Procter & Gamble Company (PG ) is one of the oldest and most recognizable consumer goods companies in the world, originally founded in Cincinnati, Ohio in 1837. P&G markets its products on a global scale through various channels including mass merchandisers, grocery stores, membership club stores, drug stores and department stores.

It’s most recognizable brand names include Gillette, Bounty, Charmin, Crest, Febreze, Olay, Oral-B, Pampers, Pantene, Tide, Vicks and many more. With its fiscal 2017 year ending on July 27, 2017, P&G had revenues of over $65 billion and 65 total brands under its umbrella.

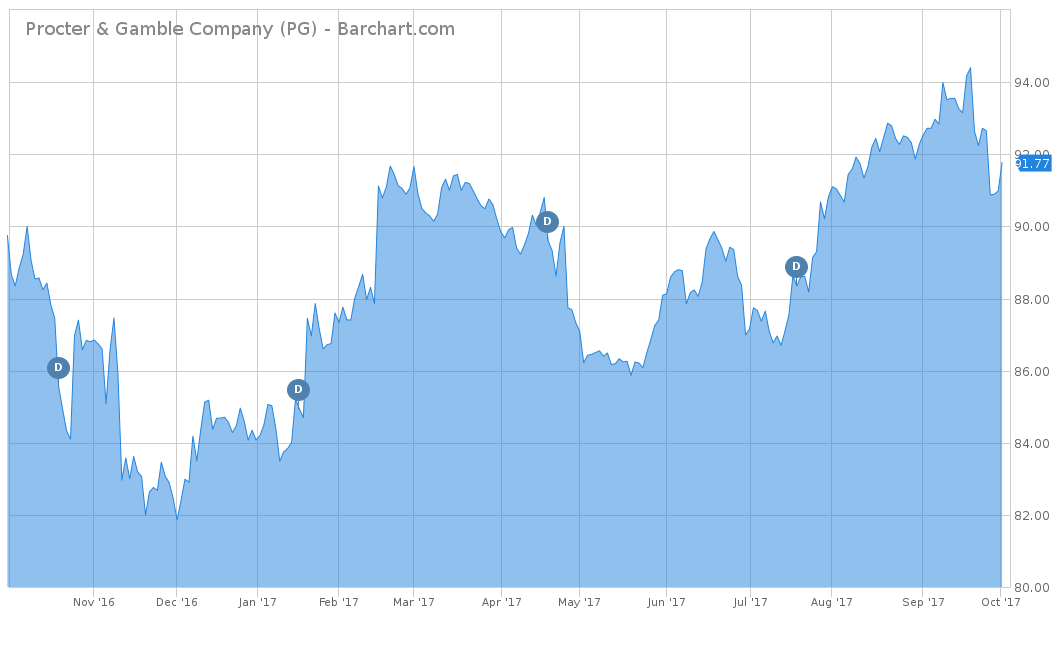

Procter & Gamble has always been considered a blue-chip staple of an investment portfolio, thanks to its stable balance sheet and consistent dividend. On a year-to-date basis, P&G has modestly underperformed and is up 9.15% versus the S&P 500’s 13.2%. However, over the trailing one-year and five-year, P&G has vastly underperformed the major indices. During those time periods, P&G was up only 3.5% for the trailing one-year and 32.3% for the trailing five-year. The S&P 500 was up 16.8% and 75.9% for the same time periods, respectively.

Procter & Gamble is a member of the Dow Jones Industrial Average. Click here for a complete list of the Dow 30 dividend stocks.

Fundamentals

According to the company’s Fiscal 2017 Highlights, the goal of P&G is to provide a focused strategy to deliver balanced growth and value creation. However, on a revenue perspective, P&G has been on a declining path since 2013. Over the last five years, P&G saw an average decline of 4.9% in revenues. With over $84 billion in 2013, P&G just closed out its 2017 year with just over $65 billion, which is $19 billion less than five years ago.

However, since the new CEO David Taylor has taken the company over in 2015, the company seems to be on the rebound. One of the major moves that Taylor has taken is to reduce the total number of brands. In 2013, the company had 16 product categories and 170 brands. As of 2017, the company has 10 product categories and only 65 brands. Management believes that trimming down the total brands will allow the company to be more nimble in the ever-changing consumer marketplace.

