Realty Income Corporation (O ) owns, manages and leases a diversified portfolio of over 5,000 commercial, manufacturing and distribution properties all across the United States. The company was founded in 1969 and is headquartered in San Diego, California. Realty Income is a familiar name within the investor community as the company is nicknamed the “Monthly Dividend Company.” It is one of the few publicly traded stocks that pays its investors on a monthly basis. Realty Income Corp. is classified as an REIT, or a real estate investment trust.

Since its listing on the NYSE in 1994, the company has had many accomplishments. Realty Income is a member of the S&P 500 and has annual revenues of just over $1 billion as of the end of 2016. The company has increased its total portfolio by almost 8 times to 5,026 in that time span. It has also issued dividend 568 consecutive times, starting from an initial payout of $0.90 per share to today’s $2.54 per share.

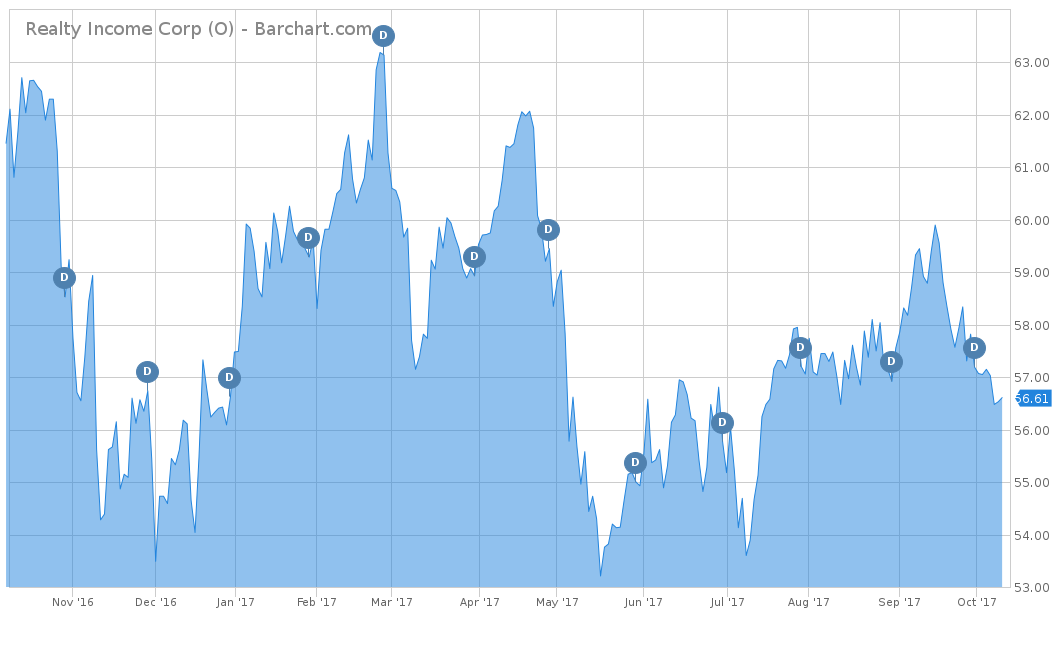

Realty Income has been a consistent performer over the long haul, both with stock price appreciation and its rising dividend. Since its listing during 1994, the stock has given investors a compounded annual return of 16.4% per year. Over the last five years, Realty Income had a total stock price appreciation of 37.27%. When factoring in total returns with reinvested dividends, Realty had a return of 74.31%. On a year-to-date basis, the stock has a price decline of 1.51%, but with reinvested dividends, it is up 3.64%. Compared to the S&P 500 Index, Realty has underperformed. However, when compared to the S&P U.S. REIT Index, Realty has performed significantly better. The REIT Index returned 1.25% on a year-to-date basis and only 31.21% over the last five years.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Realty Income has been able to pay dividend 568 times in a row thanks to a very healthy balance sheet and consistent revenues. Over the last five years, Realty has had a very high average annual revenue increase of 21.8%. In 2012, the company had revenues of $476 million. At the end of 2016, it had nearly two and a half times that, with over $1.103 billion in total revenues. From a revenue perspective, analysts are not too optimistic about Realty’s continuation of the over 20% growth it has sustained in the past. The 2017 consensus estimates revenues to be at $1.21 billion or a 9.7% increase from 2016. For 2018 estimates, analysts believe Realty will produce $1.28 billion, or a 5.7% increase, from their 2017 estimate. These estimates seem to be the trend that Realty has been showing over the last few years, as revenues showed a slight decline from year to year.

From an earnings per share perspective, Realty Income has not performed as well. Over the last five years, EPS growth averaged 4.4%. From 2013 to 2014, EPS went from $1.06 per share to $1.04 per share, a decline of 1.9%. However, Realty has bounced back in both 2015 and 2016 with earnings growth of 4.8% and 3.7%, respectively. Analysts feel that the company can maintain its earnings with a 2017 estimate of $1.19 per share, which would be a 5.3% increase. For 2018, the estimate is $1.24 per share, or a 4.2% increase, from the 2017 estimates.

Strengths

One of the reasons why Realty Income has seen such successful revenue streams is the size and diversification of its tenant portfolio, specifically in its top twenty tenants. These companies include major corporations like Walgreens Boots Alliance Inc. (WBA ), FedEx Corp. (FDX ), Dollar General Corp. (DG ) and Wal-Mart Stores Inc. (WMT ). Realty Income’s top twenty tenants represent 53% of annualized rental revenue but are still diversified because there are over eleven different industries across the United States.

