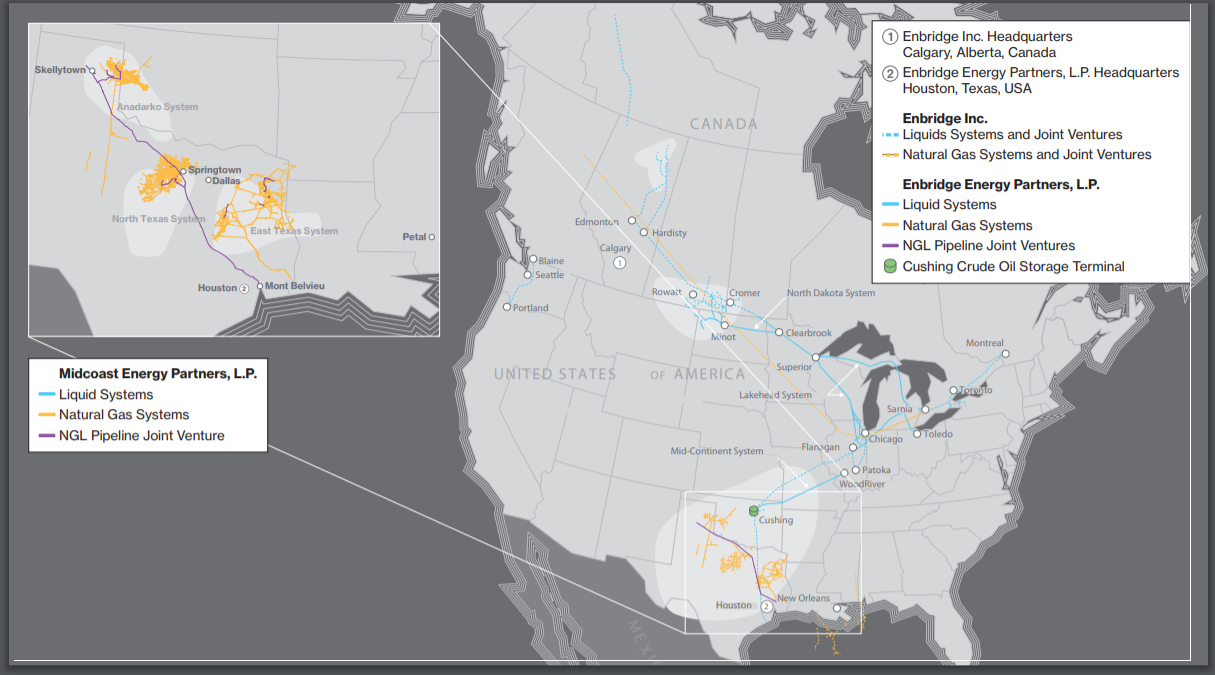

Enbridge Energy Partners LP (EEP) is a master limited partnership (MLP) that is owned by its general partner, Enbridge Inc. (ENB ). The company has been around for 65 years and is a leader in the delivery of safe and reliable energy in the United States and Canada. Enbridge Energy Partners LP is headquartered in Houston, Texas and Enbridge Inc. is headquartered in Calgary, Alberta.

Enbridge Energy, like most other MLPs, was negatively affected by the recent tax changes from the Federal Energy Regulatory Commission (FERC). On March 15, 2018, FERC announced that it will no longer allow MLP interstate natural gas and oil pipelines to recover an income tax allowance in cost of service rates, and that the 2005 Policy Statement for Recovery of Income Tax Costs would be revised accordingly. This was a significant blow to the taxation of MLP’s distributions, which were passed directly to the shareholders instead of by the actual company.

