Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center on the effects of both Hurricane Harvey and Irma. Lumber prices soared, while demand to rebuild using wood and timber has increased thanks to the destruction caused by the hurricanes. Property and casualty insurance companies were also trending, as an estimated $85 billion in claims could possibly be paid out. AT&T Inc. announced that some of its customers will receive HBO for free and get a promotion for the new iPhones. Finally, after months of speculation, Apple announced the release of its iPhone 8, iPhone 8 Plus and iPhone X.

You can view our previous trends article here, which centered on the mass destruction of Hurricane Harvey that left many parts of Texas and Louisiana heavily damaged. Exxon Mobil was one of many oil companies that had to shut down its refineries in Texas. Weyerhaeuser and other lumber companies saw movement due to the U.S. delaying Canadian lumber duties. Royal Bank of Canada beat earnings and raised its dividend again this year. Finally, Hurricane Harvey hit the headquarters and several investments of Main Street Capital Corporation.

Back-to-Back Hurricanes Cause Lumber Prices to Rise

After last week’s destruction of Texas due to Hurricane Harvey, Florida saw major damage thanks to the effects of Hurricane Irma tearing through the state. With millions of houses damaged by the aftermath of the hurricanes, lumber demand has seen a major spike and is, thus, this week’s top trending topic, up 148%. Over the last month, lumber futures prices have jumped 7.69% as demand for lumber significantly increases every time there is a natural disaster. The lumber industry in total has also gained over 6.6% for the last month, as evidenced by the iShares Global Timber & Forestry ETF (WOOD ).

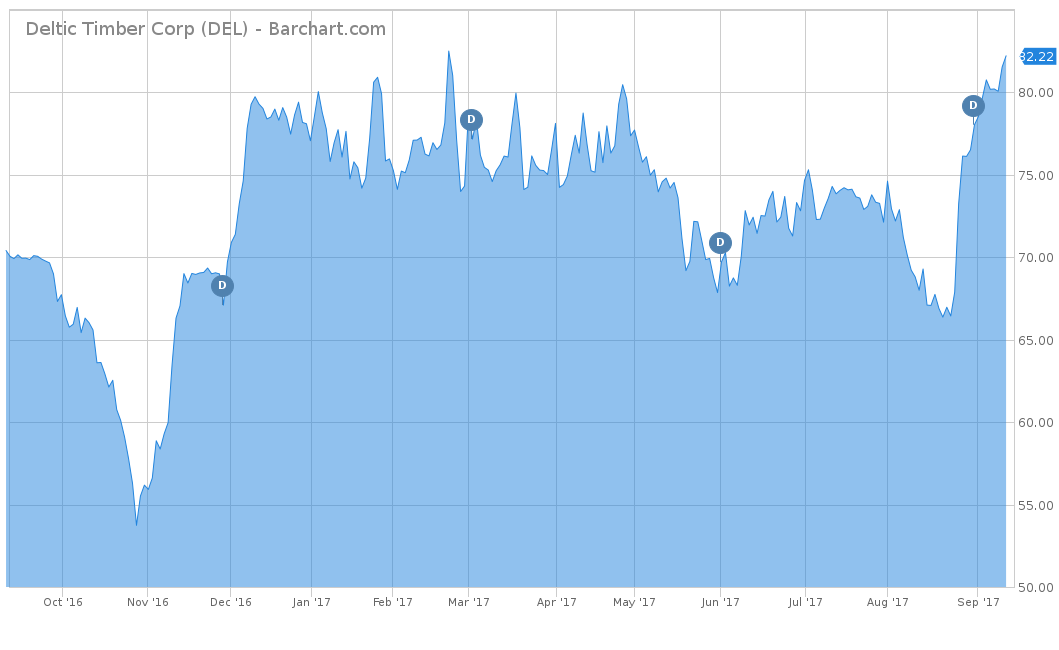

One of the top lumber and timber-producing companies that has seen large gains is Deltic Timber (DEL). The stock has jumped 4.89% in the last week alone and is up over 21% for the trailing one month. Overall, the stock has been pretty volatile on a year-to-date basis and is up only 6.89%, but it has undoubtedly benefited in recent price appreciation from the hurricanes. Deltic Timber pays one of the smaller dividends in the lumber industry, currently yielding 0.49%. However, with its potential to benefit with the sudden increase in demand for lumber, the stock should continue to do well.

To see the list of other lumber-related companies that pay a dividend, click here.

Property & Casualty Insurance Expects Big Claims

Continuing on the trend of the damage caused by Hurricane Harvey and Irma, property and casualty insurance companies was the second-most trending topic this week, up 85%. Recent estimates from Hurricane Irma’s damage expect the insurance industry to see up to $65 billion in projected damages in the Florida and Georgia areas. This is on top of the already estimated $20 billion that is expected to be caused from Hurricane Harvey in the Texas Gulf Coast area. However, the insurance company industry has not yet seen the negative effects of the large amount of claims it will have to pay. The Invesco PowerShares KBW Property & Casualty Insurance Portfolio (KBWP ) is actually up over 4.3% for the last week.

