Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center on REIT dividends, a cereal war and traveling to Mars. Uniti Group’s stock price fell after potential covenant violation from Windstream Holdings. General Mills is struggling after missing both revenues and earnings last week, and is being sued by Post Holdings for patent infringement. New Residential Investment Corp. continues to yield well over 11%, thanks to strong third-quarter earnings. Finally, Lockheed Martin and SpaceX are planning a joint announcement about their plans to make human travel to Mars a major possibility.

You can view our previous trends article here, which centered on the effects of Hurricanes Harvey and Irma, and Apple’s release of iPhone 8, iPhone 8 Plus and iPhone X.

Uniti Group Impacted After Potential Windstream Default

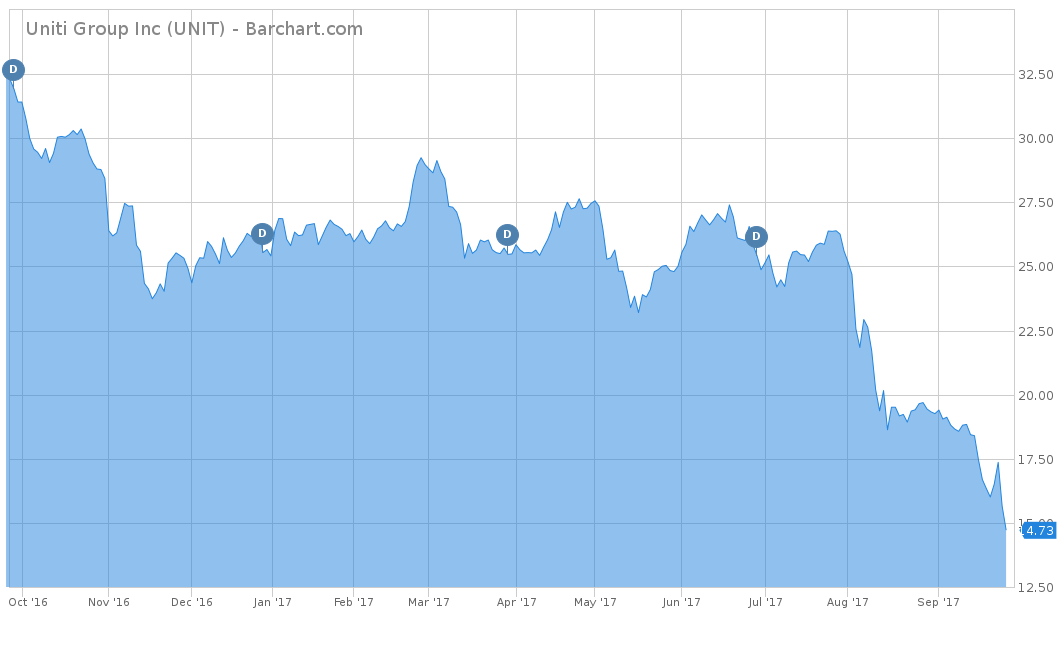

Uniti Group Inc. (UNIT) was this week’s top trending topic with an increase in viewership by 226%. Uniti Group is a real estate investment trust (REIT) focused on the acquisition and construction of fiber, wireless towers and ground leases. It was originally a spun-off entity from the once thriving Windstream Holdings Inc. (WIN) and existed under the name of Communications Sales & Leasing Inc. This week, Windstream announced that a bondholder of the 6.375% notes maturing in 2023 submitted a written claim that WIN is in default and that the spinoff of the CSAL/Uniti Group violated terms of the note. In this claim, the anonymous bondholder stated that the spinoff violated a covenant of the Sale and Leaseback transaction. In response, Windstream has adamantly denied the claims that the company is in default.

