Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center on expectations for the coming year. Ford missed earnings and reduced its outlook for 2018. Netflix is expected to beat subscriber estimates. Oil and gas prices have been on the rise due to cold weather and Omega Healthcare increased its dividend for the 22nd quarter.

You can view our previous Trends article here, which centered on Bank of Nova Scotia and Royal Bank of Canada as both Canadian banks got an upgrade from analysts.

Ford Misses Earnings and Reduces Outlook for 2018

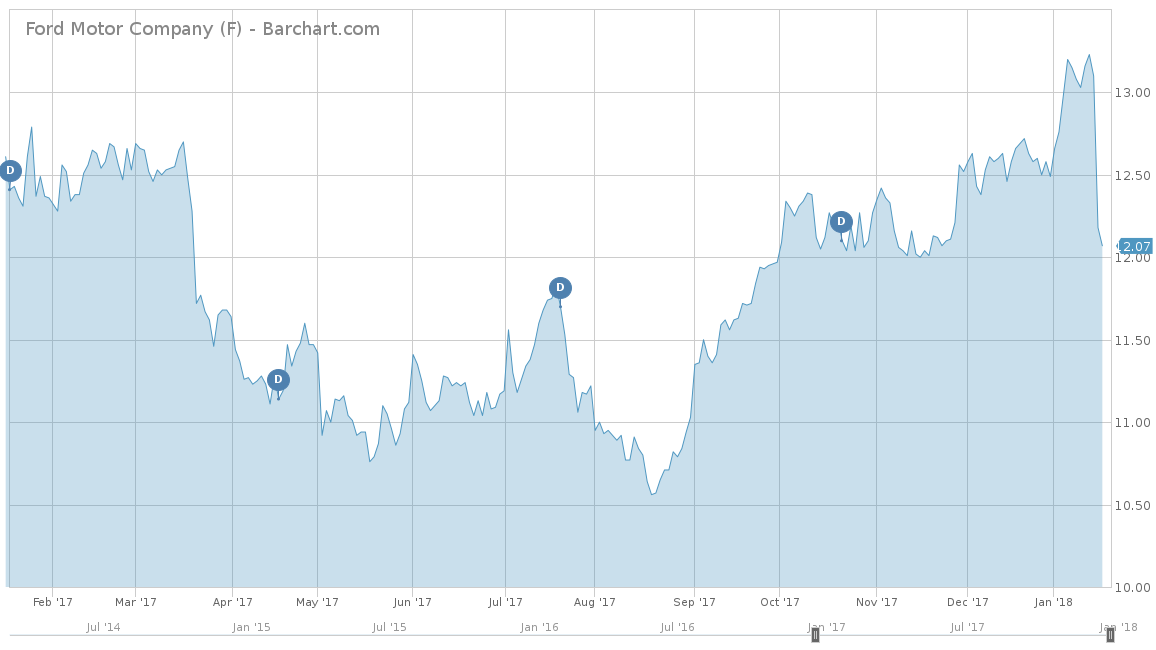

Ford Motor Company (F ) was this week’s top-trending topic after the company announced that it missed its preliminary earnings for 2017 and that it would give a more pessimistic guidance toward 2018’s outlook. Earnings came in at $1.78 per share, versus the estimates of $1.83 per share. For 2018’s guidance, Ford stated that it predicts the company will earn anywhere between $1.45 and $1.70 per share, below 2017’s measure. Much of the miss was attributed to a $1.6 billion cost toward raw materials and currency volatility that the company was not anticipating. In unison with the announcement, Ford management will also shift from being a mass-market automaker to a lower volume, high-margin models’ one. Basically, Ford said it will reduce its quantity of sedans and focus on producing pickup trucks, SUVs and hybrid vehicles.

Ford shareholders have been consistently disappointed with the company’s performance in both the near and long term. Over the last five days, the price of Ford has dropped 8.28%, with most of it coming after the announcement of the missed earnings where the stock tumbled over 7% on the day. On a year-to-date basis, the company is also down 3.36%, and down 2.74% for the trailing one-year. Even over the long haul, the stock is down 14.46% over the trailing five years. However, the company’s one saving grace is its dividend, which is currently paying 4.98% or $0.60 per quarter.

