Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week, investors were preoccupied with two main events: the import tariffs on steel and aluminum ordered by President Donald Trump and his move to block a merger between tech companies Broadcom and Qualcomm. Aluminum companies were first in the list, followed by chip-maker Micron Technology. Steel and Iron companies took third place, while Qualcomm was last.

Trump Pushes Ahead With Aluminum Tariff Despite Opposition

Aluminum companies have trended the most this week, registering an increase in viewership of 227%. Investors were on the lookout for opportunities in the sector after U.S. President Donald Trump signed a decree imposing a 25% tariff on imports of steel and 10% on aluminum, saying the domestic metals production industry was essential to national security. Potentially softening the blow to the aluminum industry, Canada and Mexico were exempted from the tariffs as the three countries are negotiating a new NAFTA agreement. Furthermore, Trump allowed U.S. allies to apply for exemptions.

Trump’s tariff came despite lobby group Aluminum Associations expressing concerns about the tariff. The group, which contains 114 producers including Alcoa (AA ), Kaiser Aluminum (KALU ) and Arconic Inc. (ARNC ), said the tariffs should be directed towards China, which it views as the main culprit for the “massive aluminum overcapacity.” It also said Canadian and European producers should be exempted from the tariffs because they are vital trading partners that play by the rules and support U.S. job growth.

The European Aluminium Association echoed the concerns of its U.S. counterpart, saying the tariff does nothing to address the root cause, which is the steady increase in Chinese supply. The body said European imports of steel were not posing a threat to the U.S. national security and called on the European Commission to tackle the U.S. import measure.

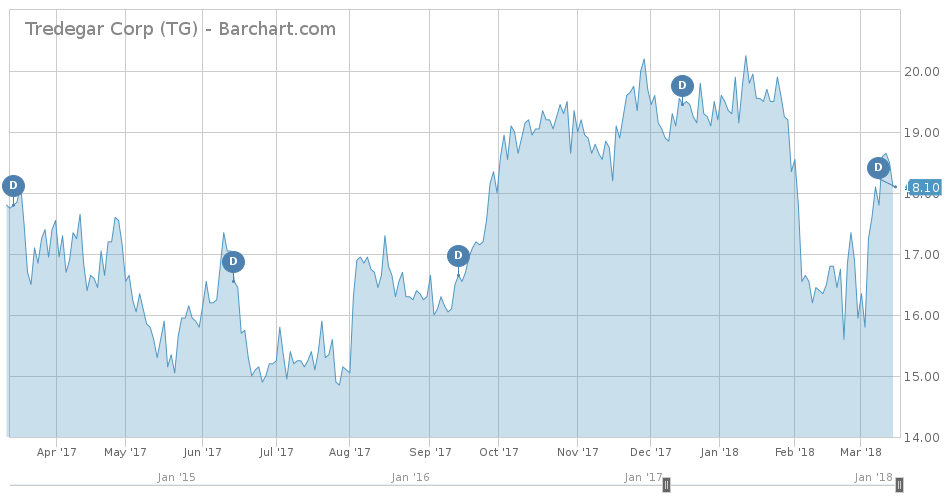

According to Dividend.com, the aluminum industry pays an average dividend of a little more than 1%, with Tredegar’s (TG) being the highest at 2.40%. Shares of many aluminum producers have failed to react to the news and have largely trading sideways.

Micron Rallies on Analyst Upgrade

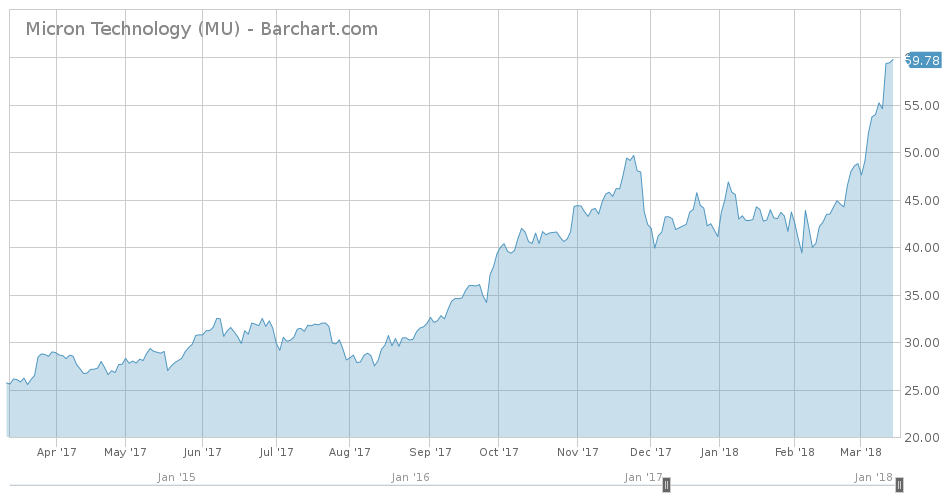

Micron Technology has seen its viewership surge as much as 124% this week, as the company is widely expected to continue its relentless rally in the years to come. Micron (MU ) does not pay a dividend, but investors have been richly rewarded with a rising stock price in the past year as demand for chips continue to soar. Analysts at Nomura believe the market for memory has changed positively and that there is a low likelihood that Micron will engage in price wars.

