Over the last few years, we have seen a steady consumer mindset shift away from fast food and an increase in health awareness. What does that mean for the world’s largest restaurant chain?

Is there value to invest in McDonald’s (MCD ) over the long term?

‘Fast Food’ Perception Shift and McDonald’s

Fast food and fast-casual restaurants form a category that is called Quick Service Restaurants (QSR). Hamburger-oriented restaurants have the maximum market share among them, and that is where McDonald’s sits.

In the last few years, fast food restaurants have lost ground to what has come to be known as ‘fast-casual’ restaurants. Until recently, the Chipotles of the world have been winning, and the McDonald’s of the world have been losing. Given that fast food has a perception of serving unhealthy food (along with severe and unhygienic working conditions), companies have gradually started to rebrand themselves. Part of the experience shift is providing consumers with some healthy options on the menu as well as focusing on fresh ingredients. You didn’t think the sudden surge in all the McDonald’s advertisements about ‘real eggs’ and ‘know your meat’ are just a coincidence?

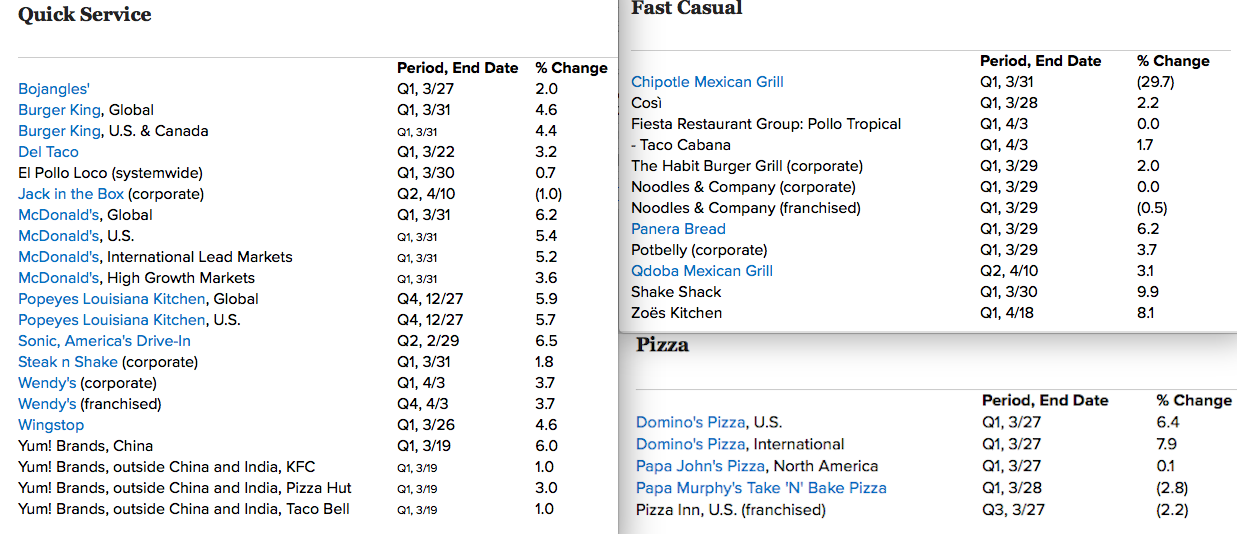

While the ‘old school’ fast food experience might be on the decline, there is certainly a renewed interest in the QSR category. The same store sales change figures, as shown below, tell a story that will surprise many. While they don’t reflect any long-term shift toward QSRs, saying that ‘fast food is dead’ simply ignores the recent nuanced shifts in consumer perception.

With increased awareness comes greater responsibility and hyper-connected Millennials don’t forget that easily. Chipotle (CMG) knows that very well as it just can’t seem to shake its E. coli issue.

On a separate note, technology will increasingly play a vital role in providing companies with the ability to differentiate. McDonald’s in recent years has doubled down on technology, and that seems to show results and will continue to grow in impact going into 2018. As per Cowen, McDonald’s is scheduled to upgrade 2,500 restaurants for a ‘futuristic experience’ by the end of 2017, and same-store sales estimates have been raised from 2% to 3%.

It is quite evident that the company is moving away from the cheap, one-size-fits-all food experience. The colors inside the restaurant are now more sophisticated, and they serve signature sandwiches with grilled chicken burgers that can be customized, premium coffee, all-day breakfast, vegan salads, apple pies and yogurt parfaits. The company now buys more apples than any other restaurant in the U.S. How’s that for a company that built its business on cheap burgers and fries?

