Enterprise Products Partners LP (EPD ) is a master limited partnership that processes and transports natural gas, natural gas liquids (NGLs), crude oil and other refined products through over 50,000 miles of pipelines across the United States. The company is one of the top midstream pipeline companies in the industry, growing its asset base from its IPO phase in 1998 from $715 million to over $52 billion as of December 31, 2016. On top of growing its asset base, Enterprise Products has raised its dividend for 53 consecutive quarters and has a current yield of 5.89%.

Enterprise has built up its assets to make the company a leader among its peers. The company currently stores 260 million barrels of NGLs and other refined products while also having 14 billion cubic feet of natural gas storage capacity. EPD also has 26 natural gas processing plants and 22 NGL and propylene fractionators. What makes Enterprise so successful is that it integrates all the different assets into a single network. This integrated network of assets is strategically located to serve the major domestic supply basins and product storage hubs as well as international markets. The company also believes that these markets provide it with access to natural gas, crude oil, NGL, petrochemical and refined products, and business-expansion opportunities.

On a year-to-date basis, EPD has gotten off to a good start and is up almost 9%. For 2017, Enterprise Products had a very lackluster year in terms of overall stock performance, being up only 4.21%. This was significantly less than the S&P 500 Index, which was up more than 20% for the same time period. However, one of EPD’s largest competitors, Williams Partners LP (WPZ), also underperformed compared to the market with a 2017 return of 8.94%. Over the longer term, EPD has again underperformed with a cumulative trailing 5-year return of 5.80%. It also significantly trailed both the S&P 500 and WPZ, which had returns of 86.69% and 27.11%, respectively, for the same time period.

Fundamentals

Over the last five years, Enterprise Products has struggled with its revenue, with a decline of 12.3% on average. From 2012 to 2014, the company had stellar revenues ranging from $42 to $47 billion each year. Then, in 2015, revenues fell 43.6% and continued to drop another 14.8% in 2016. This drop off was felt by most of the other pipeline companies as well, as the price of oil also significantly fell during the same time. However, 2017 looks to be a turnaround for the company, with analysts projecting the company to finish 2017 with an estimated $27.65 billion in revenues, an increase of more than 20%. Same goes for 2018, as analysts expect a 5.8% increase with estimates at $29.24 billion.

Since EPD is an MLP, using Price-to-Distributable Cash Flow (P/DCF) would be a more suitable measure than using earnings-per-share (EPS) or price-over-earnings (P/E). In 2016, EPD had a P/DCF of $1.96 per share, and analysts expect that for 2017 it will finish the year with a P/DCF of $2.01 per share. The company also looks to grow it incrementally over 2018, with an estimated P/DCF of $2.04 per share. If EPD can maintain these estimates and steadily grow its P/DCF every year, the stock price should continue its recent upward trend.

Strengths

Two important strengths for EPD are its location and quality of its assets. For producing companies that are looking for hydrocarbons, Enterprise offers a variety of options as it is connected to every major U.S. shale basin, every ethylene cracking pan, and 90% of the refineries that are east of the Colorado Rockies. Its regulated NGL network is based out of Mont Belvieu, Texas, and it is made up of 20,000 miles of pipelines stretching over 27 states. The company also has 5,400 miles of crude pipelines that are located in Texas, Oklahoma and New Mexico. These pipelines connect the Eagle Ford, Permian Basin, Cushing and Gulf Coast hubs, which all transport around 1.4 million barrels per day.

Enterprise also has strong contracts that typically last 15 to 20 years. For one of Enterprise’s latest investments (i.e. the PDH plant), 100% of its 750,000 pounds per day is contracted for 15 years. Another iBDH plant is also contracted for 15 years. These long-lasting contracts give Enterprise the stability it needs to pay out distributions to its shareholders over the long run, allowing the company some protection when commodity prices are down and transporting needs drop.

EPD also is second to none when it comes to vertical integration. It seamlessly integrates the process of transporting from pipelines to storage, processing, fractionation and then to trucks or rail. Its marketing operations are also a strong profit center for the company, collecting $4.3 billion in fees last year. This allows Enterprise to collect additional fees on top of its normal pipeline usage fees, of which many of EPD’s competitors do not currently do.

