Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Nvidia posted impressive financial results for the latest quarter, in no small part because of a surge in demand from cryptocurrency mining activities. Meanwhile, storied oil company British Petroleum trended as it recently paid its hefty dividend. Delivery company UPS, along with other peers, is down for a rough ride as Amazon declared its entrance into the delivery game, while remarkably stable industrial giant 3M was recently upgraded by Deutsche Bank.

Nvidia Results Boosted by Bitcoin

Nvidia (NVDA ), a company paying a small dividend, saw its traffic advance 78% this week, as the graphics chips maker reported an upbeat earnings report, prompting a rally in the stock price. In the fourth quarter, Nvidia said its revenues rose a staggering 29% to $1.74 billion, crushing analysts’ expectations of $1.59 billion. Meanwhile, profits nearly doubled to $1.12 billion or $1.78 per share.

The company benefited handsomely from two trends – rising demand for cloud-computing capacity and the cryptocurrency craze. The firm’s Volta chip infrastructure, which was launched last year, proved a hit with consumers, with CEO Jensen Huang saying every cloud service provider embraced the new technology, including Microsoft and Amazon, which are competing neck-and-neck in the cloud space. Demand from artificial intelligence and machine learning also increased, while the cryptocurrency boom provided an additional boost to earnings.

However, despite the impressive results, questions are lingering about how much of the demand was driven by cryptocurrency mining, which needs computing power to create additional virtual coins. Prices of many cryptocurrencies slid recently, potentially leading to a fall in mining activity. Nvidia’s Chief Financial Officer Colette Kress admitted that the cryptocurrency market exceeded expectations, but said the overall contribution was difficult to quantify. More visibility should be gained during the next quarters, if demand from crypto-mining activities declines.

Nvidia’s shares have risen more than 4% during the past week, extending 12-month gains to as much as 104%. Because of its high stock price, Nvidia’s dividend delivers an annual yield of just 0.25%. The quarterly dividend will be paid February 22.

BP Pays Dividend as Recovery Underway

U.K.-based oil & gas major BP (BP ) has seen its viewership rise 65% this week, taking second place in the list. BP is highly attractive to dividend-seeking investors because its stock delivers an impressive 6% annual yield amid a stable price. The company’s shares have advanced 15% in the past year and are down around 0.8% during the last five days, speaking to the relative lack of volatility.

In the fourth quarter, BP revenues came in at $70.02 billion, 34% higher than the same period last year, largely thanks to recovering oil prices and an 18% increase in oil production. The company’s operational cash flow of $6.4 billion was 42% higher than last year.

The good thing about BP’s dividend is that it is the highest in its peer group, with both Chevron (CVX ) and ExxonMobil (XOM ) paying around 4%. In addition, BP’s cash flow in 2017 completely covered dividend payments. The company’s ex-dividend date for the most recent quarterly payout of $0.60 per share was on February 15.

Although it may be considered an exponent of the old economy, BP is vivacious in its attempt to gradually shift its focus from fossil fuels to alternative energy. Its pipeline currently includes projects both in alternative and fossil fuel energy, positioning itself well to capitalize on future trends while taking advantage of current energy markets.

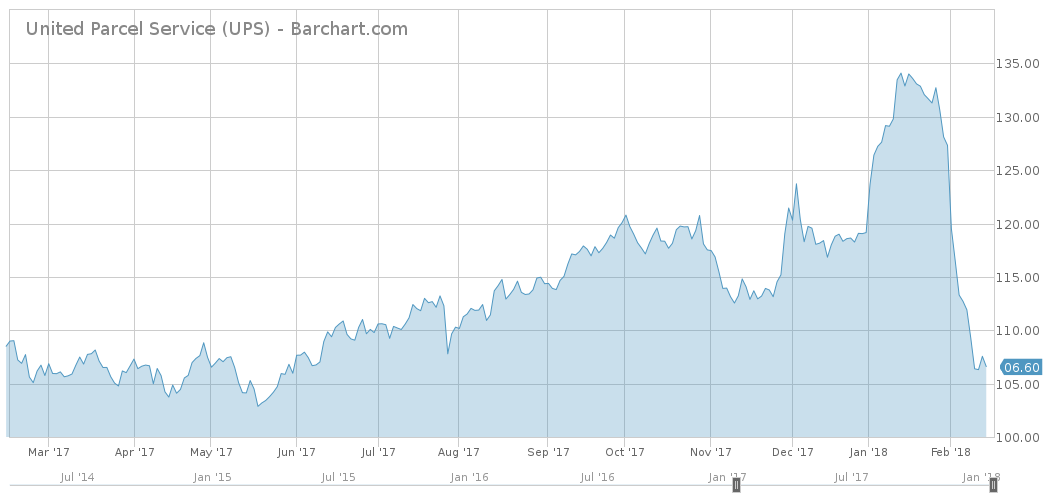

UPS Threatened by Amazon

United Parcel Service (UPS ) has seen its traffic rise 61% in the past five days, as the company is facing a competition threat from Amazon (AMZN). UPS, which for years benefited from the rise of Amazon because it had helped ship its products, may suffer going forward as the behemoth retailer announced its intention to enter the delivery market.

Shipping with Amazon, as the service is named, will start delivering products for third-party merchants in Los Angeles and gradually extend around the globe. For starters, the company will charge lower fees than competitors UPS and FedEx (FDX ) in order to gain customers. It will use the free space on its trucks that carry its own deliveries.

This is bad news for both UPS and FedEx. Indeed, UPS stock has dropped around 5% since the news emerged last week, extending monthly losses to as much as 20%. The news of Amazon’s entry extended the string of bad news for UPS, which earlier this month announced 2018 earnings forecast lower than estimates.

UPS, which yields 3.41%, pays its next dividend on February 16.

3M

3M (MMM ) is present in our list for the second consecutive week, in a sign investors are impressed with the industrial company’s performance in an otherwise difficult market. 3M has seen its viewership rise 53% in the past five days.

The company’s stock eked up around 4% in the past five days, after Deutsche Bank upgraded its stock to overweight and increased its target from $240 to $275. The investment bank said 3M is expecting a boost from a strong global economy and its high exposure to international markets, while the tax reform in the U.S. may propel it higher.

The Bottom Line

This week was about Nvidia, which reported impressive results on the back of strong demand from cryptocurrency miners. However, if the crypto fad abates Nvidia’s results may suffer. BP, meanwhile, paid its big dividend recently and the firm’s results are slowly improving along with oil prices. UPS is facing a secular challenge from Amazon, which is entering the delivery fray, while 3M is doing pretty well for an industrial behemoth.