2017 was a trend-setting year for cryptocurrencies, as hundreds of billions of dollars flowed into the digital asset class. Amid the euphoria, market participants are struggling to reach a consensus about how these new assets will impact the financial system and overall economy.

The cryptocurrency market cap grew by an astonishing 3,330% last year, with dozens of individual coins reaching a valuation of $1 billion or more. The market peaked above $830 billion in January before a month-long correction shaved two-thirds off the total value.

Regulatory Outlook

Though highly volatile, cryptocurrencies have had a lasting impact on observers and participants of the market. The growth of bitcoin was too much for the likes of CME Group and CBOE to ignore. The exchanges successfully launched bitcoin futures contracts in December to the dismay of the Futures Industry Association (FIA), which criticized the Commodity Futures Trading Commission (CFTC) for not allowing ‘public transparency and input’ on the new derivatives products.

Multiple fund managers have also submitted formal applications to list bitcoin exchange-traded funds (ETFs) but later rescinded them amid regulatory scrutiny. The U.S. Securities and Exchange Commission (SEC) has taken a tougher stance on crypto-backed funds, citing liquidity and valuation concerns. Last year, the securities regulator rejected two bitcoin ETFs, including one proposed by bitcoin billionaires Cameron and Tyler Winklevoss. The Winklevoss fund has been in the works since 2014.

Although bitcoin ETFs continue to elude the market, thematic funds with exposure to blockchain companies are slowly gaining traction. Just in January, four blockchain-based ETFs entered the market, giving investors a new way to access the crypto revolution. These ETFs include Amplify Transformation Data Sharing ETF (BLOK), Reality Shares Nasdaq NexGen Economy ETF (BLCN), Innovation Shares NextGen Protocol ETF (KOIN), and First Trust Indxx Innovative Transaction & Process ETF (LEGR). As the blockchain economy deepens, there’s strong reason to believe that thematic funds with exposure to this new technology will continue to grow.

That being said, the regulators gave a surprisingly upbeat assessment of the cryptocurrency market at the U.S. Senate Banking Committee hearings in early February. Committee Chair Mike Crapo said that regulators might require more power to promote transparency and order in the market. Currently, cryptocurrency exchanges are regulated at the state level, which means that the CFTC does not have direct jurisdiction save for investigative powers. Meanwhile, the SEC has taken special interest in initial coin offerings (ICOs), and has been keen to remind token issuers of their obligation to follow federal securities laws.

Globally, the regulatory outlook varies substantially. With the notable exceptions of China (which banned cryptocurrencies) and Japan (which granted them the status of money), most nations are still struggling to define the digital asset class. South Korea recently took a bold step by reassuring investors that it would not ban domestic cryptocurrency exchanges but would instead seek new measures to boost market transparency.

Go over one of our previous takes on bitcoin ETFs here to learn more about them.

Use the Dividend Screener to search for ETF-specific investments. For instance, you can use a screen like this to explore only dividend-paying ETFs and download the list in an editable spreadsheet for easy sorting and customized analysis.

U.S. Economy and Implications of Cryptocurrencies: 2018 and Beyond

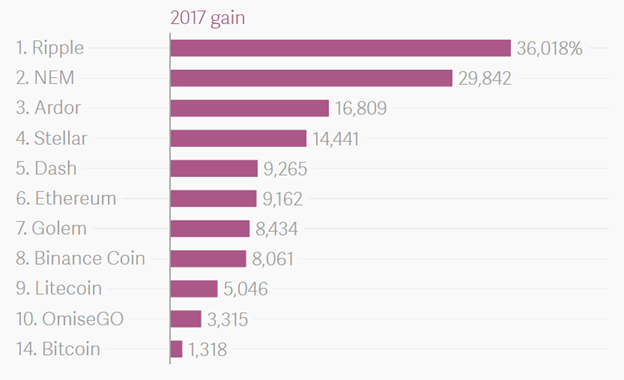

With regulators struggling to define cryptocurrency, many pundits are convinced that the digital asset class is one of the biggest bubbles of all time. As the following chart illustrates, the top cryptocurrencies put up astonishing gains in 2017, with Ripple’s XRP token adding more than 36,000%.

Those who view the cryptocurrency boom as a bubble also view the digital asset class as a significant risk to the financial system. That’s the conclusion Goldman Sachs came up with its evaluation of the domestic economy. Goldman economist Jan Hatzius identified credit and cryptocurrency as two major sources of financial imbalances that, when combined, could undermine the nation’s robust economic outlook. In his view, these imbalances could put the Federal Reserve on high alert even as it signals for higher interest rates.

“While we have not seen the type of large credit expansions that would be the most worrisome for Fed officials concerned about financial imbalances, there are now some signs of speculative behavior in financial markets, e.g., the cryptocurrency boom,” Hatzius said in the ‘10 Questions for 2018’ report issued at the end of December.

Beyond digital assets and the exchanges that facilitate their trade, a crypto market crash would impact so-called bitcoin proxy stocks, which are publicly-traded companies with direct and indirect exposure to the blockchain economy. Examples include Nvidia (NVDA ), Riot Blockchain, LongFin Corp, HIVE Blockchain Technologies and even Samsung.

A steep decline in crypto values would also impact the market for ICOs. After all, companies are issuing new cryptocurrencies on the assumption that investors can’t get enough of them. A prolonged crash would certainly impact investor interest in new tokens.

For a market crash to have a destructive impact on the domestic economy or even Wall Street, cryptocurrencies need to be far more adopted than they are now. The asset class as a whole is simply not big enough to have a contagion effect on Wall Street. However, this perception could change drastically if cryptocurrencies experience another period of uninterrupted growth like the one we saw in 2017.

Despite regulatory uncertainty and price volatility, cryptocurrencies maintain a generally favorable outlook thanks to growing mainstream adoption, higher institutional demand and technical developments aimed at solving scalability issues. However, no two assets are exactly alike. As Ethereum founder Vitalik Buterin indicated, the vast majority of cryptocurrencies issued to date are likely to fail. But the cream will rise to the top, and new advances in token issuance will lead to better currencies being minted in the future.

The Bottom Line

Blockchain technology is having a profound impact on financial markets. It is also forcing institutional investors, traders and even governments to re-evaluate their perception of monetary value.

To learn more about the rise of blockchain and what it could mean for your investment portfolio, read Blockchain and Digital Dividends.