Another area of change for the firm (as has been the case for some U.S. companies like Walmart (WMT )) has been a focus on its employees, such as increasing the minimum pay and other benefits. Right now, things seem to be going in the right direction.

The Fast Food Business

In the last decade, it is easy to spot that McDonald’s revenue reached its peak in 2013. After a couple of years of being in the woods, the company started to show positive signs in 2016. Cost of goods sold (COGS) came down to 58.5% after staying above 61% for the previous three years. As a result, operating margin went up to 31.4% from 28.9% in 2014. As part of the strategy, the company has also been gradually converting to a franchise-run business from an ‘owned stores’ model. Margins are expected to cross 40% when the company reaches its target of converting 95% of its stores to franchises. From 8,000 company-owned and 23,000 franchises in 2006, the company has reached 5,700 company-owned and 31,000 franchises in 2016.

McDonald’s has also been consistently buying back shares and has helped steady the earnings per share (EPS) numbers. In 2014, the EPS dipped 13% after three consecutive years of growth. Hard work and innovation helped steady EPS in 2015, and eventually, it grew back 13% last year. McDonald’s will look to build on the momentum it has gained recently. ‘Guilt’ food vs. health food is not a zero sum game. Coca Cola (KO ) is an example of another iconic company that has zeroed in on its core strengths instead of moving away from sugary drinks.

Check out what investors are currently most interested in by visiting our Most Watched Stocks Page.

MCD as an Investment

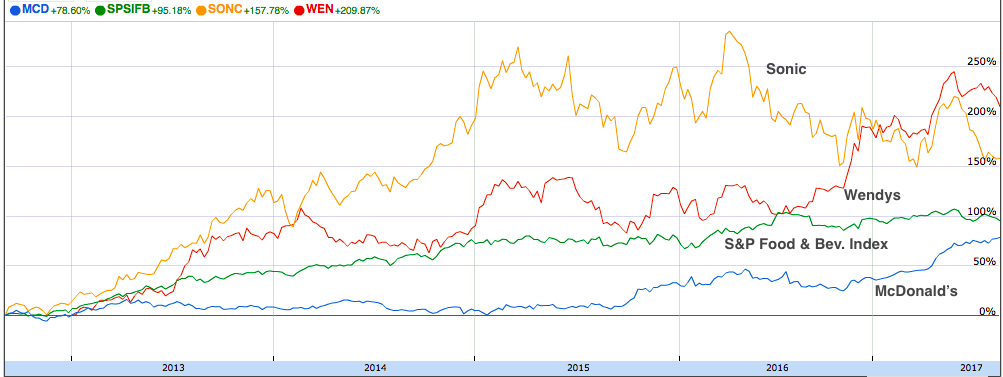

McDonald’s stock is at an all-time high, which is usually a cause of concern for buyers (and for good reason). The current P/E is lower than Wendy’s (WEN ) and Taco Bell – owned by Yum Brands (YUM ) – but greater than Sonic Corp. (SONC) and Jack in the Box Inc. (JACK ). That too doesn’t sound any less ominous. However, to put things in context, one needs to take into account a couple of things. First, MCD is several times bigger than any of the companies discussed above (e.g., 31x bigger in market cap and 36x bigger in net income compared to Wendy’s). So, while they serve burgers, the scale of operations and factors affecting the businesses are entirely different. Second, even though MCD stock is at an all-time high, it still has lagged behind the likes of Wendy’s, Jack in the Box, Sonic and even the S&P Food & Beverage Select Industry Index over the last three to four years.

McDonald’s is also an excellent dividend payer and has grown its payouts consecutively for 40 years. Current yield stands at almost 2.4%, and the payout ratio is a comfortable 58%. Free cash flow per share has been rising steadily from 3.84 in 2012 to 5.52 in 2016. The company seems to be in a good position to grow its dividends for years to come.

McDonald’s is a Dividend Aristocrat. Find all the companies that have increased their dividends for more than 25 consecutive years, in our 25-Year Dividend Increasing Stocks page.

The Bottom Line

McDonald’s is a solid company with an unmatched scale of operations that gives the company a strategic advantage over peers. The recent steps taken by the firm have put the momentum back into their business. CEO Steve Easterbrook has been frank about the past poor performance and has promised to turn the company into a “modern and progressive burger company.” The bull run has raised the stock to all-time highs, but investors can expect good returns as same-store sales are projected to go up further in coming years.

Start your free trial to Dividend.com Premium account here.

Follow me on Twitter @tanmoyroy for more frequent updates.