W.P. Carey Incorporated (WPC ) is a self-managed real estate investment trust that currently manages $8.3 billion in assets. The company is based out of New York City and was founded in 1973 by William P. Carey. Today the company manages 890 properties that equal 85.9 million in total square footage. WPC prides itself on having high occupancy rates with 211 tenants and a 99.8% occupancy rate as of the end of 2016. Its portfolio is also very diversified across many different industries, with its largest positions in retail stores at 18% and consumer services at 11%.

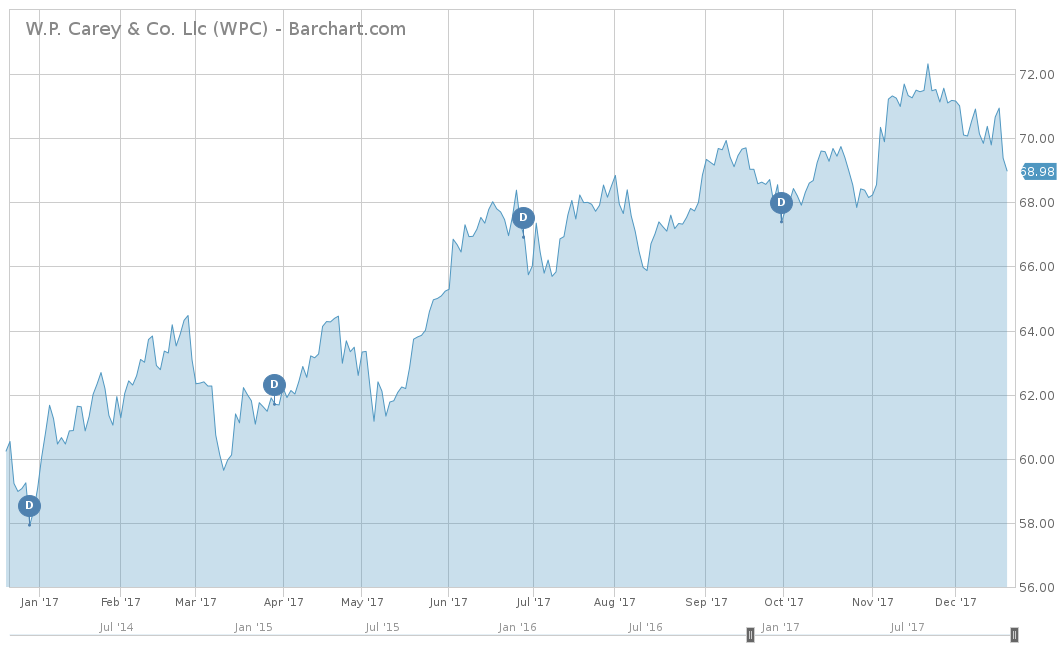

On a year-to-date basis, WPC has slightly underperformed the S&P 500 with a return of 16.74% versus the S&P 500’s 19.67%. W.P. Carey has significantly outperformed its peers when compared to the Vanguard REIT Index Fund ETF (VNQ), which is the largest REIT ETF by assets under management. VNQ is up only 0.39% on a year-to-date basis, underperforming WPC by 16.35%. However, over the long term, WPC has seen little growth, with only a 37.34% return over the trailing five years. This is significantly less than the S&P 500’s 85.58%, but better than VNQ’s 24.72% for the same time period.

Fundamentals

Over the past five years, WPC has shown an excellent track record for its growing revenues, with an average revenue growth rate of 24.9%. Its greatest jump was from 2013 to 2014, where revenues nearly doubled and grew by 85% to over $906 million. However, things don’t look the same for 2017, in which analysts expect revenues to come in considerably lower than 2016’s figures. Analysts expect revenues to come in at $693 million, or 30.34% lower than 2016’s $941 million amount. Analysts also expect a slight gain from 2017, with an estimated $713 million in 2018, equal to a 2.9% increase.

On an earnings-per-share basis, W.P. Carey shows a negative 7.9% five-year EPS growth rate. However, this is due to a 32.6% decline in 2015, which brought down the average. Since then WPC has had great EPS growth, with a 54.7% increase in 2016. However, analysts feel that it cannot replicate its 2016 growth, and they estimate that the company will finish out the year with an EPS of $2.42, which would be a 2.85% decline. They even predict that EPS growth will fall another 8.62% in 2018, with estimates reporting at $2.22 per share.

In addition to using earnings-per-share as a measure for fundamental analysis, REITs typically rely on funds from operations (FFO). In 2016, WPC had an FFO of over $5.39 per share, which is up considerably from its 2012 FFO of over $2.06 per share. On its most recent earnings call, it reported a Q3 FFO of $1.37 per share, $0.07 better than the analyst estimate of $1.30 per share. W. P. Carey’s management also sees 2017 year-end FFO ranging from $5.25-$5.35 per share, versus the consensus of $5.22 per share that analysts anticipate.