To view other dividend-paying auto manufacturers’ stocks, click here.

Netflix Expected to Beat Subscriber Estimates

Netflix Inc. (NFLX) was the second-most trending topic this week, after GBH Insights announced that the online streaming company is estimated to report net subscriber additions of 7 million in December, versus the expected 6.3 million. This was announced by GBH Insight’s Head of Technology Research Daniel Ives, who said that Netflix will top expectations by 11%. The stock continues its 2017 rally as Wall Street is waiting for its earnings announcement on January 22.

Over the last five days, the stock is up 1.42%, and up 14.78% on a year-to-date basis. Netflix has also been one of the best performers of 2017, with the company’s stock price up 65.34% for the trailing one-year. Netflix has also been one of the best-performing stocks over the trailing five-years, up over 1,455.22%. Netflix does not currently pay a dividend.

For the top 11 Internet software stocks that do pay a dividend, click here.

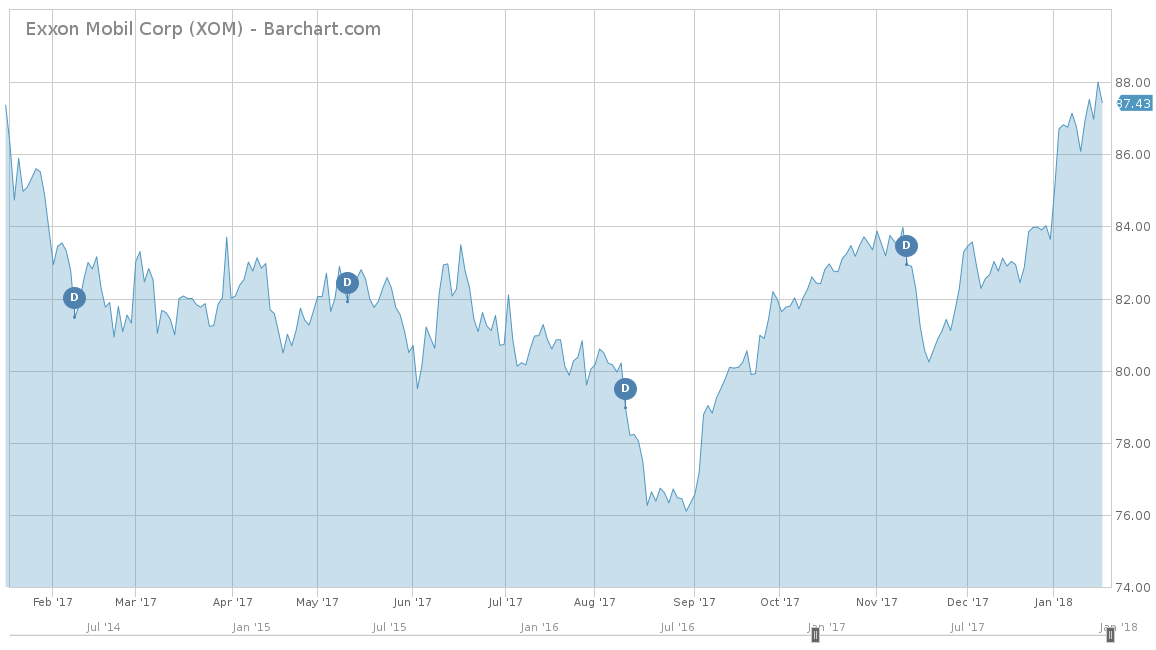

Oil and Gas Prices Soar Due to Cold Weather

Oil and gas prices were the third-most trending topic of the week, due to the massive cold front that hit most of North America last week. This drove up prices and demand for oil and gas, as homes were forced to deal with the cold conditions and heat their homes. Bank of America Merrill Lynch and Morgan Stanley raised forecasts for oil prices in 2018, while Goldman Sachs said there is growing risk that it will have to push up its targets. Brent crude rose to above $70 per barrel this week, while West Texas Intermediate was trading above the $63 per barrel mark.

