Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center around President Trump’s actions and how they affect the U.S. economy. With Trump’s decision to withdraw the U.S. from the Paris Climate Accord, energy companies like Exxon Mobil were trending. Wal-Mart had its 2017 shareholder meeting this week, with a focus to compete with Amazon. President Trump spoke again about repealing Obamacare, which led healthcare stocks like GlaxoSmithKline to trend. Finally, Pepsi was in the news with a potential bid to buy the coconut water leader, Vita Coco.

Check out our previous trends article on how the U.S. and Saudi Arabia deal helped the defense sector stocks.

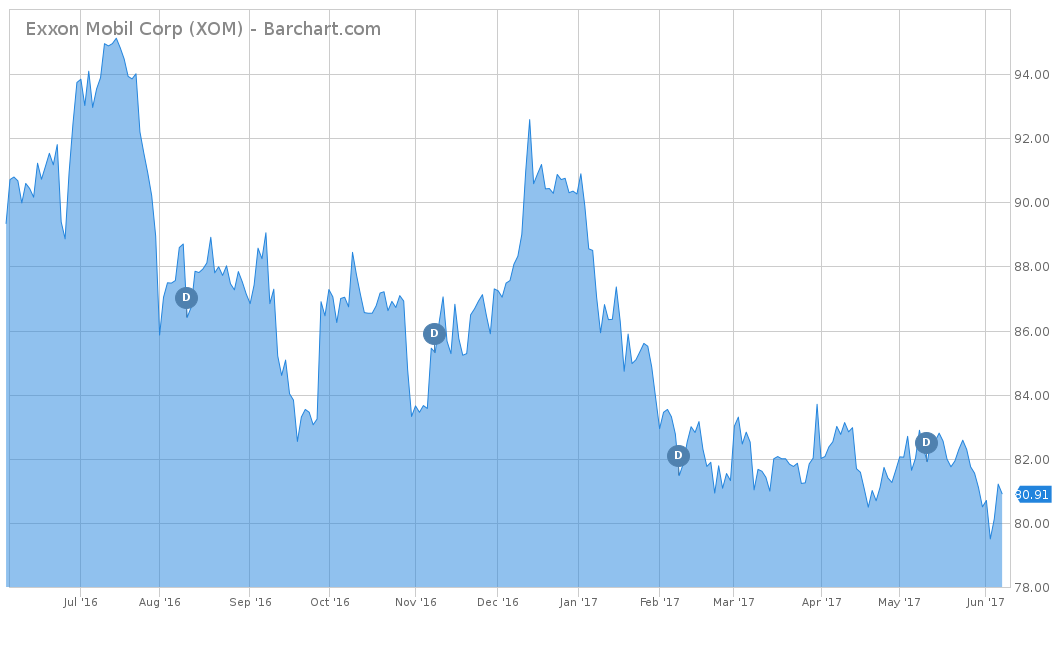

Exxon Mobil Declines After U.S. Withdraws from Paris Agreement

In a very controversial move, President Trump made the decision to withdraw the United States from the Paris Climate Accord this week. Last week, Exxon Mobil (XOM ) had 62% of shareholders vote in favor of a proposal that causes the company to back the Paris Agreement. This comes as a surprise, considering that last year Exxon lobbied heavily against the proposal and a vote only reaching 38% of shareholder support. The proposal calls on Exxon to assess how green technology and climate change regulation will affect its business through 2040.

Its stock price did not respond well to the news in the last week, declining 1.14%. It is trading near its 52-week low of $79.26 and down 10.67% on a year-to-date basis. As the clear leader in the oil and gas sector, Exxon’s stock price has been affected by the decline of oil. However, the company has diversified across many other avenues of energy like natural gas to help soften the blow from further pullback in oil prices. Another draw to the company is that it has a history of growing its dividend over the last 34 years and currently yields 3.82%. As a result, XOM saw its readership spike 49% this week and took the No. 1 spot on our list.

To learn more about dividends, click here.