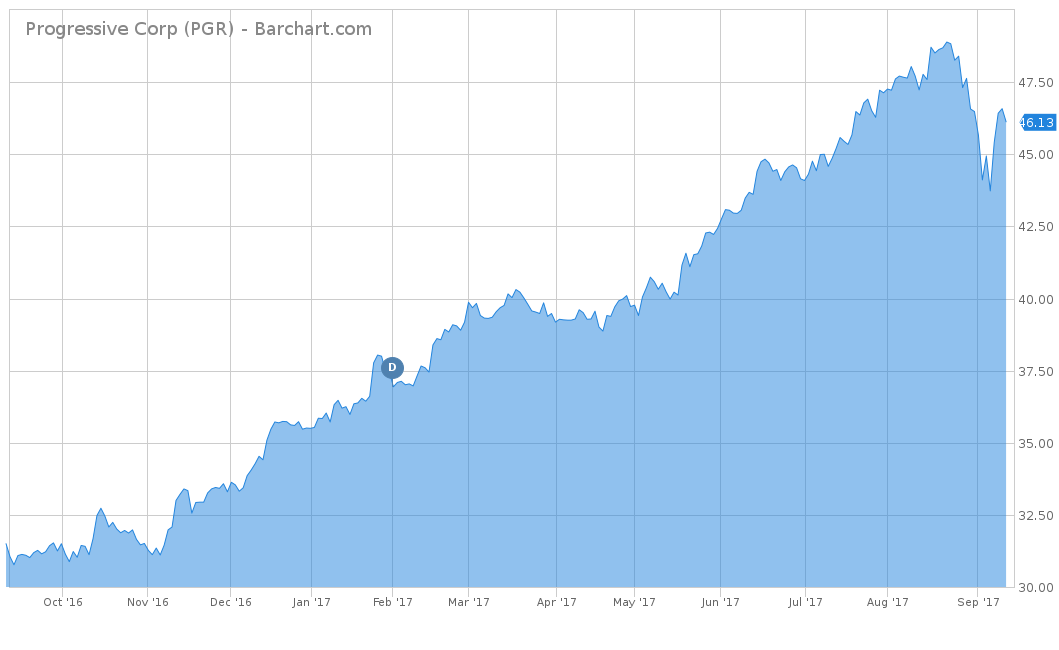

One of the largest property and casualty insurance providers is Progressive Corporation (PGR ). Like KBWP, this stock is also up in the last week, gaining over 2.6%. However, it has vastly outperformed its peers and is up nearly 30% on a year-to-date basis and up over 47% for the trailing one year. Another added benefit to owning PGR is that the stock has a 1.47% dividend yield, of which it has increased every year since 2014. However, the stock only pays its dividend on an annual basis, every February.

To view the entire list of dividend-paying property and casualty insurance companies, click here.

AT&T Clients Benefit From Upcoming Time Warner Merger

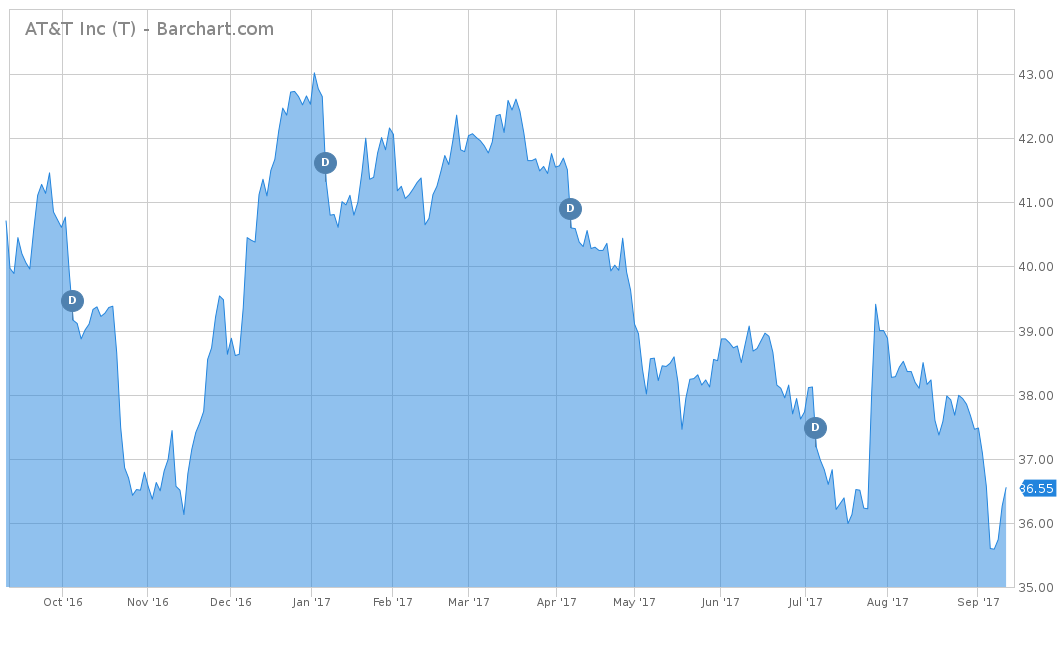

AT&T Inc. (T ) had an increase in viewership of 56%, thanks to a variety of factors affecting the stock this week. AT&T agreed to purchase Time Warner for $85 billion, and the deal is expected to close by end of year. In the meantime, AT&T customers have been seeing several benefits. Unlimited Choice customers who already subscribe to DIRECTTV or U-Verse TV will automatically get HBO as part of their plan. On top of this news, AT&T announced it will be offering a ‘buy one, get one free’ promotion for the new Apple iPhone 8 and 8 Plus. This deal only applies to AT&T’s DIRECTV subscribers and will start this Friday.

