Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center around the release of second quarter earnings reports. Netflix hit a new high after adding 5.2 million subscribers last quarter. Lockheed Martin also hit a new high, after beating EPS and revenue expectations. Procter & Gamble is in the crosshairs of activist fund Trian Management. Finally, Bank of America stock tumbled last week after beating expectations in all but one of its key financial metrics.

You can view our previous trends article here, which highlighted Bank of America, JPMorgan and Wells Fargo raising their dividends thanks to successful stress test results. Kroger was also a trending topic thanks to its Clicklist technology that is supposed to reduce the threat from online giants like Amazon.

Netflix Hits New High After Passing 100 Million Subscribers

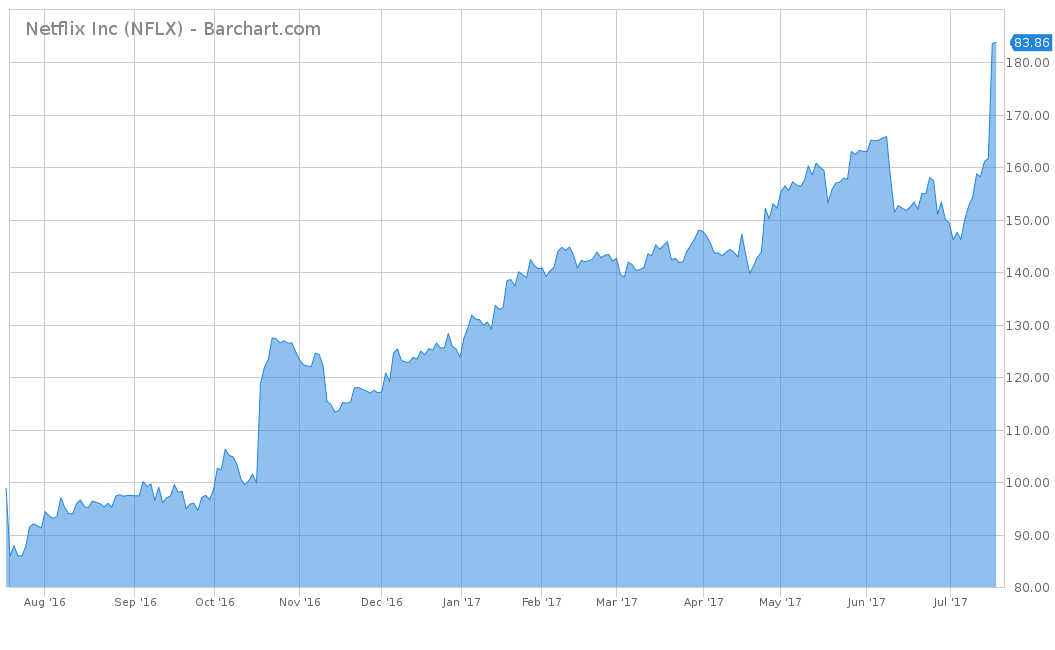

The most popular online streaming network, Netflix Inc. (NFLX), was this week’s top trending topic, up 113%. This week, Netflix released its earnings report for the second quarter of 2017 and surpassed expectations. On Monday, the company announced it added 5.2 million new subscribers over the last quarter, vastly beating its own expectations of 3.2 million. On June 30, Netflix also announced that it surpassed the 100 million subscriber mark and now has around 104 million subscribers worldwide. The company attributes this jump in growth due to the popularity of new shows like The Crown, 13 Reasons Why and Stranger Things. Netflix also has 91 Emmy nominations that were announced last week, which helped to drive new customers to sign up.

Immediately after the news hit, Netflix stock surged and was up over 13% during intraday trading and touched a new all-time high of $187 per share yesterday. Over the last week, the stock has done extremely well and is up over 22%. The stock also remains as one of the best performers overall, as it is up over 48% on a year-to-date basis as well as up close to 110% for the trailing one-year. Like most technology and Internet-based stocks, Netflix does not issue a dividend and is primarily a growth play for investors.

To view a list of the top 100 dividend-paying technology stocks, click here.