Pepsi Looks to Acquire Vita Coco

In an effort to expand its healthy, non-carbonated beverage market, PepsiCo Inc. (PEP ) has put in a bid to buy Vita Coco. This led to a 42% rise in PEP’s readership this week. Vita Coco was started in 2004, in New York, and now has exposure in over 30 countries. It currently has a 26% market share of the coconut water industry and is worth $2.5 billion, far less than the bid of just under $1 billion that Pepsi offered. Pepsi tried to compete in the coconut water market by acquiring O.N.E. coconut water in 2010, but fell short when competing against Vita Coco and Coca Cola’s (KO ) Zico. Pepsi hopes to acquire Vita Coco in an effort to diversify its revenues, which have been on a steady decline with its carbonated drinks. Consumers have been steadily leaning toward healthy alternatives like bottled water and coconut water instead of sugar-infused soda drinks.

On the news of this potential acquisition, Pepsi stock did not react well and declined 1.71% for the week. This is likely due to the low-ball offer that Vita Coco will likely reject. On a year-to-date basis, Pepsi has done well, up 10.76%. Pepsi is also known for having a consistent dividend, having raised it 44 years in a row. Currently, Pepsi’s stock is yielding 2.78%.

Check out PEP’s impressive dividend history here.

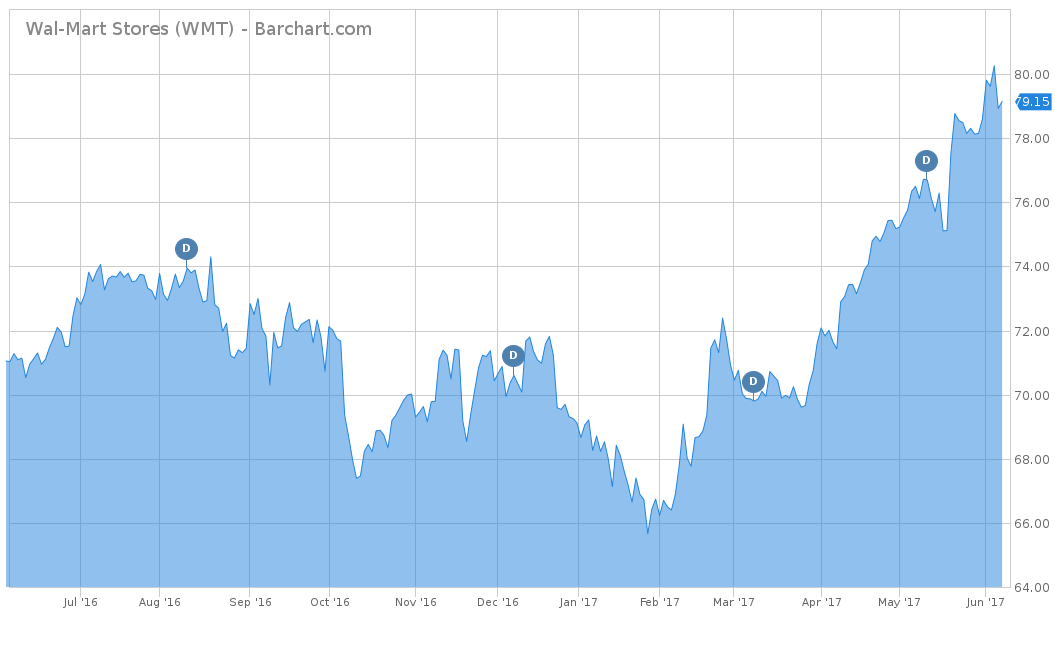

Wal-Mart Looking to Take on Amazon

The largest retailer in the world had its 2017 shareholder meeting, leading to a 34% jump in its readership this week. Its focus this year is to compete with the threat of Amazon.com (AMZN) and other online retailers. With its acquisition of Jet.com and the introduction of free two-day delivery on qualified products, Wal-Mart (WMT ) looks to drive consumers to its website. However, Wal-Mart’s e-commerce success is lagging compared to Amazon’s, which accounted for almost 1/3 of online U.S. sales versus Wal-Mart’s 7.8%. Another way to compete with other retailers is by the introduction of in-person pickups. With Wal-Mart grocery pickup growing in popularity, Wal-Mart has decided to test the waters with a kiosk that lets shoppers pick up their groceries at any time.