Over the last five days, AT&T stock has shown little movement and is slightly down 0.08%. The stock has struggled on a year-to-date basis, down 14.08%, and was down nearly 8% for the trailing one year. However, one of the biggest draws to the company is its high-paying dividend of 5.38%. The company pays out an annual amount of $1.96 per share, on a quarterly basis. One of the most notable features about the stock is that it has raised its dividend for 32 years in a row, making it a consistent payer for investors looking for regular income.

To view other domestic telecom stocks that pay a dividend, click here.

Apple Investors Excited Following New iPhone Releases

The fourth-most trending topic this week revolves around Apple Inc. (AAPL ), up 51%. Apple is the largest company in the world by market capitalization and held its much-anticipated press release on Tuesday. The company announced several new products, such as the iPhone 8, iPhone 8 Plus, iPhone X, the Apple Watch Series 3 and Apple TV 4K. Most of the excitement was centered on the iPhone X, named after the ten-year anniversary of the original Apple iPhone. The phone is expected to drive lots of preorder sales even though it comes with a hefty price of $999. This news of excitement especially impacts Apple’s top direct holders, the Chairman of the Board Arthur Levinson, and CEO Tim Cook. Combined, the two Apple officers have 2 million shares of Apple stock.

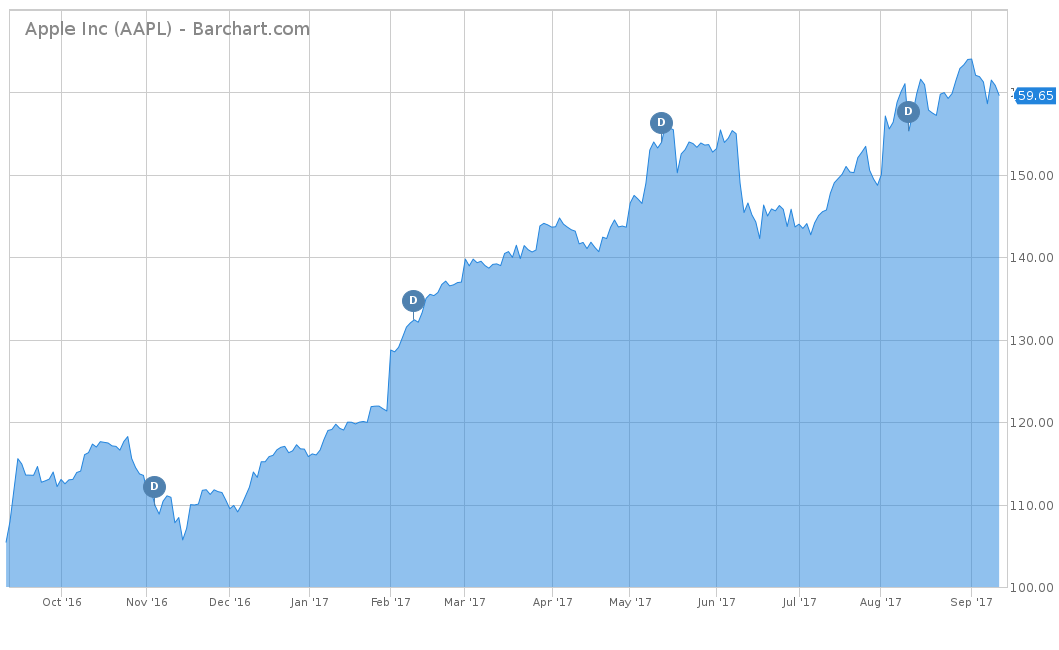

Apple has been one of the best-performing stocks over the long term but over the last week, the stock is down 2.68%. However, this decline is most likely temporary, as the stock is up over 37% on a year-to-date basis and up over 54% for the trailing one year. One advantage the stock has that most technology companies do not is that Apple began paying a dividend in 2013. It has also grown it every year since then and currently pays shareholders an annual payout of $2.52 per share. This 1.58% yield, along with some of the best gains in the stock market, has Apple continuing to be the star of the investing world.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

Most of this article was based around Hurricane Harvey in the Texas area and Hurricane Irma in the Florida and Georgia parts of the country. Lumber and timber continue to see an increase in demand as damaged houses and buildings are repaired. Property and casualty companies like Progressive Corp. are trending with the potential to see all-time highs in claims. AT&T rewards its customers with free HBO service and iPhone promotions. Finally, Apple Inc. held its much-anticipated announcement with the release of several new products.

For more Dividend.com news and analysis, subscribe to our free newsletter.