Lockheed Martin Rallies After Beating Earnings Expectations

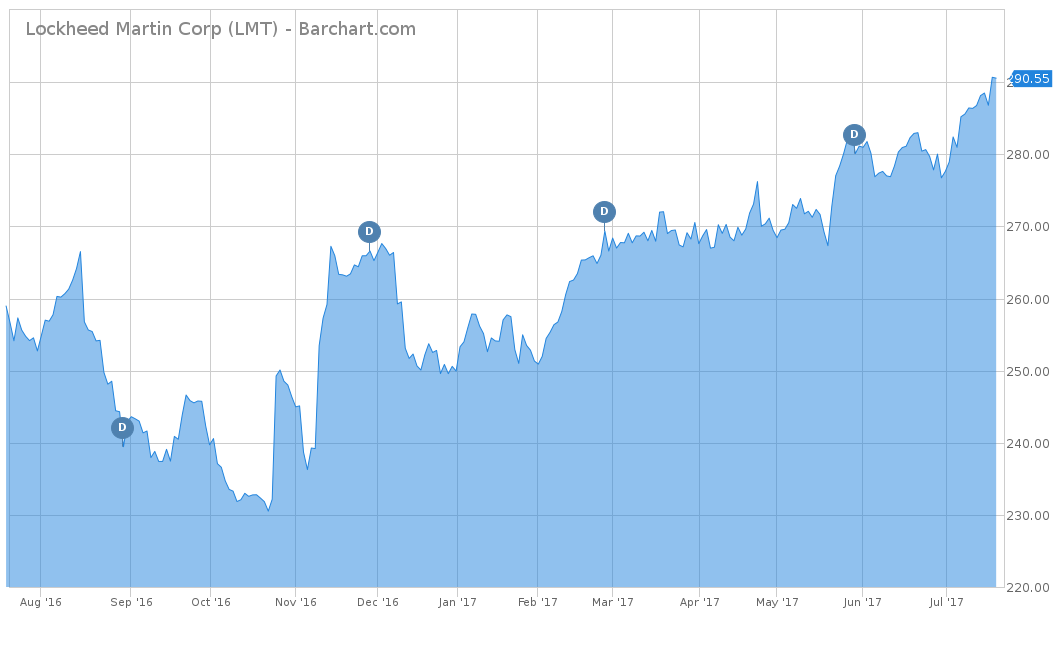

Lockheed Martin Corp. (LMT ) hit new highs this week and is the second-most trending topic after seeing an increase of 29% in viewership. This week, the company had its second quarter earnings beat consensus expectations. Earnings per share reported at $3.23, higher than the expectation amount of $3.11. Revenue also rose $12.69 billion from $11.58 billion, thanks to better than expected beats from rotary and mission systems and space systems. It was also driven by the near 20% increase in sales in its aeronautics unit, which includes its F-35 stealth fighter, the world’s largest defense program.

After the earnings release, LMT soared over 2.3% in premarket trading but over the last week, the stock is up 1.48%. The company has performed well on a year-to-date basis and is up over 15%. Over the trailing one-year, the stock has underperformed the broad market, but is still up over 12% and trading a few dollars off its all-time high of $292.97. The company has also paid a consistent dividend, which pays out an annual amount of $7.28. This equals a yield of 2.51%, a fairly strong dividend, especially with a 57.7% payout ratio. LMT has also been consistent with its dividend, having raised it for 14 consecutive years.

To view other aerospace and defense stocks, click here.

Activist Investor Looks to Claim Board Seat for Procter & Gamble

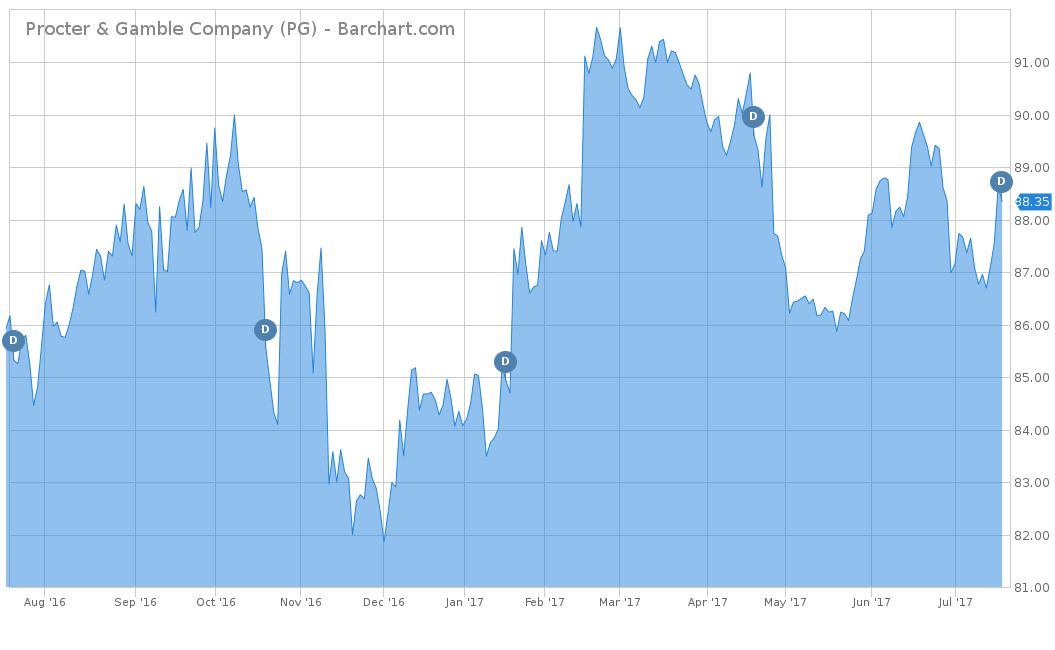

The third most trending topic this week revolves around Procter & Gamble Co. (PG ), which saw an increase in viewership of 22%. The chief executive of Trian Fund Management LP, Nelson Peltz, made some noise this week as the fund has acquired over $3.3 billion of P&G’s stock. Peltz made a bid to investors to vote for him to take a seat on the board of directors to revive sales for the company. Peltz has had a successful track record in reviving companies and is currently on the board of several major corporations like Wendy’s Company (WEN ), Mondelez International (MDLZ ) and Ingersoll Rand PLC (IR ). Trian is launching a proxy fight due to P&G’s underperformance that might also require organizational restructuring.

