Most people probably know Kimberly-Clark (KMB ) as the “tissue company” whose name is recognizable from the toilet paper dispensers in public washrooms.

Fewer people know that the firm is 90 years old and owns some of the biggest consumer brands in the world including Kleenex, Scott, Huggies, Kotex and Depend, with its products being sold across more than 175 countries.

The Tissue Business

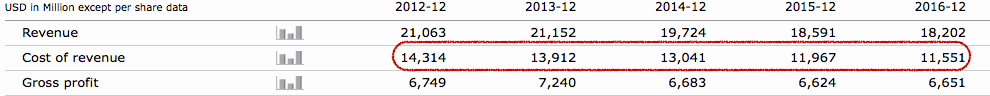

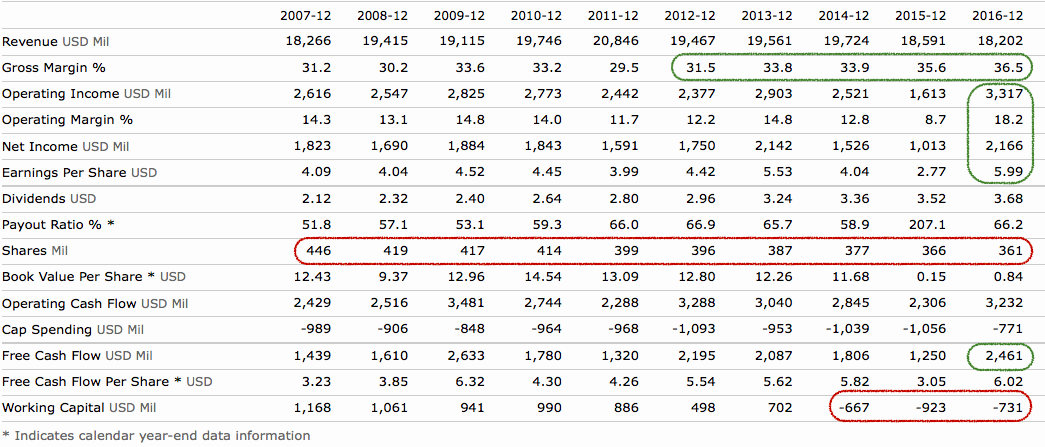

KMB has not been able to grow its revenues in the last ten years, as demonstrated by the tables below. While that has been a problem, the management has found ways to deliver good corporate results in North America, which contributes 52% of overall sales and 70% of operating profits. North American sales (1.4% in 2015 and 0.1% in 2016) and operating profits (8.8% in 2015 and 6.5% in 2016) have grown in the last two years. Sales in Europe, Asia, Latin America and other regions fell, and that resulted in an overall 2% decline in sales in 2016. Given that the company has close to 50% business from outside of North America, currency fluctuations negatively impacted revenues in 2016.

Another example of great execution is the reduction in the cost of goods sold, which has resulted in significant improvement in gross margin in the last five years (29.5% in 2011 to 36.5% in 2016).

The company has been reducing its shares outstanding on a consistent basis from 446 million in 2007 to 361 million in 2016. This has helped maintain a healthy range ($4 to $6) for earnings-per-share (EPS) in the last decade, except in 2015, when it dipped to $2.77. Kimberly-Clark expects the EPS to grow and stay between $6.2 and $6.35 in 2017.

2016 was a good year for the company, as operating income, net income, operating cash flow and free cash flow increased in a significant way. This was accomplished despite an overall decline of 2% in sales. In 2016, the company had record savings of $435 million from its FORCE (Focused On Reducing Costs Everywhere) program and finished a 2014 reorganization which ended up saving $140 million annualized. Kimberly-Clark also recorded organic growth in North America and developing and emerging markets. Organic sales in developed regions outside of North America remained flat.

Segment Distribution

The company operates in three major segments that are also based on product groupings:

- Personal Care: 50% of revenues, 56% of operating profits. Although the volume increased by 4%, unfavorable currency issues caused a decline in overall sales. Brands include Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Kotex, U by Kotex, Intimus, Depend, Plenitud, Poise and others.

- Consumer Tissue: 33% of revenues and operating profits. Sales remain flat in 2016, but unfavorable currency issues dragged the numbers down. Brands include Kleenex, Scott, Cottonelle, Viva, Andrex, Scottex, Neve and others.

- K-C Professional: 17% of revenues, 18% of operating profits. Although the volume remained flat, unfavorable currency issues produced negative revenue numbers. Cost savings helped increase operating profits by 2.2% in 2016 despite the fall in revenues. Brands include Kleenex, Scott, WypAll, Kimtech and Jackson Safety.

Kimberly-Clark brands are continuously refreshed with new technology and R&D initiatives ($328 million in 2016), which has resulted in numerous patents.

Kimberly-Clark as an Investment

KMB stock has been range-bound for the past four months after a sharp rise in the months of January and February. It looked set to break the previous all-time high of around $137 in mid-2016 but lost steam from March onwards. The stock has been recently testing the $127 price level, and investors should watch out for any breaches. Other important price levels are marked in the figure below.

The company’s price-to-earnings ratio (PE) of 20.5 is lower than some peers like Procter & Gamble (PG ), Colgate-Palmolive (CL ) and Unilever (UL ), which suggests that the current price is not overvalued. It is on par with the industry PE, lower than its own five-year average and marginally lower than that of the S&P 500.

To find out more about if owning Kimberly-Clark is worth it, click here.

Kimberly-Clark happens to be a dividend aristocrat that has grown its dividend payouts for 44 consecutive years. It has a good current yield of more than 3% and the payout ratio is at an unalarming 62%. The free cash flow in 2016 stood at $2.46 billion, which is higher than what it had been in the previous four years. Future dividend expectations can be considered a safe probability given the above factors.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend Increasing Stocks page, and for more than ten consecutive years on our 10-Year Dividend Increasing Stocks page.

The Bottom Line

Kimberly-Clark’s management have a proven track record of producing robust corporate results despite challenges in the market (e.g. currency issues). The company also takes pride in increasing dividend payouts every year and the current valuation of the company is not overly pricey.

Check out our Best Dividend Stocks page by going Premium for free. For the latest dividend news and analysis, subscribe to our free newsletter.

The views expressed in the article are my own and do not represent the views of my clients. Follow me on Twitter @tanmoyroy for more frequent updates.