Digital Realty Trust Incorporated (DLR ) is a real estate investment trust that invests in data centers and other IT-related properties that support the operations of social networking and mobile communications. DLR has 182 data centers that span over 30 countries across the world. The company’s top customers include International Business Machines Corp. (IBM ), Facebook Inc. (FB ), Cyxtera Technologies, Oracle Corp. (ORCL ), and Verizon Communications (VZ ).

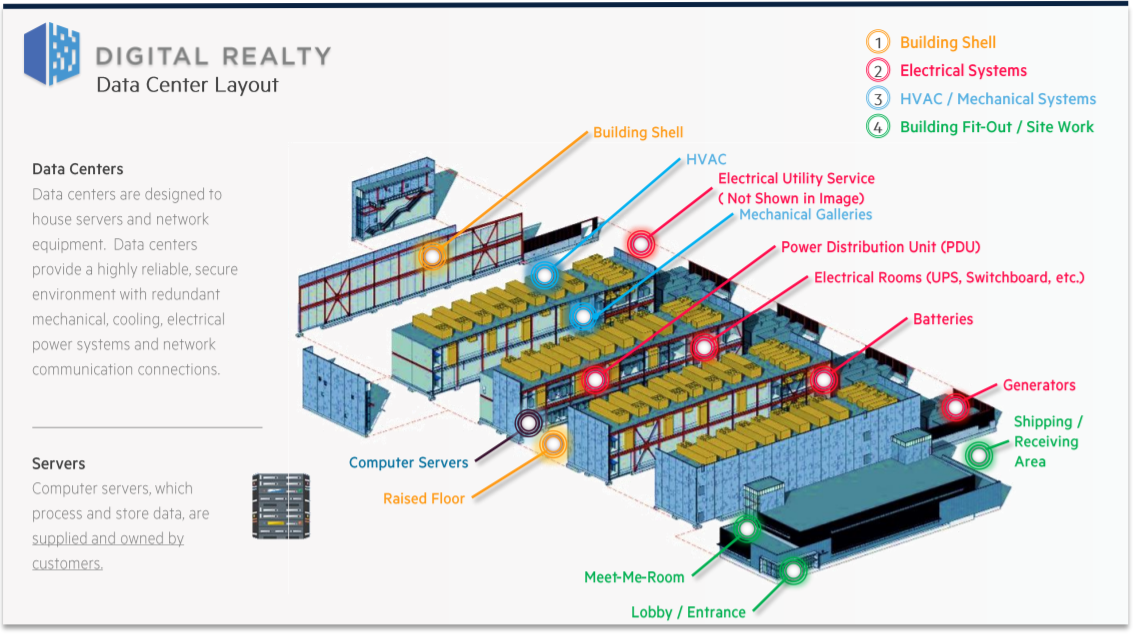

Data centers are designed to house servers and network equipment while also providing a highly reliable and secure environment that provides mechanical, cooling and electrical power systems. Each of DLR’s 182 data centers is comprised of four parts: its building shell, its electrical systems, its HVAC and mechanical systems and its building fit-out. Each of the data centers features computer room air conditioners, air-cooled chillers and uninterruptible power supplies that ensure that its customers’ servers are running to their maximum potential. With this superior structure, Digital Realty provides the real estate foundation that many customers and partners rely on.