Over the last week, P&G stock has performed relatively well and is up 1.59%. However, the stock has underperformed when compared to its peers and most major indices. On a year-to-date basis, the stock is up only 5.9%. For the trailing one-year, the stock has also underperformed and produced a return of 4.36%.

As Peltz tries to make his bid for a place on the board so that he can help turn around the company, shareholders can benefit from P&G’s consistent dividend track record. The company has a 60-year history of raising its dividend, which is currently paying out $2.76 per share on an annual basis. The payout ratio is 71.5%, based on a 2017 estimated earnings per share of $3.86. Investors looking for a stock that has potential for upside and pays a current yield of 3.10% should consider Procter & Gamble.

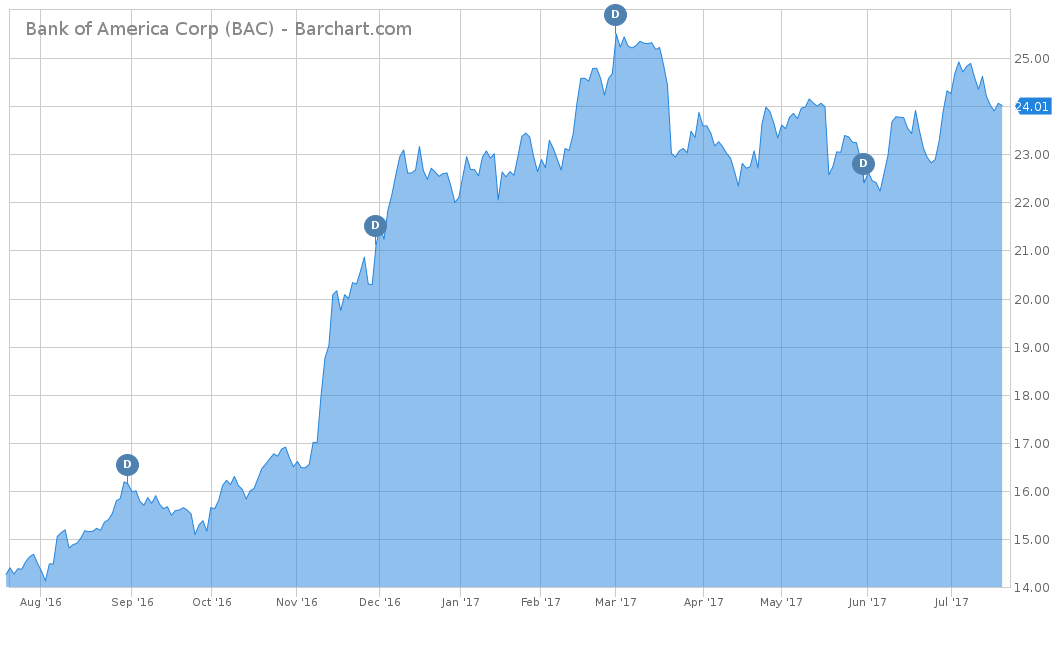

Bank of America Tumbles After Missing Key Metric Goal

After seeing some gains over the last few weeks, Bank of America Co. (BAC ) took a tumble this week and saw an increase in viewership of 17%. Earlier in the month, the banking sector rallied after all 34 major banks passed the Fed’s annual stress tests. However, two days ago, Bank of America announced that earnings per share came in at $0.46, beating the expectation of $0.43 per share. The company also beat expectations on many other metrics like revenues, fixed income trading and net charge-offs. However, the cause of the stock’s decline is due to a marginal decline in the net interest income to $11.2 billion from $11.3 billion in the previous quarter. On top of that, this was an unexpected event as the other banks showed substantial improvement in this metric during the same time period.

For the last five days, the stock fell by 3.87%. However, like the rest of the financial sector, BAC had performed very well on a year-to-date basis, having risen over 8.5%. Even on a trailing year basis, the stock is up over 65%.

Bank of America also pays a dividend of $0.30 per share, yielding 1.25%. Thanks to the Fed passing BAC during the stress test, the bank was approved to raise its dividend by 60% next quarter, enabling the bank to raise dividends for three consecutive years. Investors looking for a bank stock that might be a recent buying opportunity should consider Bank of America.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

Most of this article was based around the release of second quarter earnings reports. Netflix continues to remain the most dominant force in the streaming world after it surpassed the 100 million subscriber mark. Thanks to its successful aeronautics unit landing the F-35 deal, Lockheed Martin’s stock soared as the company beat expectations. Activist Nelson Peltz made a bid to P&G shareholders for a seat on the board so that he can turn the company around. Finally, Bank of America tumbles over 3% this week after reporting a marginal drop in its quarterly net interest income.

For more Dividend.com news and analysis, subscribe to our free newsletter.