Southern Company (SO ) is a utilities company that currently distributes electricity and natural gas to 9 million customers in nine different states. The company has a generating capacity of 46,000 MW and 1.500 billion cubic feet of combined natural gas consumption. Southern Company has over 200,000 miles of electric transmission lines and over 80,000 miles of natural gas pipeline.

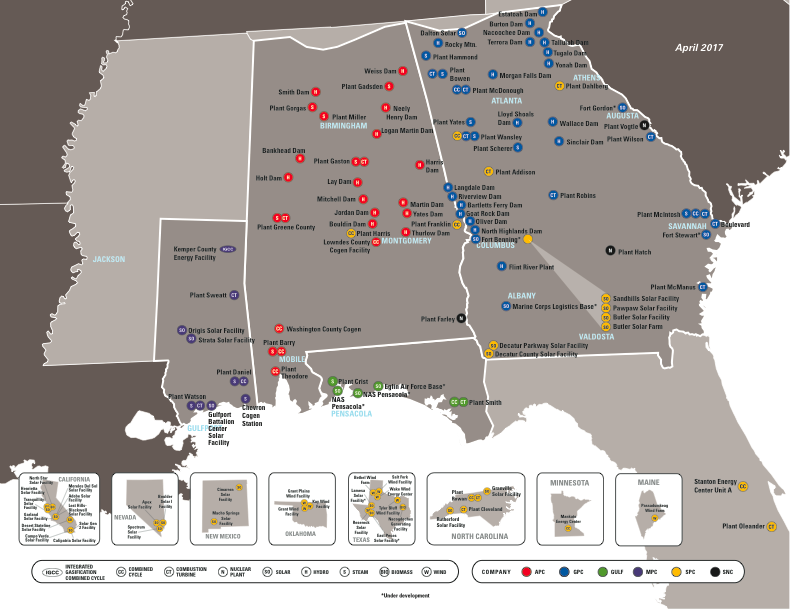

Southern is broken into eight different segments. Its electric utilities consist of four traditional providers: Alabama Power, Georgia Power, Gulf Power and Mississippi Power. The four companies combined currently serve more than 4.5 million retail customers in the Southeastern part of the United States. Another segment is Southern Power, which is the leading U.S. wholesale energy provider consisting of 46 natural gas, wind, solar and biomass generating assets capable of delivering more than 12,600 MW of energy.

Southern Power currently serves Alabama, California, Florida, Georgia, Maine, Minnesota, Nevada, New Mexico, North Carolina, Oklahoma and Texas. Southern Company Gas is the segment that distributes natural gas to 4.5 million customers through utilities in seven states. PowerSecure is Southern Company’s provider of utility and energy technologies to electric utilities and industrial, institutional and commercial customers. Finally, the rest of the parent company is made up of smaller subsidiaries like Southern Nuclear, Southern Linc, Southern Telecom, Sequent Energy Management and Pivotal Home Solutions.