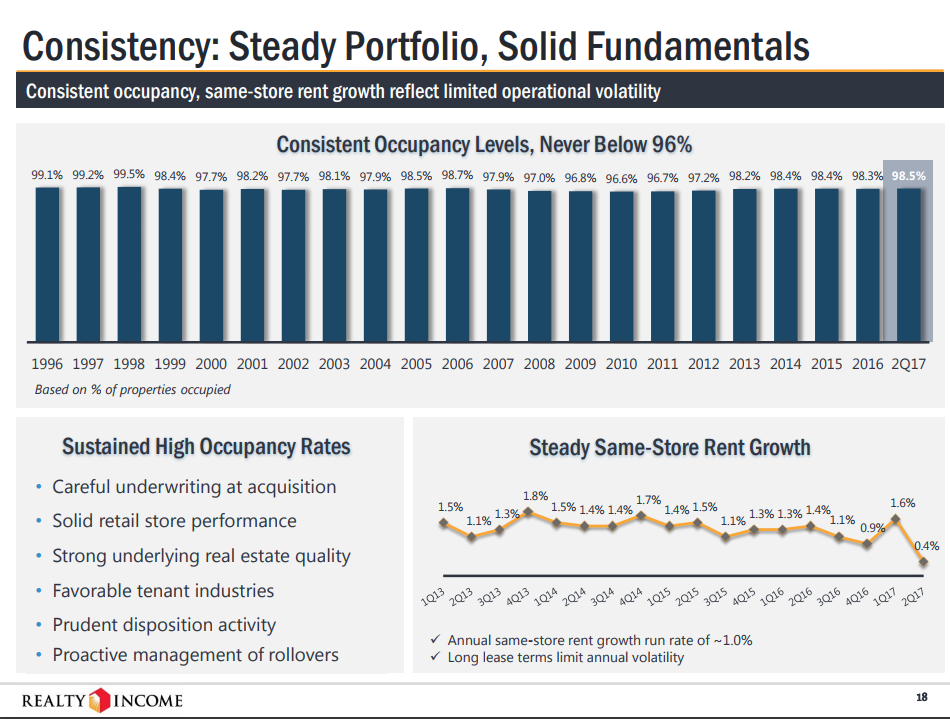

Another major factor about Realty Income is that investors like the company’s ability to remain consistent in an otherwise volatile area of the market. This consistency stems from having a steady portfolio with solid fundamentals. Since 1996, Realty Income’s properties have never had less than a 96% occupancy levels, with current levels at 98.5%. This also attributed to Realty having a 99% recapture rate of expiring rents since 1996. Till now in 2017, the company re-leased 102 properties that were set to expire, with 91 of those re-leased to the same tenant.

Realty Income also knows how to maximize the value of its real estate, which increases return and lowers overall portfolio risk. Since 2010, there has been $544 million of dispositions, with a year-to-date cap rate of 7.9%. This consistency with tenant revenues and leasing allows the company to reward its shareholders with dividend hikes.

To view other retail REITs that pay a dividend, click here.

Growth Catalyst

With a company as consistent as Realty Income, quick growth is hard to come by. The company’s large portfolio would make a single new tenant lease have very little immediate effect on the bottom line. That is why the company’s management focuses on long-term, slow-and-steady growth.

However, one area that could move the needle for Realty Income is if the company decides to expand its non-retail portfolio. Currently, 90% of the total portfolio is made up of retail tenants, which provide non-discretionary or low-price services. This allows Realty Income to be less affected in a down economy. Realty Income is trying to expand more into non-retail clients that are of investment-grade quality, like FedEx, Boeing Co. (BA) and General Electric Co. (GE ). Having more non-retail will allow the company to further diversify its portfolio and provide greater revenues over the long haul.

Dividend Analysis

As mentioned previously, Realty Income is a monthly dividend payer. The company currently pays an annual payout of $2.54 per share, which is equal to a yield of 4.48%. Although this yield is certainly not the highest when compared to other REITs, Realty Income’s dividend is by far the most consistent. The company has raised its dividend every year since 1996.

Check out our list of monthly dividend stocks here.

Unlike REITs with higher yields that tend to cut their dividend during downturns, Realty Income looks to always maintain or raise its dividends during every quarter. The company has a payout ratio of 84.8%, which may seem high for the typical dividend stock. However, REITs are structured to have a high portion of their revenues passed through to their shareholders, so if revenues stay consistent, so should the dividend.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Potential Risks

Obviously anytime the economy turns bearish, real estate investment trusts are impacted. Tenant renewals decline as the consumer is no longer flush with discretionary funds to purchase goods. However, Realty Income has focused 90% of its portfolio on defensive, non-discretionary tenants that should not be as affected in a down economy. But as management looks to grow its non-retail, discretionary tenant occupancy, this area will feel the full effects of a declining economy.

Another risk to Realty Income is the looming threat of a rising interest rate market. REITs and other high-yielding investments have been very popular with income-seeking investors ever since the financial crisis where interest rates were forced to bottom out. Fixed income investors have been replacing their lower yielding bonds with higher yielding stocks. A major risk to Realty Income is when bonds begin to offer similar yields with significantly less risk than a stock. In order to combat this, Realty Income may be forced to raise its dividend faster than it would like, which could eventually pressure the otherwise steady balance sheet.

The Bottom Line

Realty Income has shown a history of consistency with very strong revenue growth, thanks to its excellent portfolio management of its diversified tenant portfolio. A potential growth catalyst could be in the form of bringing in more non-retail tenants. Nevertheless, its management’s primary focus on slow-and-steady growth has enabled the company to issue dividend for the 568th time in a row.

Check out our Best Dividend Stocks page by going Premium for free.