Since the news hit, both UNIT and WIN stocks have taken a dive. Uniti Group was clearly more affected by the accusation, with the stock tanking over 22% in the last five trading days. Windstream also has suffered from the news but is only down over 6% for the same time period. Both stocks have also been on a downtrend on a year-to-date basis, with Uniti down over 43% and WIN down over 76%. The “nail in the coffin” for Windstream was when the company eliminated its dividend in early August, causing the stock to drop over 51% since then. One of the biggest concerns with the Uniti Group is maintaining its very high dividend yield of 16.67%. Investors are extremely worried that with this recent news, plus S&P cutting its credit rating from B+ to B, could cause management to cut its dividend. Doing this would undoubtedly cause its remaining investors to abandon ship and drive the stock price to its lowest levels.

To view a list of the top REIT stocks, click here.

General Mills Falls Due to Missed Earnings and Lawsuit

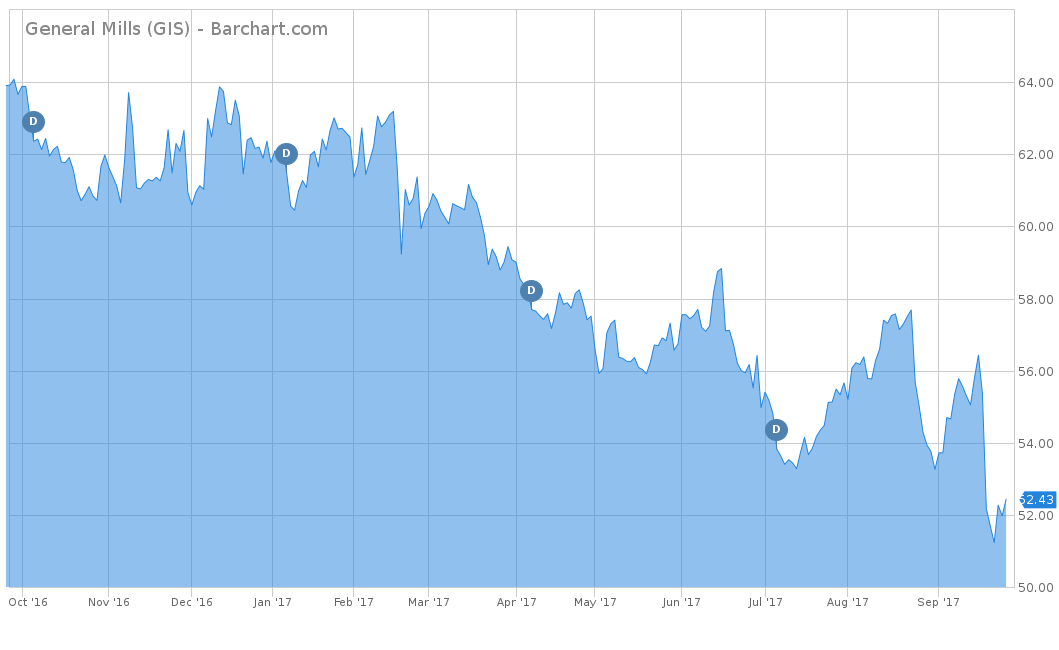

One of the most popular consumer food brands in the world, General Mills Inc. (GIS ), was the second-most trending topic this week, up 119%. General Mills started out the week with an earnings miss of $0.05 below consensus estimates to report $0.71 per share. Revenues also fell short of expectations and came in at $3.77 billion versus $3.79 billion. Then on Tuesday, General Mills’ largest rival, Post Holdings Inc., filed a lawsuit for patent infringement of its bagged cereal displays. POST claims that GIS is trying to piggyback off the design success of its vertical plastic dividers that were launched early last year. General Mills started using a very similar display pattern later that year in what Post believes is not a coincidence.

