Philip Morris International Inc. (PM ) is a holding company that was originally part of the Altria Group (MO ), until it was spun off in March 2008. Philip Morris International manufactures and sells cigarettes and other tobacco products outside of the United States, while Altria Group Inc. (MO ) sells within the U.S.

Philip Morris International (PMI) is the leading international tobacco company in the world, with over 80,000 employees. Like its American sister company Altria, PMI is most known for having some of tobacco’s top brands like Marlboro, L&M, Chesterfield, Parliament and Bond Street. Marlboro has been the number one cigarette brand in the world since 1972, with over 282 billion cigarettes being sold outside the U.S. and China in 2016. L&M is the third best-selling international cigarette, with over 97 billion sold in 2016.

Like most of the cigarette industry, government regulations and ongoing health concerns have caused PMI to switch its core focus from cigarettes to smoke-free products. The company has 400 dedicated scientists and engineers developing less harmful alternatives to cigarettes in its Switzerland and Singapore research facilities. Since 2008, PMI has invested over $3 billion in this venture and more than 3.7 million consumers have switched to the company’s first smoke-free products.

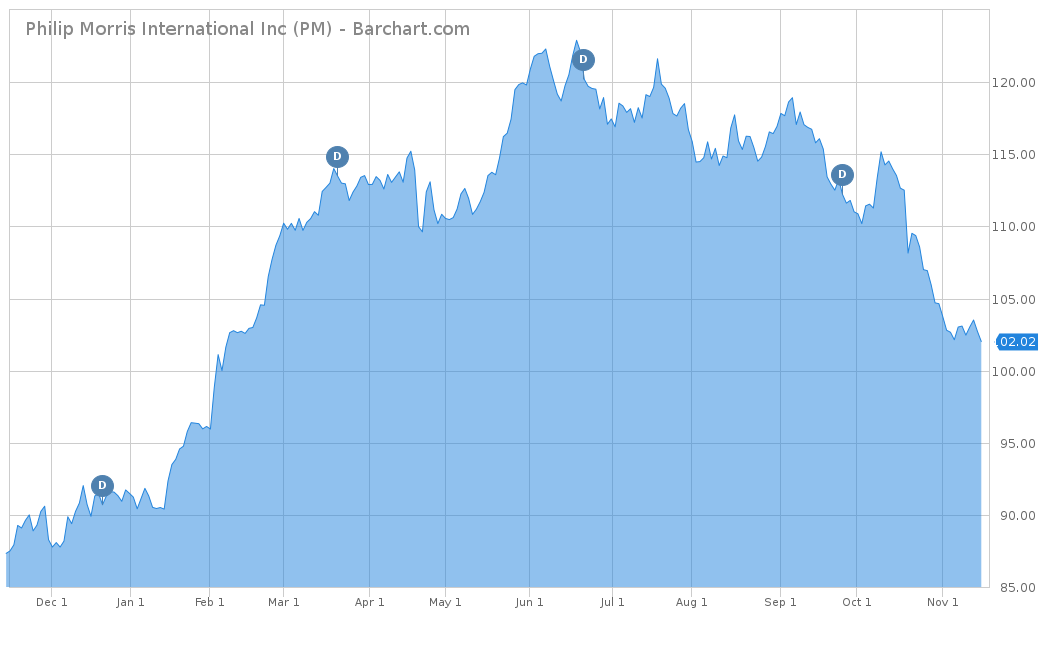

On a year-to-date basis, PMI’s stock price has performed fairly well and is up almost 12%. Although this is underperforming the S&P 500’s year-to-date performance of 14.57%, it is outperforming Altria, which is down 2.5% for the same time. However, over the last five years, PMI has seen only a cumulative return of around 20%. This is way below the returns of the S&P 500 and Altria, with 90% and 110% for the same time, respectively.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, PMI has seen a declining rate of revenue, with an average growth rate of negative 3.0%. However, analysts are very optimistic about PMI revenues in the future, expecting to see growth of 6.9% with estimates of $28.53 billion in 2017. The same goes for 2018, with an expected increase of 9.5% to $31.9 billion.