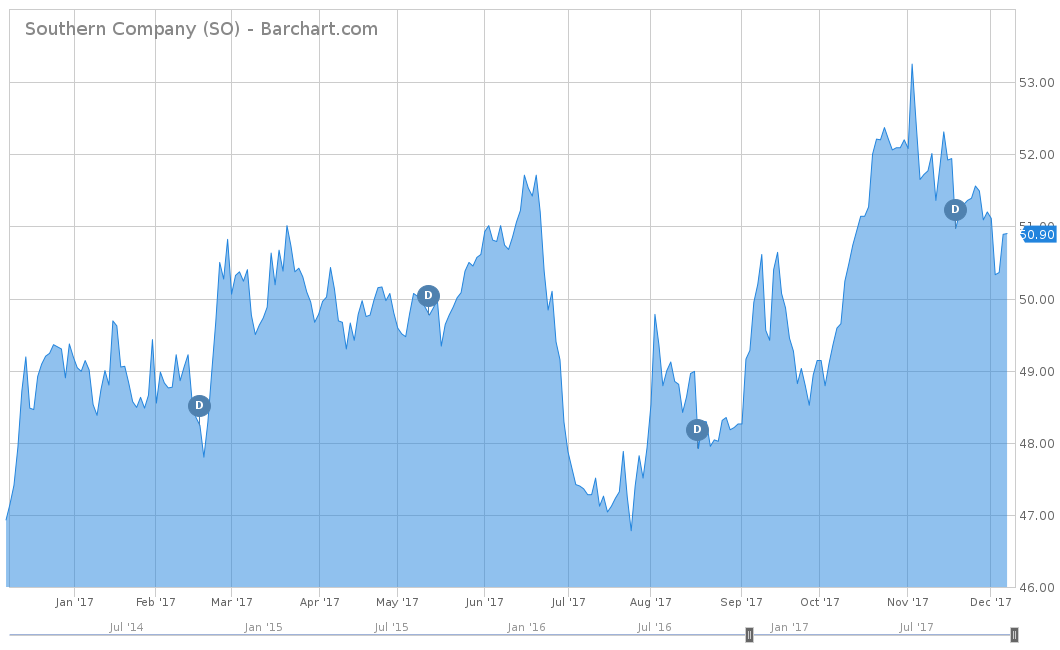

On a year-to-date basis, Southern Company has significantly underperformed the S&P 500 with a return of 3.19% versus the S&P 500’s 17.84%. When compared to its peers, Southern Company has also underperformed when compared to the Utilities Select Sector SPDR Fund (XLU), which is the largest utilities ETF by assets under management. XLU is up 14.14% on a year-to-date basis, outperforming SO by 10.95%. Over the long term, Southern Company has seen little growth, with a 15.94% return over the trailing five years. This is significantly less than the S&P 500’s 86.07% and XLU’s 56.42% for the same time period.

Fundamentals

Like its stock price, Southern Company’s revenues have been stagnant over the last five years, with an average revenue growth of 2.4%. Although it saw a decline of 5.3% in revenue in 2015, the company seems to have bounced back with a 13.8% increase in 2016. Analysts expect 2017 to be a double-digit-growth year as well, with estimates at $23.02 billion. This would be a 14.56% increase from the 2016 revenue of $19.90 billion. However, analysts do not expect the same dramatic increase the following year, with 2018’s estimate at $23.99 billion, a 4.13% change.

On an earnings-per-share basis, Southern Company has been completely flat for the last five years, with a 0.00% average growth rate in earnings. However, this number is mostly tainted by a 30% drop off in 2013, where net income was significantly off from the year prior. In 2016, Southern saw a 1.5% slight decline in its EPS from 2015, but analysts expect it to rebound like its revenues in 2017. Estimates for 2017 are $2.95 per share, 14.54% higher than 2016’s EPS. In 2018, analysts are seeing SO’s EPS growth level out to $3.03 per share, only a 2.67% increase.

Strengths

Like most utility companies, Southern Company is looking to the future and innovation when thinking about its long-term outlook on energy distribution. In 2000, Southern Company had nearly 80% of its electricity generated from coal. By 2030, the company hopes to whittle it down to 20%, with the remaining coming from nuclear, natural gas and other renewable energy sources. Southern Company is so dedicated to innovation that it actually developed an Atlanta-based Energy Innovation Center. It is the home of SO’s most inventive ideas and programs that work to bring better, more reliable and more efficient energy to customers across the country. It has, and will continue, to invest in innovation, as it spent over $2 billion on innovation since 1970.

Most of the past declines have been attributed to slowdowns in the Vogtle Nuclear Plant, which is wholly owned by Georgia Power, and the Kemper project located in Mississippi. The Vogtle plant and Kemper projects are both behind schedule, and total costs and halts from regulators have put a strain on Southern Company’s ability to maximize its margins. However, Southern Company has put new management in place at the Vogtle plant, which has a track record of successfully keeping projects on budget and completed on time. It also looks like this change has gotten the plant back on course, as Vogtle Units 3 and 4 are now in operation. These are the first new nuclear units built in the United States in the last three decades.

Growth Catalyst

The largest growth opportunity for SO is its three natural gas transmission pipeline projects that are expected to be completed and in service in the next three years. The projects are part of Southern Company Gas, which has expected capital expenditures of approximately $780 million. These projects, along with Southern Company Gas’ existing pipelines, are intended to provide diverse sources of natural gas supplies to customers, resolve current and long-term supply planning for new capacity, enhance system reliability, and generate economic development in the areas served. One of these projects received regulatory approval in August 2016, and most recently, the Atlantic Coast Pipeline was approved in October 2017.

Dividend Analysis

Southern Company pays one of the higher dividends in the utility sector, with a current yield of 4.56%. Although not the highest yield in the sector, it is certainly well above the average of the electric utility sector of 2.47%. The company has also shown a nice trend of hiking its dividend every year for 15 consecutive years and will most likely continue to do so in 2018 if revenues and earnings continue to grow as analysts expect. Shareholders currently receive a quarterly dividend amount of $0.58 per share, or an annual amount of $2.32 per share.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

Like other utility providers, Southern Company’s largest risk is the decline of its current regulatory regulations. All the pending project timelines are dependent on regulatory bodies approving each project in a timely manner. Any stalls or holdups will cost Southern Company both in current operating costs but also in future revenue earning potential with a later operational date.

The Bottom Line

With one of the best management teams in all of corporate America, Southern Company looks to be back in action after several delays with its Vogtle and Kemper projects. Under a new project lead, the company was able to launch its Vogtle Units 3 and 4 with success. Analysts are very optimistic about this development, as they expect both revenues and EPS to grow north of 14% in 2017. With one of the highest yields in the utility sector, Southern Company looks like a very attractive investment going forward.

Check out our Best Dividend Stocks page by going Premium for free.

Disclaimer: All the YTD data has been verified on December 12, 2017.