The stock hasn’t reacted well in the last week and is down 1.10%. However, on a year-to-date basis, Wal-Mart has fared well and is up 14.18%. In addition, compared to Amazon, Wal-Mart’s stock has not kept up. Amazon is up 1.43% for the week and up 34.72% YTD. The one big difference between the two companies is the dividend. Wal-Mart has had a consistent dividend, growing it for 42 consecutive years. On the other hand, Amazon.com does not issue a dividend.

You can use our Dividend Screener to search relevant dividend-paying stocks based on different parameters.

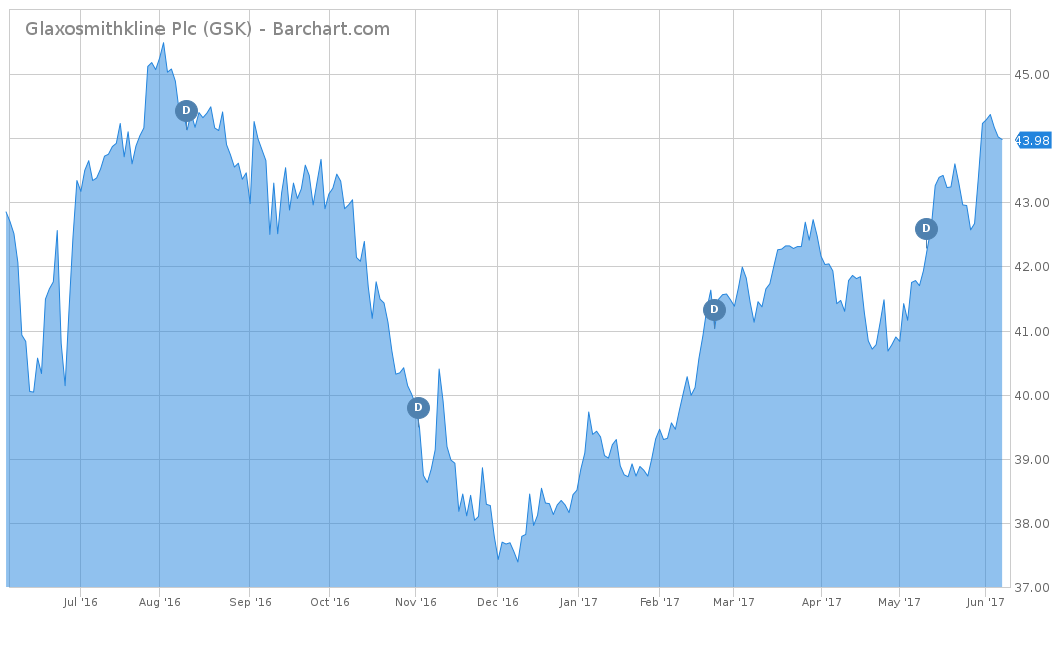

GlaxoSmithKline Trends After Trump’s Remarks on Healthcare Sector

On the wake of the White House’s proclaimed “infrastructure week,” President Trump made several remarks about America’s healthcare status and how the Affordable Care Act, also known as Obamacare, is “crashing. It’s dead, it’s in a death spiral.” This caused healthcare stocks to decline this week. However, this did not affect GlaxoSmithKline PLC (GSK ), whose stock faired well in comparison – up 2.66% for the week and up 13.71% year-to-date. Nevertheless, readership at GSK spiked 32% this week.

GlaxoSmithKline is one of the largest pharmaceutical companies in the world and has succeeded with its diverse pipeline of patent-protected drugs. Its next-generation respiratory drug, Advair, is the company’s leading drug representing 10% of overall revenue. Glaxo also has HIV drugs that are well-positioned and gaining market share quickly. What is more appealing is that GSK has one of the highest dividend yields in the healthcare sector, at 4.54%.

To see other healthcare stocks that might be a bargain, read this article.

The Bottom Line

Exxon Mobil and other energy stocks showed movement this week, as the U.S. withdrew from the Paris Agreement. Wal-Mart takes aim at Amazon by offering two-day free shipping in the hopes of increasing its e-commerce revenue. Healthcare stocks like GlaxoSmithKline saw movement after Trump mentioned repealing Obamacare in favor of the American Health Care Act. Pepsi hopes to diversify its product line while increasing its bottom line, and adding Vita Coco to its portfolio might just do that.

For more Dividend news and analysis, subscribe to our free newsletter.