Over the last week, General Mills’ stock price has declined 6.29%. On a year-to-date basis, the stock has also underperformed both the market and its peers, down over 15% and currently trading just above its 52-week low of $50.40. However, investors who are holding onto the stock get the benefit of a fairly high dividend yield of 3.75%. The company pays an annual amount of $1.96 per share with a payout ratio of 63%. More importantly, management knows the company’s stock price is closely tied to its dividend, as it has raised it consecutively every year since 2004. If General Mills can get through the lawsuit and finish out the rest of 2017 with positive earnings, the stock should bounce back from its current trading level.

For the Best Processed & Packaged Goods Dividend Stocks, click here.

NRZ Flourishes With High Dividend Yield

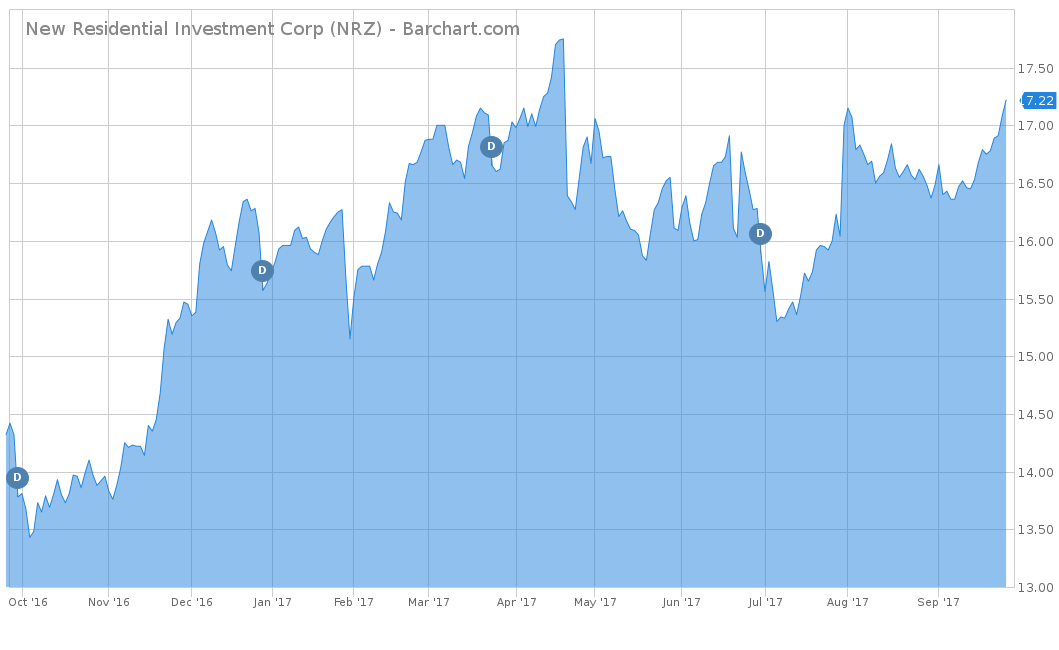

New Residential Investment Corp. Liquid error: internal, a real estate investment trust (REIT) that primarily focuses on mortgage servicing and opportunistic investments, was the third-most trending topic with an increase of 44%. The stock continues to be on the rise due to its dividend yield of 11.61%. The company has raised its dividend already twice this year, from $0.46 per share to $0.50 per share. This company has seen success over the last five years with a total EPS growth of over 227% and a year-over-year growth rate of over 59%. This is important to note if revenues and earnings continue to increase, another potential dividend increase could be in store for the fourth quarter.

Over the last week, the stock has appreciated 4.51% with management announcing it will keep its third-quarter dividend at the $0.50 per share level. On a year-to-date basis, the stock is up 9.89%, which is great for investors who are also collecting the annualized payout of $2.00 per share. The company has a fairly high payout ratio of 76%, but this is typical of companies in a REIT structure where all income is passed to its shareholders in the form of a dividend. If NRZ continues to profit and increase its revenues, expect the stock price to see positive gains through the next year.

To view other residential REITS that pay a dividend, click here.