Over the last week, the largest oil and gas company in the world, ExxonMobil Corp (XOM ), also saw a slight boost in stock price and was up 0.58%. The company is up 4.53% on a year-to-date basis and up only 1.33% for the trailing one-year. Like the price of oil itself, Exxon stock has suffered over the last five years and is down 3.71%. However, investors are still sticking with the company thanks to its consistent dividend hikes, which the company continues to do for its 35th year in a row. Exxon stock is currently yielding 3.51% for an annual payout of $3.08 per share.

For the best major integrated oil & gas dividend stocks, click here.

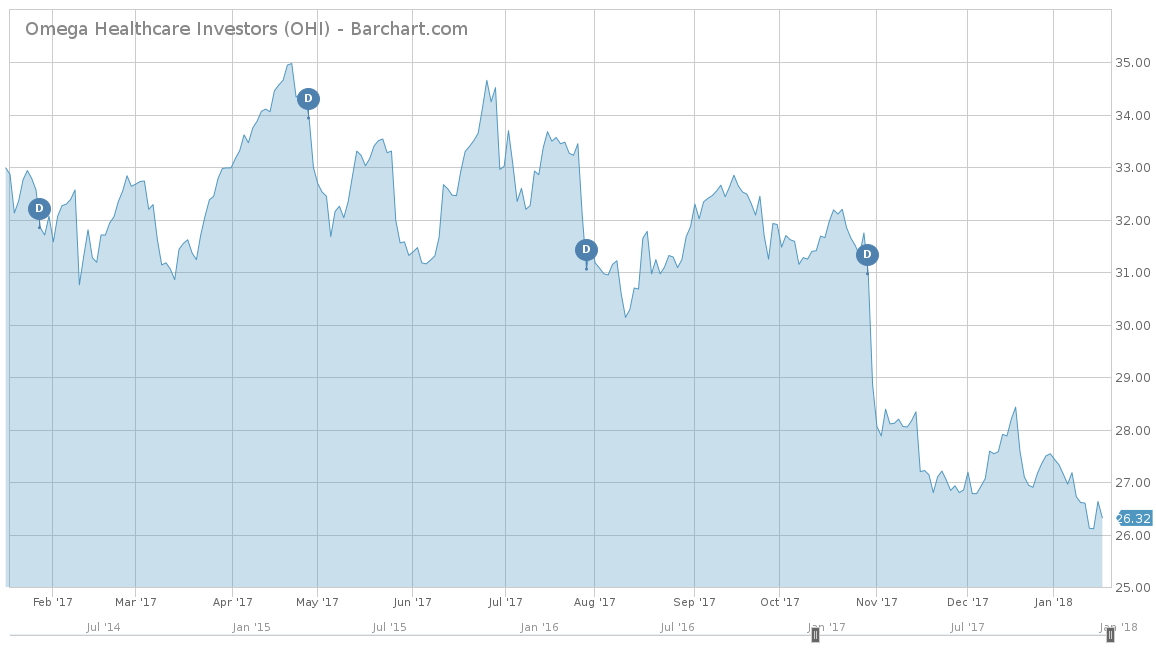

Omega HealthCare Hikes Dividend for 22nd Quarter

The fourth-most trending topic this week revolves around Omega HealthCare Investors Inc.(OHI ). The company announced that it will raise its dividend for the 22nd consecutive quarter in a row. The dividend will now pay $0.66 per share, with the increase of $0.01 per quarter that will be payable on February 15, 2018.

Even though the positive announcement was made, the stock was still down 1.05% for the last week. It is also down 4.43% year-to-date, to add to its negative 19.93% for the trailing one-year. Over the longer term, the stock has broken just above even and is up 3.34% for the trailing five-years. However, most investors do not own this company for appreciation, but rather for its dividend. The company currently yields 10.03% for an annual payout of $2.64. On top of the 22 consecutive quarters of dividend hikes, it has also raised its dividend at least every year for the last 8 years.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

Most of this week’s trends centered on both positive and negative expectations toward the coming year. Ford missed its preliminary earnings causing the stock price to drop 7% in a day. Netflix is expected to continue to rise, thanks to increasing subscribers. ExxonMobil is finally seeing an uptick thanks to rising oil and gas prices. Finally, Omega continues to be one of the highest-yielding stocks that has also been raising its dividend on a consistent basis.

For more Dividend.com news and analysis, subscribe to our free newsletter.