On an earnings-per-share basis, PMI hasn’t performed well over the last five years but analysts expect that to change as well. Over the past five years, earnings have declined an average of 1.6%. However, for 2017, analysts expect a growth of nearly 6% to $4.75 per share. For 2018, analysts see an uptick of 11.8% to $5.31 per share.

On a price over earnings multiple, PMI currently has a 21.5, which is slightly below that of the S&P 500’s 25.71. However, its P/E is higher than the measures of their competitors, like British American Tobacco p.l.c. (BTI ) at 17.2. This current measure is also most likely inflated due to the recent stock price appreciation it has had. As earnings improve over the next few years, expect PMI’s P/E to move back to near its five-year average of around 18.

Strengths

Although the cigarette industry is being phased out, PMI is still king with a global market share of 28%. With its signature Marlboro and L&M brands, PMI has and will continue to have brand loyalty for those customers that have been smoking for years. Outside of these two main brands, PMI has built an extensive diversified portfolio of cigarette brands that appeal to a wide variety of markets. The premium-priced market consists of Parliament and Virginia Slims while the mid-price brands are L&M, Lark, Merit, Muratti and Philip Morris. PMI also owns a number of local cigarette brands in countries like Indonesia, Philippines, Pakistan, Russia, Colombia, Canada, Germany, Greece and the Czech Republic. With such a diverse portfolio, PMI is not totally reliant on revenues purely from one area of the world or its main brand Marlboro.

However, as the smoking trend dies, Philip Morris needs to shift its focus away from cigarettes and to the smokeless industry or it will continue to see a decline in revenues.

Growth Catalyst

Philip Morris has continually voiced that the company’s goal is to replace cigarettes with the smoke-free products that they are developing and selling. These products are designed to create a flavorful and satisfying nicotine-containing vapor, without burning and without smoke. Their smoke-free product portfolio consists of four products in various stages of development.

The IQOS brand was the first of these products and over 3.7 million customers have switched from cigarettes to this new technology. The IQOS system works with three components, a heated tobacco unit, an IQOS holder and charger. The system works by heating up tobacco at a lower temperature than a traditional cigarette would, releasing a flavorful nicotine in a vapor. This avoids burning the tobacco, which is the ultimate source for all the harmful chemicals. So far, PMI has seen success with the IQOS product, especially in Japan and other trial markets.

Dividend Analysis

Philip Morris International is quite attractive in terms of its dividend payout and history. Currently, the stock has a yield of 4.15% and has one of the highest yields in the cigarette industry.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

The company pays its dividend on a quarterly basis to equal a total annual amount of $4.28 per year. Management has also demonstrated in its annual report that the company strives to raise its dividend every year. In fact, it has raised its dividend every year since it spun off from Altria in 2008. After its third quarter earnings report, PMI raised its dividend 2.9%, making it the tenth consecutive year of raises.

Find all the companies that have increased their dividends for more than 25 consecutive years, in our 25 year dividend increasing stocks page, and for more than 10 consecutive years, in our 10 year dividend increasing stocks page.

Risks

Obviously, a major risk with any cigarette company is the global decline of smokers and an increase in governmental regulations that prohibit tobacco sales. These issues alone are one of the reasons why Altria spun off its international and U.S. brands into two separate units. However, PMI is looking to get ahead of the eventual downturn and move into the smokeless marketspace.

Another risk to PMI is growing competition in the smokeless tobacco market. Although its IQOS product is revolutionary to the market, expect PMI’s competitors to create similar products that will be available to the market.

The Bottom Line

Overall, it looks like PMI is making the most out of a trend that they know will end. Refocusing the business from cigarettes to smokeless tobacco products is the only way the company can have a future or it will continue to lose customers and revenues. Its IQOS product shows promise, along with the other three products that will be released in the near future. If PMI can convert its cigarette customers to smokeless tobacco products, it can continue to see growth and a sustainable revenue stream over the long term.

Check out our Best Dividend Stocks page by going Premium for free.