Originally founded as Bell Atlantic in 1983 as a result of AT&T’s (T ) breakup into the seven Baby Bells, Verizon (VZ ) is one of the largest telecommunications companies in the United States.

A Dow component since 2004, Verizon operates in two primary business lines. Its wireless division covers wireless voice, data and equipment, while its wireline segment includes hardline voice, data and broadband services as well as network and cloud computing services.

Its current share price of $45 is roughly 20% off its 52-week high, but its current dividend yield of just over 5% represents an intriguing possibility for income-focused investors.

Click here for a complete list of the Dow 30 dividend stocks.

Tough Times for Business

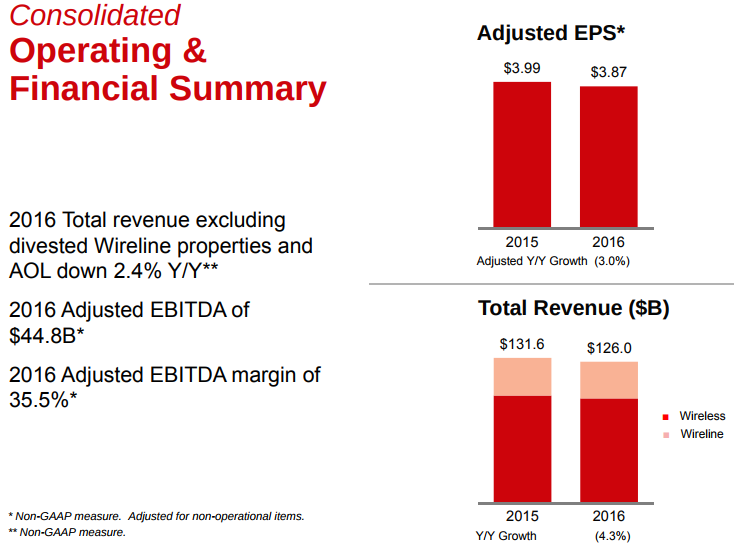

Verizon’s wireless segment accounted for more than two-thirds of the company’s 2016 revenue of $126 billion. That number is down more than 4% compared to the prior year. EBITDA of nearly $45 billion and adjusted earnings per share of $3.87 are also down versus 2016. The combination of decreased overage charges, postpaid customer losses and increased promotional costs are largely to blame.

Verizon’s struggles come amid increased competition from rivals such as Sprint (S) and T-Mobile (TMUS). For the first time in the company’s history, Verizon lost more than 300,000 wireless customers in the first quarter of 2017. New unlimited data plans offered by these smaller competitors appear largely to blame. During the same quarter, AT&T reported a net 191,000 subscriber loss, while T-Mobile posted a gain of 914,000 customers. Verizon subsequently rolled out its own unlimited data plan and reported a net gain of over 100,000 subscribers since the launch, stemming some of the recent losses. Nevertheless, at around 146 million total customers, Verizon remains the largest wireless provider in the country.

Verizon’s stock price is down 14% thus far in 2017 making it the worst-performing Dow stock year-to-date. The stock trades at around 12 times its 2017 earnings estimates, much lower than the 18 multiple of the broader S&P 500. That P/E ratio is comparable to AT&T but lower than those of faster-growing rivals T-Mobile and Sprint.

Uncertainty Around Dividend Uptrend

Verizon pays an annualized dividend of $2.31 per share putting its dividend yield at just above 5%. The company has been steadily growing its dividend for the past 10 years, making it a popular choice among income seekers. The stock’s recent payout ratio of just over 60% is reasonable for a mature company, although recent weakness in revenues and volatility in cash flows puts the strength of the dividend in question. For instance, in 2016, operating cash flows dropped by more than 40%, while free cash flow plummeted by nearly 75%. Nevertheless, the dividend has grown about 4.3% annually over the past 10 years. Earlier this year, Verizon also announced a stock repurchase plan of up to 100 million shares to be completed no later than 2020.

For investment concepts, visit our Dividend Investing Ideas Center.

Verizon Continues to Drive the Industry

Despite current competitive pressures, Verizon remains a leader in the telecom sector and, as such, enjoys several advantages in the industry.

- Strong wireless business - Verizon continues to draw the lion’s share of its business via its wireless segment, which sees some of the company’s strongest margins. Service revenues from this area were also up 2% year-over-year.

- Broad and reliable network - Verizon enjoys the most comprehensive geographic network coverage, with one recent study by an independent testing firm confirming Verizon as having the most reliable network.

- Strong EBITDA margins - In 2016, Verizon generated an overall adjusted EBITDA margin of 35.5%, fueled by a 43.8% margin in the wireless business. The margin for the wireless business expanded by 1.3% year-over-year.

- High value postpaid customer base - Despite some competitors managing to chip away at its customer base, Verizon is still the top carrier with more than 146 million wireless customers.

Click here to read about how Verizon is becoming more than just a boring wireless company.

Future Avenues for Growth

With the smartphone market nearing a point of saturation and recent revenues declining, Verizon is focusing on a few areas to drive future growth.

- 5G network rollout - Verizon is currently developing its next generation 5G wireless network and is testing it in 11 different markets. The network, which would deliver some of the fastest internet speeds, is expected to be launched sometime in 2018.

- Move into online media - Verizon originally bought AOL for $4.4 billion in 2015. Following the company’s recent purchase of Yahoo’s internet assets, it will package those two entities (along with The Huffington Post) as a new business called Oath. Oath will be Verizon’s digital media division as it expands beyond its traditional phone business.

- Shedding non-core assets - Verizon continues working on streamlining its operations and balance sheet by selling off non-core assets. The cash could be used to develop any one of its main goals or to buy back additional stock.

Current Business Risks

While Verizon is a leader within the telecom space, there are a number of headwinds the company must deal with in order to stay in front.

- High spectrum prices - Telecom providers are clamoring for wireless spectrum, the radio frequencies in which wireless signals travel, in order to better service customers. The problem is there just isn’t much left. That makes spectrum very expensive for companies looking to obtain it.

- Declining fixed-line business - The traditional landline business continues to slowly decline as wireless demand keeps growing. As revenue from this source degrades, Verizon will need to develop new revenue drivers to replace it.

- Increased competition - Verizon and AT&T are the leaders in the wireless space, but up-and-comers, notably T-Mobile, are quickly emerging and gaining customers.

- Added leverage - Verizon’s 2014 buyout of Vodafone’s 45% stake in Verizon Wireless was made with $59 billion in cash, $60 billion in stock and $5 billion in new notes. Verizon has more than $108 billion in long-term debt on its books and a debt/equity ratio of 5.

The Bottom Line

Verizon stock is popular among dividend investors for its 5% yield, but it’s not a company without its share of issues. The company’s growth is slowing, it’s being impacted by increased competition and its plan to grow future revenues are as of yet unproven. Verizon is a solid telecom play, but investors should be well aware of some short-term hurdles the company is facing before committing.

Check out our Best Dividend Stocks page by going Premium for free.