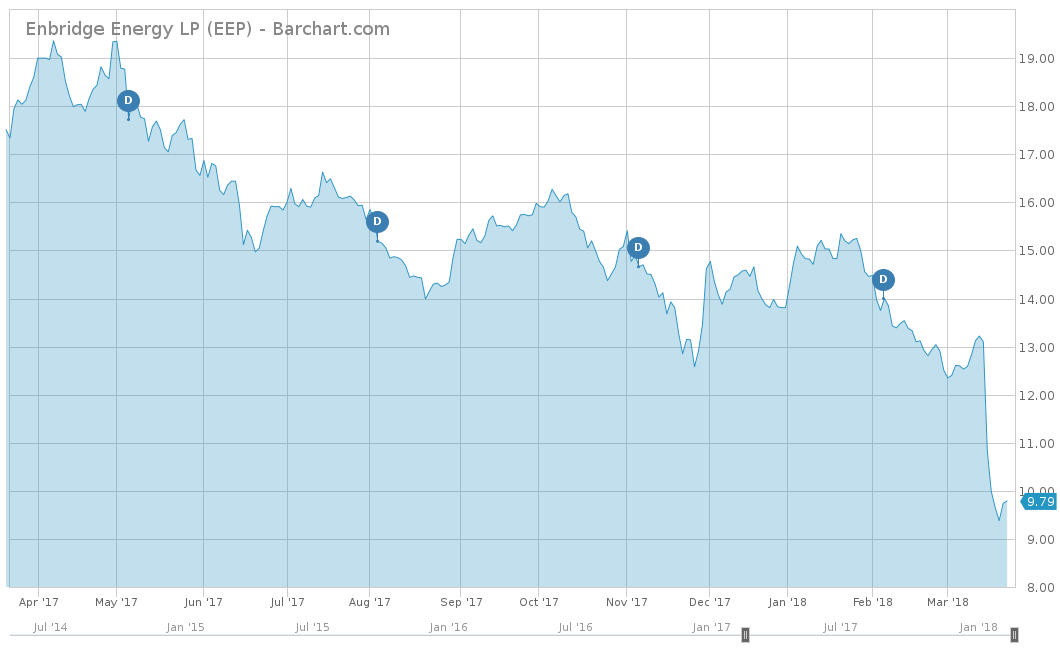

On a year-to-date basis, EEP’s stock price has really been hit hard by the FERC announcement and is down 29.11%. The same goes for the trailing year, where the stock is down 43.54%. Even over the long term, the stock has underperformed and is down 66.59% for the trailing five years. Compared to the S&P 500, which had returns of -1.12%, 12.57% and 69.81% for the same time period, EEP has looked like a terrible investment. A more accurate measure would be against a benchmark like the Alerian MLP ETF Liquid error: internal, which is an index of all the major MLPs. On a YTD basis, AMLP is down 13.07%. For the trailing one year and five year, AMLP is down 24.84% and 46.40%, respectively. So, comparatively speaking, EEP also underperforms against its peers in every time frame.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, EEP has had terrible revenue growth and is down 18.4% on average. The last time the company had positive growth in its revenue was in 2014. Most recently, 2017 has seen the worst revenue decline, with EEP seeing more thana 45% drop off from 2016. However, analysts forecast that its revenues will actually rebound from its bleak 2017 drop off. In 2018, analysts expect the company to pull in $2.69 billion, which would be an increase of over 10%. The same goes for 2019, where analysts expect another increase of nearly 5% to $2.82 billion.

For 2017, EEP saw a gain of more than 29% to $0.80/unit versus 2016’s $0.62/unit with respect to the adjusted net income per unit. Analysts are not as optimistic for 2018 and expect it to drop off to $0.71/unit but bounce back in 2019 with a $0.82/unit reading.

Strengths

Enbridge Energy Partners owns and operates contract and operational storage terminals with a total capacity of approximately 43.5 million barrels located in Oklahoma, Illinois, Wisconsin, Indiana and Minnesota. Its largest storage terminal is based in Cushing, Oklahoma, which consists of 100 individual storage tanks, ranging in size from 78,000 to 575,000 barrels. The Cushing terminal accounts for 20.1 million barrels of the company’s total storage.

EEP is also a leader in crude oil transportation, with its pipelines positioned strategically to benefit from production in Western Canada’s vast oil sand reserves. Its largest pipeline is the Lakehead System, which measures 4,212 miles from Neche, North Dakota to Chicago, Illinois. This Lakehead System represents 70% of Canada’s pipeline takeaway capacity, which generates a bulk of the company’s toll revenues. There is also an extension to the northeastern part of the U.S. that ends in Buffalo, New York. Enbridge Partners also has 660 miles of pipelines that focus on the Bakken area, which runs from Plentywood, Montana to Clearbrook, Minnesota.

Growth Catalyst

Enbridge Energy Partners’ growth potential comes from the Line 3 Replacement that spans from Hardisty, Alberta to Superior, Wisconsin. This extension consists of 1,031 miles of 36-inch diameter pipeline and will be a major enhancement to the company’s mainland pipeline system. The line is physically equipped to transport all grades of crude oil, and the type of crude oil transported in the future (as in the past) will be based on shipper demand. This new Line 3 Replacement will help drive new revenues for the company and looks to be completed on time in 2019.

Dividend Analysis

Enbridge Energy Partners’ stock has a yield of 14.66% and has the third highest yield of the Oil & Gas Pipelines Industry. The company pays its dividend on a quarterly basis to equal a total amount of $1.40 per year. With such a high yield and a payout ratio of over 191%, it is very likely that the dividend might be cut at some time in the near future.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend Increasing Stocks page, and for more than 10 consecutive years on our 10-Year Dividend Increasing Stocks page.

Risks

The biggest risk to Enbridge Energy Partners is the FERC decision that added taxation to the distributions that the company did not forecast. As soon as the news was announced, the stock price dropped 17% the day after and an additional 8% the following day. The company might have to restructure into a C-corporation in the next few years, which will cost the company unplanned resources and money it didn’t already factor.

The Bottom Line

With the devastating FERC decision making the stock plummet, the management of Enbridge Energy Partners has a lot of planning to do. The company shows optimism with its Line 3 Replacement project that should lead to more revenue growth. However, if EEP does not figure out a plan soon to deal with the new regulations, the growth will be minimal and management might be forced to cut the dividend. This undoubtedly will cause its investors to head for the hills.

Check out our Best Dividend Stocks page by going Premium for free.