Merck (MRK ) is one of the largest global healthcare companies in the league, with other top peers like J&J (JNJ ), Pfizer (PFE ) and GSK (GSK ).

The company has had a top-line problem in the last few years, and this article will explore if the company is well placed for a turnaround.

The Numbers Story

Merck has a top-line problem. It makes 18% less revenue from what it used to six years back. Its earnings-per-share has been patchy as well – on a downtrend for the last three years – despite reducing the number of shares outstanding by 10% over the last seven years.

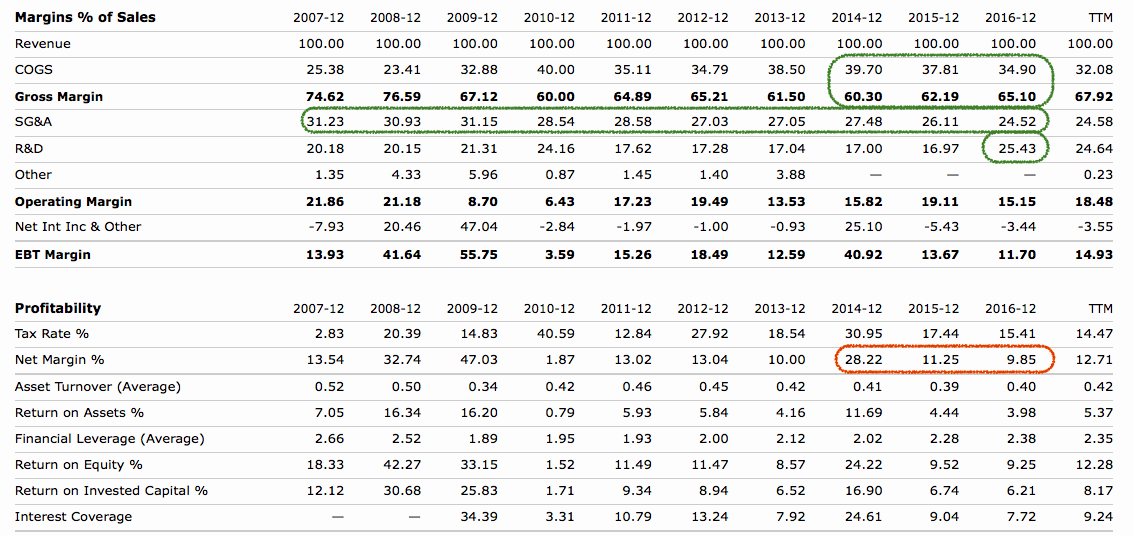

While top line has been a problem, there are some encouraging signs. The company has been able to pull the Cost of Goods Sold (COGS) down for two years in a row (from 39.7% in 2014 to 34.9%) and looks good to continue the trend in 2017 (32% for the trailing twelve months). There has also been a gradual reduction of SG&A costs, from 31% a decade ago to 27% five years ago to 24.5% in 2016. Merck has spent more money on R&D (25% of sales) in 2016 than it has in over a decade.

Growth Areas

The revenue problem Merck is facing is largely because a number of its products saw a small decline in sales. While that is a problem, there are some winners that have started to make a positive impact.

The products that have seen substantial changes in sales over a period of six months compared to the same time in the previous year (recent Q2 results) are highlighted below. Only one product saw a major decline, whereas three products have seen a significant increase in sales. Zepatier (455%, $743 million), Keytruda (160%, $902 million) and Gardasil (30%, $231 million) more than make up for the decline in sales for Zetia (46%, $613 million). If the trend continues, these products will start to bring the top line back to green.

Keytruda is particularly exciting as the company looks to establish the drug as a foundation for cancer treatment. Recently Keytruda received four new indications in the United States and an additional indication in Europe. This will further increase sales in the coming quarters. Oncology is the largest and fastest-growing drug class with significant unmet needs. In July of this year, the company entered into a global strategic oncology collaboration to co-develop and co-commercialize AstraZeneca’s Lynparza for multiple cancer types. This partnership is likely to cement Merck’s leadership position in oncology treatments.

Like many companies in search of top-line growth, Merck has been restructuring its business to cut long-term costs. The company has spent $317 million and reduced its headcount by more than 1,000 in the first six months of 2017.

Merck as an Investment

If you were an investor sitting on Merck stock, you would have made about 46% in the last five years. For reference, that return would be lower than J&J or the S&P 500, but it would be on par with some related companies like Pfizer, Novartis (NVS ), Roche Holding but higher than GSK. The company doesn’t grow its dividends every year, but it currently stands at a very capable 2.86% yield. The company also has a rich history of paying dividends for almost three decades since the late 80s. The payout ratio is under 50%, and the free cash flow stands at more than $8 billion. It has been higher – at more than $10 billion – not too long ago, but current levels are not worrisome for dividend investors.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. You can even screen stocks with DARS ratings above a certain threshold. Be sure to visit our complete recommended list of the Best Dividend Stocks.

The Bottom Line

Merck is a big $175 billion company with a history going back more than 100 years. While its overall top line has been an issue in the past, some products have picked up momentum in the last few quarters. Oncology treatments will be the next big thing in pharmaceuticals and Merck is in an excellent position to leverage its current leadership position.

The stock is not valued cheaply (i.e. P/E currently higher than than those of Pfizer, J&J, GSK and Novartis), but 2017 results are likely to move the stock higher from current levels, in addition to a nearly 3% dividend yield.

Start your free trial to a Dividend.com Premium account here.