazon (AMZN) passed Walmart (WMT ) as the world’s largest retailer by market value some time back. Even though Walmart generated more than 3.5 times AMZN in revenue last year ($486 billion vs. $136 billion), Amazon is valued twice as much ($445 billion vs. $232 billion) as of today. In fact, Amazon is now valued more than the combined total of 8 large U.S. retailers, including the likes of Best Buy (BBY ), Macy’s (M ), Target, Walmart and Sears (SHLD).

That sheds some light on the market values and why Target has been struggling to attract a better valuation at the secondary market.

The Online Conundrum

Depending on the quarter in the last two years, Target’s eCommerce sales add up to approximately 2.5-5% of total sales. This distribution is somewhat similar to Walmart’s. Target has had substantial year-on-year growth in online sales in the last few quarters (20-40%), and that is a bright spot in their online story. Walmart, on the other hand, has struggled to keep up with its growth numbers. Walmart’s e-Commerce growth used to be more than 20% in 2014, but it lost steam and fell to single digits from Q3 2015. Target’s growth has been a result of aggressive product pricing and shipping cost reductions, which are hard to keep up.

Target had announced in 2016 a plan to spend a billion dollars to improve its online experience and compete with the likes of Amazon. The company doubled its digital sales from 2013 to 2016. A couple months back, Target CEO Brian Cornell announced that the company is looking to deploy $7 billion in capital in the next three years to grow sales faster, improve market share and adapt to changing customer preferences. The Minnesota company also announced that it would launch its mobile payment service this year challenging Apple Pay, Android Pay and Samsung Pay. A similar move was announced by Walmart with its mobile payment service. Like Walmart, Target has been late to the game and it remains to be seen if these business decisions create an impact in the long run.

Target has one distinct advantage over Amazon – its 1,800 brick-and-mortar stores across the US. Stores are also warehouses for the company to provide same day deliveries and “order and pickup” services to customers. This is especially useful in peak sale holiday season, like December. Earlier this year, Brian Cornell stated, “the number of items we shipped from stores doubled year-over-year and, in the few days leading to Christmas, we saw nearly 50 percent of Target.com orders picked up in store.” Some analysts see Target’s goodwill and customer demographics better suited to omnichannel transformation as compared to Walmart.

To get dividend-specific information about other discount variety stores: click here.

Target as an Investment

Given the price corrections, Target now has a lower PE compared to similar retailers like Walmart, Costco (COST ), CVS and Dollar General (DG ), considering $20 billion plus market cap only.

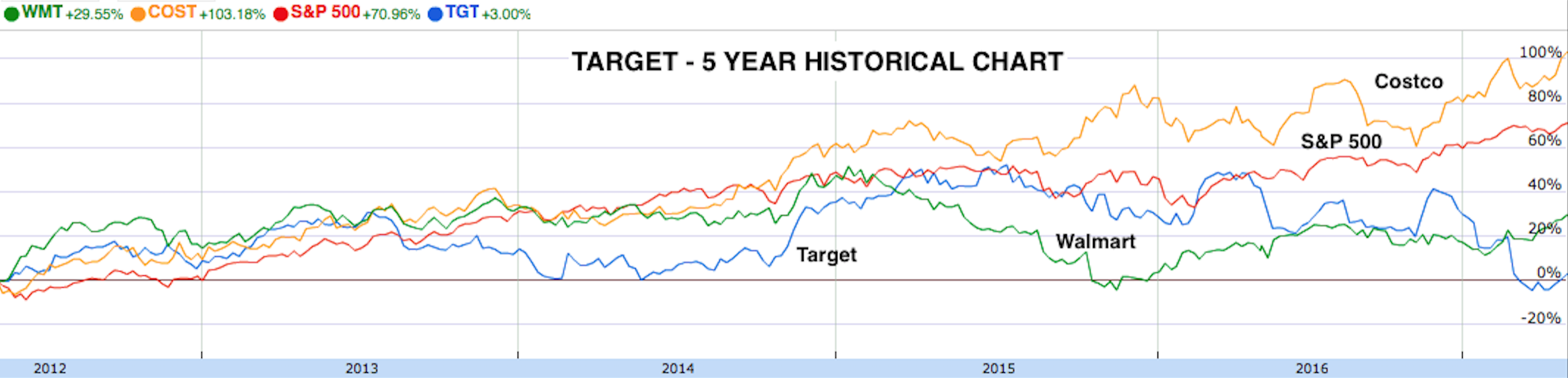

Target has gained and lost 20% or more in market value on several occasions in the last decade. As a result, the stock has remained flat, returning 3% in the previous five years and -3% in the last decade. In comparison, Costco has returned 103%, CVS 81%, Dollar General 54% and Walmart 30% in the post-recessionary period of the last five years. To put things in context of the overall market, the S&P 500 has returned 71% in the same period.

Things are not gloomy on the dividend front either. The company has a current dividend yield of 4.19% and has been increasing its payouts for 49 years in a row. It has recorded an annualized growth of 16% in the last five years. Check out the dividend history of Target here.

The payout ratio stands at around 60% and the free cash flow, despite being choppy in the last four years, has gone up from $2.05 billion in 2012 to $3.89 billion in 2016. Among all the bad news, it is encouraging to know that the company has not let the situation spin out of control and that future dividends are likely to continue. To learn more about how Target has consistently raised dividends, click here.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. You can even screen stocks with DARS ratings above a certain threshold. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

The Bottom Line

Target’s inertia in focusing on its online sales has put the company back a few years regarding business strategy. The company has been struggling to meet its expectations, and as a result, has been punished in the stock market.

It can be argued that sometimes the punishment was harsher than the company deserved, but as a result, Target is now largely valued cheaper compared to its peers. Investment in Target will come with its share of risk, but if the company can recover from its topline problem, investors can expect handsome capital returns and dividend payouts in the next few years.

Stay up to date with next week’s significant corporate changes regarding dividends in our News section on Dividend.com.

Start your free trial to Dividend.com Premium account here.