Growth Catalyst

Enterprise has a strong hold in the natural liquid gas market, with its Houston Ship Channel, Beaumont Terminal and Mont Belvieu assets. Currently, EPD generates 60% of its gross operating margins solely from its NGL business, and management expects this number to grow significantly over the next few years. Much of the demand and a major growth driver will come from the Gulf Coast, as Enterprise has already made connections with every ethylene cracking plant in the area.

Enterprise also does propylene fractionation with seven plants and pipeline systems aggregating approximately 680 miles long. This side of Enterprise’s business includes an export facility and associated above-ground polymer-grade propylene storage spheres located in Seabrook, Texas.

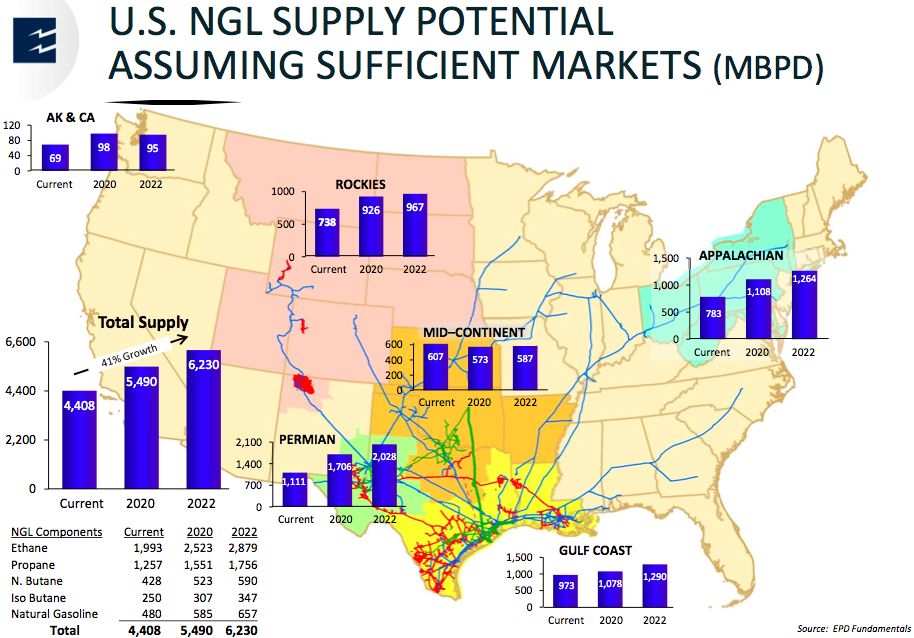

With several strengths that help the company stand out among its peers when it comes to NGLs, Enterprise should be the dominant leader in this segment in the next few years. As evidenced by the chart below, EPD has significant upside when it comes to its NGL supply, with an expected growth of 41% to 2022.

Dividend Analysis

As mentioned, Enterprise Products recently raised its dividend for the 53rd consecutive quarter. The company has also raised its dividend every single year for 19 consecutive years, demonstrating the company’s ability to continue to reward its shareholders over the long term. The stock pays a fairly high dividend in comparison to its peers with a 5.89% yield, equal to $1.70 per year on an annual basis. This is significantly higher than the average of the independent oil & gas industry, which is yielding 2.20%.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

The biggest risk to Enterprise Products is if the demand for natural gas liquids from the petrochemical industry in the Gulf does not materialize as expected. Along with NGL, Enterprise shares commodity risks with natural gas and crude oil as well, but any uncertainty around NGL-related business would be the biggest loss as it currently makes up the largest portion of the company’s revenues.

The Bottom Line

For investors looking for a company that pays a high and rising dividend, Enterprise Products Partners would be an excellent option. With the company showing a bounce back from the oil decline the industry experienced in 2014 to 2016, Enterprise looks like the stock will finally gain some ground in the future. If it continues to see a rise in demand with its NGL business from the Gulf region, expect the company to go back to its revenues in the $40 billion range over the next few years.

Check out our Best Dividend Stocks page by going Premium for free.