Omega Healthcare Investors Inc. (OHI ) is a real estate investment trust (REIT) primarily involved in healthcare-related income-producing facilities. The company is partnered with over 75 skilled nursing and assisted-living facilities in both the United States and the United Kingdom.

Omega was first listed on the New York Stock Exchange in 1992, and was one of the first publicly traded REITs structured to finance the sale and leaseback, construction and renovation of skilled nursing facilities. In 2015, Omega merged with Aviv REIT, creating the largest publicly traded REIT in the U.S. dedicated to skilled nursing facilities. Omega’s portfolio consists of approximately 85% in senior nursing facilities and 15% in senior housing facilities, totaling approximately $9.3 billion in investments. Additionally, the combined companies have invested over $375 million since 2009 for reinvestment and new construction.

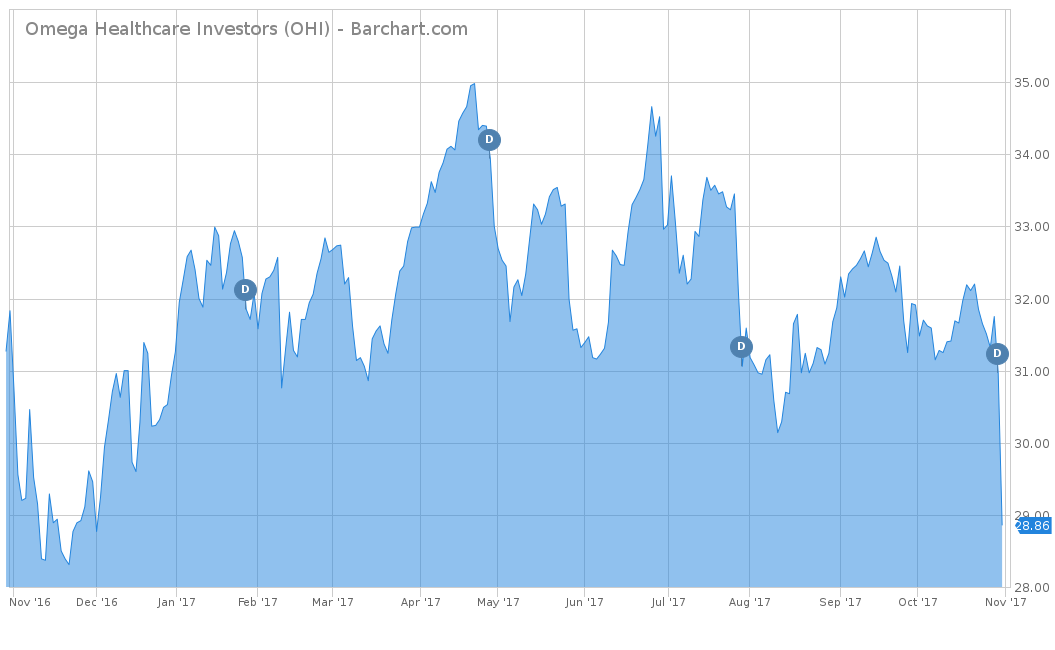

Like most real estate investment trusts, Omega Healthcare’s primary goal to its shareholders is to return most of its profits in the form of dividends. Omega has one of the highest dividend yields in the REIT marketplace, currently north of the 9% range. On a stock return basis, the company is down almost 10%, but so far has paid out four dividends in 2017 totaling $2.54. Over the last five years, the stock’s price is up almost 23% in cumulative price appreciation, without factoring the many dividends it has paid its shareholders over that time. When compared to the SPDR DJ Wilshire REIT ETF (RWR), Omega performs comparably well. On a year-to-date-basis, RWR is down 0.33%, but up almost 28% for the cumulative trailing five-years. However, the current dividend yield for RWR is considerably lower at 3.30%, nearly one-third of Omega’s current dividend yield.