Strengths

The strength behind W.P. Carey’s business goes back to its time-tested investment strategy, which allows the company to identify, structure and execute attractive acquisition opportunities. This four-decade-old strategy also allows WPC to capitalize on strategic dispositions. The company employs a disciplined approach using four key factors. The first is based on the creditworthiness of the tenants, where WPC looks at the tenant’s financial history, competitor analysis and industry drivers. The second is the criticality of the asset to the tenant’s building. WPC prefers the tenant to use its property as its corporate headquarters or as one of its top-performing retail stores. The third factor is that the fundamental value of the underlying real estate must be in excellent condition, having completed a third-party analysis and downside evaluations. The fourth and final factor is transaction structure and pricing. WPC looks for strong lease terms, paired with financial covenants and security deposits.

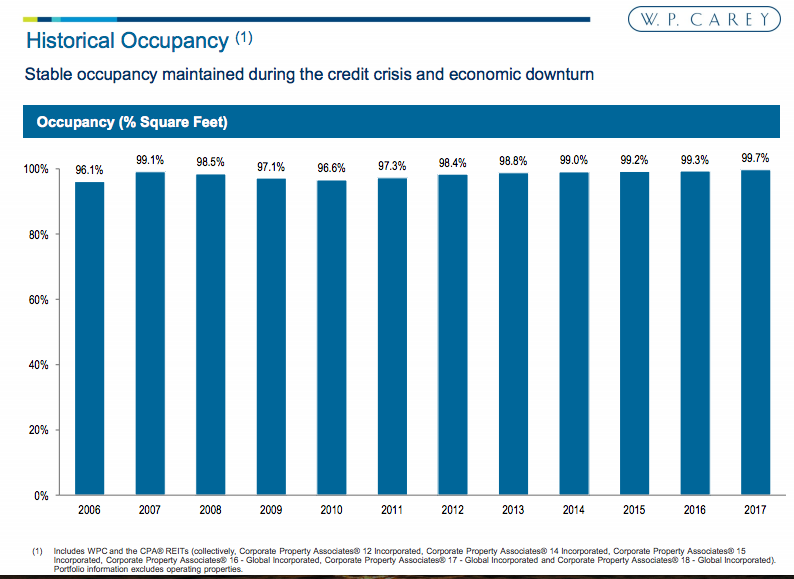

Another strong feature of WPC, like any other REIT, is its current and historic occupancy levels and lease terms. The company has not had below a 96% occupancy rate since 2006, with its current level at 99.7%. It has maintained a 99% or above average since 2014 and looks to continue to maintain that with long-term lease commitments from its core tenant base. The current -weighted average lease term (WALT) is 9.5 years, with 47.5% of its tenants’ leases expiring after 2025. With this consistency and long lease rates, it is no wonder why WPC’s stock price is having its best year yet.

Growth Catalyst

When it comes to REITs, it is rare to find a major growth opportunity that would cause the stock price to spike. When looking at W.P. Carey’s growth for the future, most of it would be tied to its growing international presence. Most publicly traded REITs consist of U.S.-based companies. However, with WPC, only 65% of its total portfolio derives from the United States. The remaining portions come from other countries throughout the world, such as Germany with 9%, the U.K. with 5% and Spain with 4%. The company has been investing internationally for 19 years, primarily in Europe. As the European and global economies continue to follow in the footsteps of the booming U.S. economy, expect WPC to benefit with increasingly international tenants being added to the portfolio.

Dividend Analysis

W.P. Carey’s strong suit is its consistent dividend, which currently pays an annual amount of $4.04 per share. This is equal to a 5.92% yield, which is in line with its competitors, as VNQ has a current yield of 6.10%. However, one strength that WPC has over its competitors is its history of dividend growth. The company has raised its dividend 17 consecutive years, with its most recent increase coming in December 2017. Investors who have owned WPC have been very happy with the company in 2017, having seen the stock’s price grow over 16% while still collecting a dividend well north of the 5% mark.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

The biggest risk to WPC would be if there was a major downturn in the U.S. and global economies. As this would undoubtedly affect most of the publicly traded companies out there, REITs get hit hard when tenants can no longer renew their leases. This, in turn, causes rental levels to come down in a more competitive environment and, therefore, push revenues and margins down with it. If occupancy levels fall, investors may begin to bail on the company’s once immaculate track record for more conservative investments. If occupancy levels fall, so will profits and the ability to raise or even pay the company’s dividend. However, WPC should be one of the last REITs to be affected as the company has separated itself by having high quality and diversified tenants.

The Bottom Line

Having a great year so far with its stock price, WPC seems to have a positive future going forward it. However, analysts believe the company is running out of steam, and although occupancy levels are still topped out, revenues look to be on the decline. However, investors looking for a dividend yield of over 5.8% with a consistent 17-year track record of dividend hikes should consider putting WPC in their portfolios.

Check out our Best Dividend Stocks page by going Premium for free.

Disclaimer: All the YTD data has been verified as of December 20, 2017.