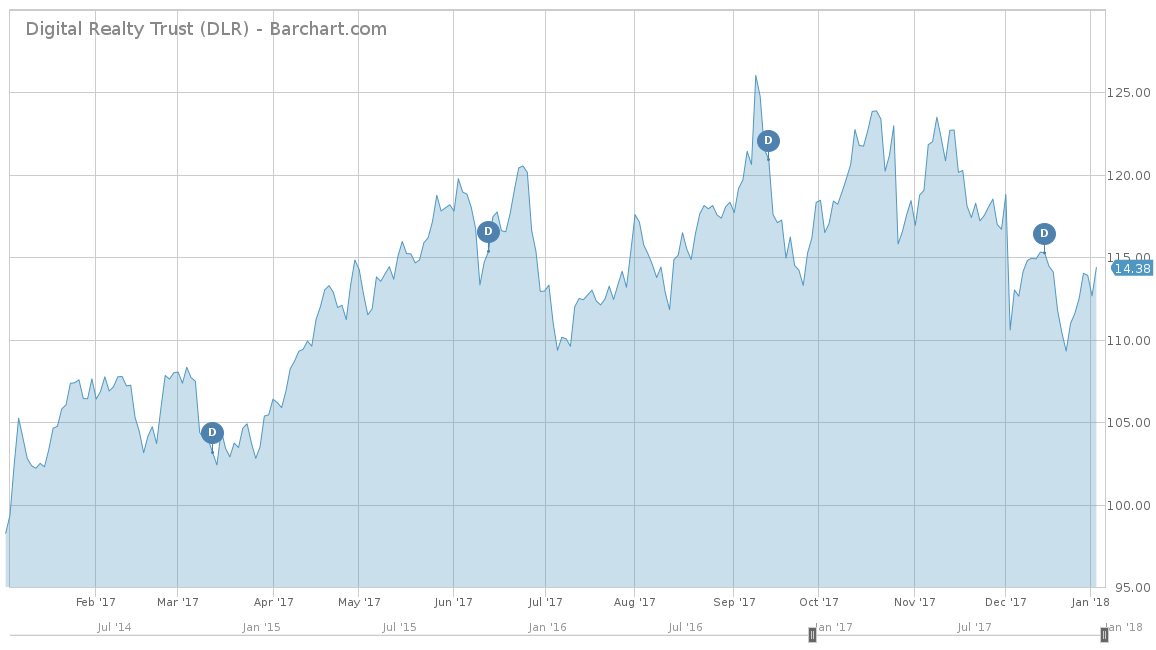

For 2017, Digital Realty Trust performed fairly well and was up 19.70%. This was up slightly more than the S&P 500 Index, which was up 18.87% for the year. However, DLR’s largest competitor, Equinix Inc. (EQIX ), was up 29.05% for the same time. Over the longer term, DLR has performed fairly well, with a cumulative trailing 5-year return of 65.72%. Again, it significantly trailed both the S&P 500 and EQIX, which had returns of 85.21% and 128.11% for the same time period.

Fundamentals

Over the last five years, Digital Realty Trust has shown a strong track record for revenue growth with an average of 15.1%. It has grown revenues from $1.28 billion in 2012 to nearly double in 2016 with $2.14 billion. In fact, analysts believe that DLR will continue its growth trend and report revenues around $2.46 billion in 2017, a 14.95% increase from 2016. Analysts also predict that 2018 will be a positive year for DLR again, with estimates reporting at $3.08 billion, an increase of 25.20% from 2017.

Since DLR is a REIT, using fund flows from operations (FFO) would be a more suitable measure than using earnings-per-share (EPS). Since 2012, DLR has grown its FFO from $625 million to over $956 million in 2016, which is over a 52% cumulative gain. Analysts project that DLR will close out 2017 with a FFO of over $1.017 billion, which is equal to an increase of 6.36%. Estimates are projected to be even higher for 2018, with FFO estimated to be at $1.414 billion, an increase of over 39%.

Strengths

Digital Realty Trust has a philosophy to deliver superior returns by capitalizing on its core competencies and tailoring them to meet customers’ growing data center needs. The company plans to prudently allocate capital to extend its global footprint using an opportunistic methodology. DLR has a diverse product offering that drives higher returns. Finally, the company plans on achieving operating efficiencies to accelerate growth in cash flow and value per share.

One of Digital Realty’s strengths is its comprehensive customer-focused product suite. DLR can provide widely scalable solutions, beginning for medium 300+ kW companies to very large deployments in a matter of weeks and contracting them for five to ten years. DLR provides colocation, which provides much-needed agility to quickly deploy a computing infrastructure in days for a contract of two to three years if need be. It also allows its customers to enable as small as a one-cabinet or as large as a seventy-five-cabinet data center deployment. DLR also connects its customers and partners directly within the data center, which is a more private and secure process.

Growth Catalyst

In mid-2017, Digital Realty announced a deal that the company is merging with DuPont Fabros Technology. After the transaction, DLR will gain access to twelve new properties. This will give DLR over 26 million rentable square feet, helping Digital Realty solidify its holdings where it already had some of its footprint. This transaction has led to some of the largest growth potential that DLR has seen in years. Five key markets will help DLR’s booking acceleration for 2018. Northern Virginia, Chicago, Silicon Valley, Dallas and London are all the top areas for key geographic growth in the data center industry. Currently, DLR has nearly 2.0 million of square feet of capacity, 1.6 million of which is in North America and available to these key marketplaces. Northern Virginia actually comprises of 50% of DLR’s sellable inventory, making it North America’s largest data center market.

Another growth opportunity for DLR is that it is entering the Tokyo marketplace with key global brand partner Mitsubishi Corporation. The 50%/50% partnership is initially valued at $350 million and gives DLR access to both the Tokyo and Osaka marketplaces. If the relationship between the two companies continues to flourish, Digital Realty could see further expansion into the very lucrative Japanese market.

Dividend Analysis

Digital Realty Trust pays a dividend that is currently yielding 3.30%. This is equal to an annual payout of $3.72 per share. However, unlike most of its competitors, Digital Realty has a thirteen-year track record of raising its dividend on a consecutive basis. This is considerably better than its competitor, Equinix, which has only a two-year history of raising its dividend. DLR also has a considerably higher dividend yield than EQIX, which currently yields only 1.78%.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

The biggest risk to Digital Realty moving forward is if the company does not reach its booking goals for 2018. Many analysts believe that the company will have no issues filling its 2.0 million capacities over the next few years, especially in its five key markets. Adding the assets of DuPont Fabros Technology really brought Digital Realty into the next level in terms of size and market capitalization, so any failure in filling its capacities would cause a decline in revenues and profits going forward.

The Bottom Line

After the DFT merger, Digital Realty looks to continue its revenue growth trend with its high potential for upside in its five key mega market locations. If its salesforce can fill its 2.0 million capacities in the upcoming years, expect the stock price to continue its upward trend. Along with its growing revenues, income investors can expect a fourteenth year of consecutive dividend raises, making Digital Realty a fairly high-yielding investment with plenty of room for appreciation.

Check out our Best Dividend Stocks page by going Premium for free.