Lockheed Martin and SpaceX Announce Mars Travel

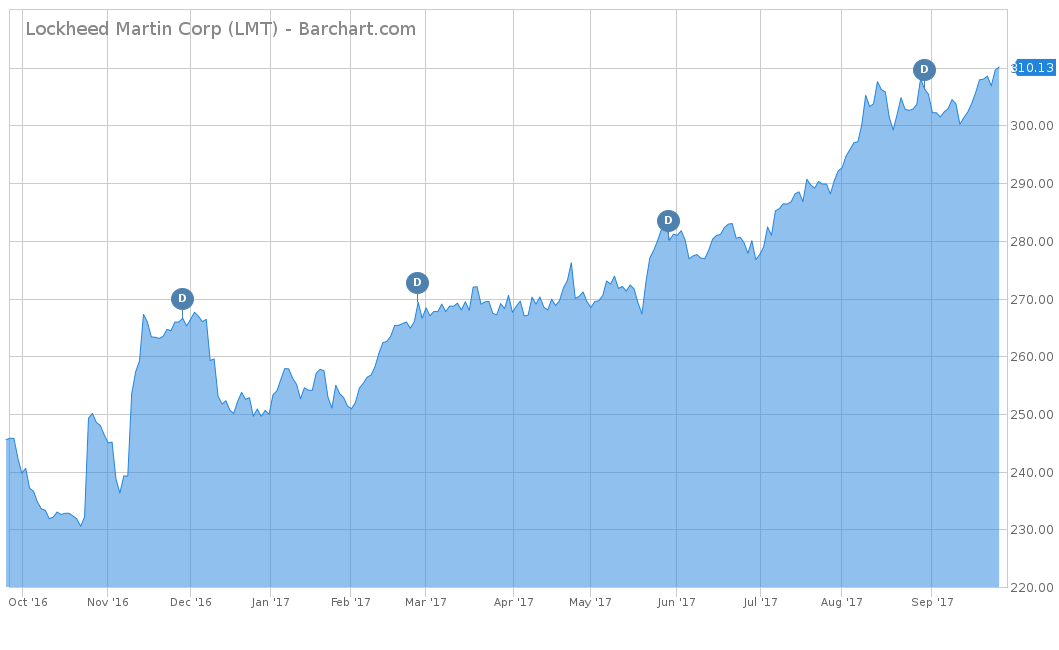

The fourth-most trending topic this week revolves around Lockheed Martin Corp. (LMT ), which is up 41%. The company plans to make a major announcement with Elon Musk’s SpaceX program about their joint efforts in getting people to Mars. The companies will make the announcement at the 68th International Astronautical Congress in Adelaide, Australia. This comes after news that Lockheed Martin revealed a new, fully reusable, crewed Martian lander earlier today at the same conference. Lockheed anticipates it will send humans to Mars in a mission that will last three years, with travel time taking up to six to nine months one way. Lockheed Martin also announced its Mars Base Camp project, which is part of NASA’s Deep Space Gateway mission that will begin in the early 2020s.

Over the last five days, LMT has seen a slight uptick of 2.13% with investors anxious to hear the announcements on Thursday, September 28. From a year-to-date perspective, LMT is thriving and is up over 23.5% thanks to several new government contracts it has gained throughout the year. Long-term investors have been rewarded the most, with LMT increasing dividends over 200% over the trailing five years. LMT also has a consistent dividend yield of 2.59%, which has been raised every year since 2003. As Lockheed Martin begins its new course toward Mars, expect its stock price to continue to skyrocket.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

The biggest story of the week has been centered on the falling stock price of Uniti Group, thanks to accusations from a WIN bondholder that the spinoff violated a covenant. General Mills is under fire after its bagged cereal displays look too similar to its biggest rival Post Holdings. New Residential Investment Corp. continues to grow thanks to a consistent dividend of over 11%. Finally, Lockheed Martin announces major plans for its Mars Base Camp project.

For more Dividend.com news and analysis, subscribe to our free newsletter.