This trimmed down version of P&G has shown a direct impact on the company’s earnings. In the last quarter of their fiscal 2017, P&G had beaten expectations on both revenue earnings and on an earnings per share basis. P&G reported $16.08 billion versus $16.02 billion consensus on revenues as well as $0.85 per share EPS versus $0.78 per share consensus. Unlike revenues, P&G has performed moderately well on an earnings per share basis with a five-year average of 3.8%. The real improvement has been in its 2016 EPS measure of $3.69 and now 2017 EPS measure of $5.59, which have grown by more than 50% in each of those years. Analysts remain pessimistic about the company’s ability to sustain the last two years of EPS growth. The consensus has 2018 EPS at $4.17 per share, which would be a dropoff of over 25% from 2017’s EPS of $5.80. This is most likely attributed to P&G’s revenues that continue to remain stagnant and that management has already done all it can to squeeze out any inefficiency in its operations.

According to Morningstar, with a price over earnings (P/E) multiple of 25.1, Procter & Gamble is aligned with the S&P 500’s current P/E of 25.27. This is slightly higher than the company’s five-year average of 22.1 and is also higher than the P/E of the consumer staples sector of 23.41.

Strengths

The biggest strength for P&G has always been its strong brand recognition that translates into consumer loyalty. P&G is the clear leader in household and personal care products, as it has more than a 25% share of the baby care market, 65% of shaving blades and razors, over 25% of feminine products and over 25% of fabric care. This strong brand loyalty allows P&G to spend over $2 billion annually on research and development and promote new products to its already existing customer base.

Another major strength of P&G is that it continually returns value to its shareholders. Over the past 10 years, P&G has returned $120 billion of capital to shareholders in the form of dividends and share repurchases. In 2017, P&G returned nearly $22 billion to shareholders and plans on targeting up to $70 billion in capital returns through fiscal 2019.

Growth Catalyst

The current growth catalyst for P&G is the company’s ability to reignite its top line growth due to management trimming its total brands from over 140 to 65. Although this seems like it would reduce total revenues, most of the brands that were kept intact actually made up the majority of total revenues, as more than 20 brands together generate upward of $10 billion in revenues.

The CEO has also been working on a $10 billion cost-saving initiative that will dramatically reduce headcount and overhead, while improving manufacturing efficiency. This should drive sustainable and profitable growth in the near term.

Dividend Analysis

As mentioned previously, one of P&G’s strengths is that the company regularly returns value to shareholders in the form of both share repurchases and dividends. The company has one of the longest track records of dividend growth, starting back in 1957 for 60 years in a row. The dividend currently has an annualized payout of $2.76 per share, which is equal to a current yield of 2.98%.

With P&G making dividend hikes a regular part of its history, expect management to continue raising it in the years to come.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Potential Risks

Earlier this year, activist investor Nelson Peltz has been targeting to become a board member of P&G. Since then, Peltz has acquired nearly 1% of shares outstanding, which is equal to over $3 billion of the company’s stock. Peltz runs a $12.7 billion hedge fund called Trian Partners that believes the current management and culture of P&G is in much need of a change. Peltz claims that he can improve performance by increasing sales and profits by regaining lost market share.

However, P&G management has recently announced that it feels that it is not the right time for Nelson Peltz to gain a seat on the board and that it would undo any of the current management’s plans to improve the company’s bottom line. During the many weeks leading up to the proxy vote, shareholders were bombarded by both sides in one of the most expensive proxy fights in U.S. history. On Tuesday, October 10, P&G had its annual shareholders’ meeting; after tallying its proxy votes, the company announced that Peltz would not be added to the board of directors. However, Peltz claims that the votes were too close to make a final decision and that he will wait for an independent inspector for the certified election results. However, analysts believe that even if Peltz eventually gets the final results that gain him a seat on the board, the closeness of the outcome shows that shareholders also have faith in David Taylor and the board of directors around him.

The Bottom Line

Overall, P&G remains a steady, solid company as it has always been. The company consistently raises its dividend, even if revenues are slipping. As of late, P&G has trimmed down its total brands in what seems to be a smart effort to become more tactical when addressing consumer needs. However, the stock price could be easily influenced if activist Nelson Peltz’s independent election results end up gaining him a seat on P&G’s board.

Check out our Best Dividend Stocks page by going Premium for free.