Micron’s stock has risen 9% in the past five days, extending year-to-date gains to as much as 43%. Despite the rally, the company still seems undervalued, trading at a price-to-earnings ratio of around 9.

Micron’s rally may also be attributed to takeover speculation, although it’s still early to draw conclusions. As Trump blocked Broadcom’s (AVGO ) efforts to buy Qualcomm (QCOM ), the Singapore giant may now turn its attention to Micron. The company recently adopted a shareholder rights plan, or poison pill, which is designed to prevent a change in control situation. Often, the implementation of the poison pill is the precursor to a hostile takeover or an activist attack.

Trump’s Steel Tariff Risks Global Trade War

Steel and iron took third place in the list, as Trump pushed ahead with the 25% import tariff on steel, invoking national security reasons. Steel has seen its viewership rise as much as 113% this week.

The tariff, however, has failed to trigger a rally in steel stocks, with VanEck Vectors Steel ETF (SLX) falling 3.5% in the past month. Investors seemingly fear that a potential trade war between the U.S. and its partners will lead to lower economic output across the board and negatively affect a range of sectors, including steel.

The tariffs were aimed mainly at China, which has been dumping the metal at low-ball prices in many parts of the world. However, U.S. tariffs may indirectly have a negative effect on the global market and add extra difficulty to already struggling steel companies. Instead of selling it to the U.S., China will market its steel to Europe or other parts of the world, putting pressure on prices. The good news is that Chinese steel represents just under 3% of total U.S. steel imports.

According to Dividend.com, the steel industry pays, on average, a dividend of a little below 1%, with Nucor (NUE ), Schnitzer Steel (SCHN) and Commercial Metals (CMC ) among the best dividend stocks.

U.S. Blocks Broadcom’s Takeover of Qualcomm

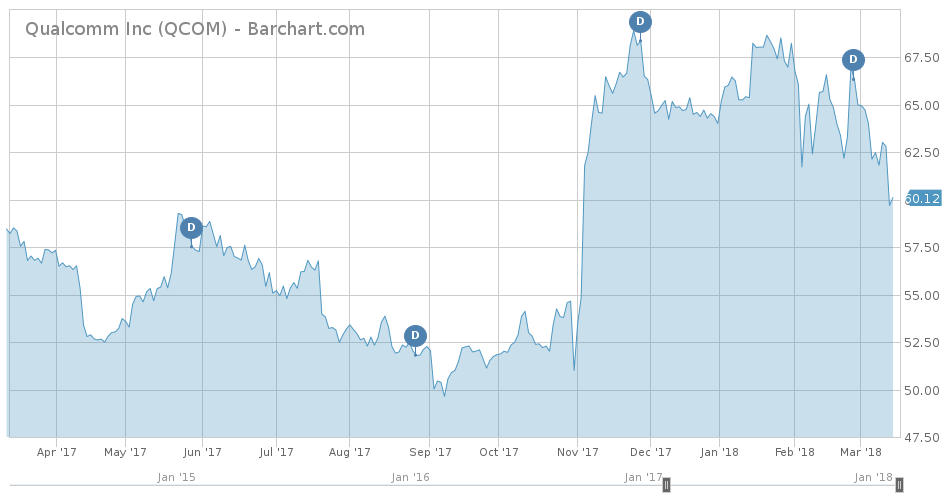

U.S. chip-maker Qualcomm has been in the spotlight of late thanks to the takeover fight with its Singapore-based peer Broadcom. The drama ended days ago after President Trump signed an order blocking the deal from proceeding, although Qualcomm itself rejected Broadcom’s overtures.

Trump acted on a recommendation by The Committee on Foreign Investment in the United States (CFIUS), which claimed a potential deal would hurt the nation’s competitive position in the global chip market. Broadcom, a serial acquirer, typically cuts R&D costs at its takeover targets in order to boost profits. Because it was expected to do the same with Qualcomm, the company may lose its battle against China-based Huawei, the organization contended.

Qualcomm distributes a solid dividend of $2.28 per year, representing a payout of 3.8%. The company gives more than 80% of its earnings back to shareholders.

The Bottom Line

This week, aluminum and steel trended after President Trump instituted tariffs on imports of both metals, potentially triggering a trade war with U.S. partners. Micron, meanwhile, continued to rise thanks to a solid upgrade by two analysts. Lastly, Broadcom’s hostile takeover approach concluded in failure after Trump signed an order blocking the deal on national security grounds.