Fundamentals

Over the last five years, Omega has seen a phenomenal revenue growth rate of 25.3% on average over the last five years. As of the end of 2016, Omega surpassed over $900 million in revenues and, according to analyst estimates aggregated by Yahoo, is on track to inch closer to the $1 billion mark in 2018. However, after its third-quarter earnings call this month, revenue came in at $219.6 million, missing expectations by over $18 million. Analysts predict Omega will end the year with a total of just over $947 million, which is only a 5.2% increase and considerably lower than than last year’s increase of 21.1%.

Instead of using earnings-per-share as a measure for fundamental analysis, REITs typically rely on funds from operations (FFO) as the main data point. In 2016, Omega had a FFO of $3.35 and management had 2017 year-end guidance in the range of $3.42-3.44. However, during this week’s earnings call, management has stated that third-quarter FFO reported at $0.79, missing by $0.06. This caused management to lower its year-end guidance from the $3.42-3.44 range to the $3.27-3.28 range. This adjusted expectation caused investors to panic, making the stock drop 6.81% the day after the call. Moving forward, analysts still expect 2018’s FFO to be in the $3.44 range, but will most likely be revised after the last FFO miss.

Strengths

Although the company has recently seen a revenue and FFO miss in its last quarterly call, over the longer term, the company’s financials were pretty consistent. The company has provided shareholders an excellent total return of 246.9% over the last ten years, as of year-end 2016. This equals a 13.2% average per year on an annual basis, which far exceeds the returns of the healthcare REIT average.

The company also has committed to investing in its own long-term growth by investing in new investments. Since 2003, Omega has continued to pursue investments of over $5.8 billion, with most recently $1.328 billion in 2016 and $124 million in 2017. Additionally, the company has approximately $287 million committed to its operators for capital improvement and new construction projects to be completed over the next 24 to 36 months.

Growth Catalyst

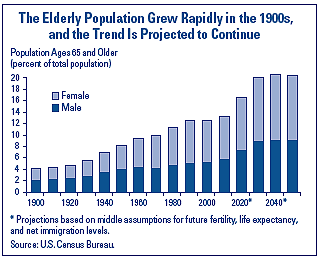

One of the biggest growth catalysts for Omega is the aging baby boomer population. The baby boomer population is roughly around 76 million people in the United States, who have begun entering into retirement over the last few years. As this generation gets older, the baby boomers will be moving into skilled nursing and assisted-living facilities, which are Omega’s specialities.

Another factor is that the average American is living much longer, thanks to advances in medicine and healthcare. This longevity will keep tenants living in Omega’s properties longer. According to Omega’s June 2017 Investor Presentation, management expects its property occupancy to grow to 105% in 2025 and 142% in 2035.

Dividend Analysis

Like most REITs, Omega is defined by its dividend and dividend payout history. Although the company had a recent miss, it still was able to raise its quarterly dividend by $0.01 to $0.65 per share. This was the 21st consecutive dividend raise in a row, which has now pushed the yield over the 9% mark. The company has also been raising dividends since 2010 and currently has a payout ratio of 81%, which is in line with most REITs. Even though Omega’s stock price dipped after the earnings miss, this might be a good opportunity for income investors to buy a high-yielding stock in an otherwise highly priced market.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

The biggest risks Omega currently faces are based on tenant occupancy issues over the short term and the changing healthcare landscape in the United States. From 2009 to 2016, the skilled nursing care facilities and Omega portfolio occupancy trend has been on a slight decline. In 2009, Omega’s occupancy was at 84.6%, while it went down to 82.2% in 2016. Although revenues have been increasing, the occupancy rate has not, which finally caught up with Omega’s FFO figures. Although management expects occupancy to rise with the baby boomer population, it needs to solve the declines in the short term or see investors continue to panic.

The Bottom Line

Until recently, Omega Healthcare Investors Inc. was a well-managed company with stellar revenue gains of more than 25%. But the recent revenue and FFO miss caused the stock to plummet over 6% in one day. This could be an opportunity for investors to buy a high-yielding dividend REIT on a temporary dip, but it could also be the first sign of a company that is truly suffering from its stagnant occupancy levels.

Check out our Best Dividend Stocks page by going Premium for free.